Posts Tagged ‘Business Credit’

5 Ways to Be Smart with Your Business Loan

A business loan can serve many purposes, from covering startup costs to keeping cash flowing or allowing for expansion into new products or markets. Before you get one, it’s important to decide how you plan to spend it. It’s also essential to get the loan from a trustworthy lending institution, and while conducting individual research…

Read MoreSmall Business Credit Options to Manage Cash Flow

Small business owners quickly learn the importance of monitoring their cash flow. The flow of money in and out of your business can impact everything from the stock you have to sell to keeping the lights on. In a perfect world, your cash flows would align. All of our customers would pay their bills before…

Read More5 Things You Didn’t Know About Your Business Credit Rating

Your business credit rating is highly important. It can determine how effective your company runs in the present, and even start to affect the long-term, big picture plans of the future. In the end, many businesses fail all the time in what are frankly silly, preventable ways. One of these sure-fire ways to flop is…

Read More5 Tips to Improve Your Business Credit Score

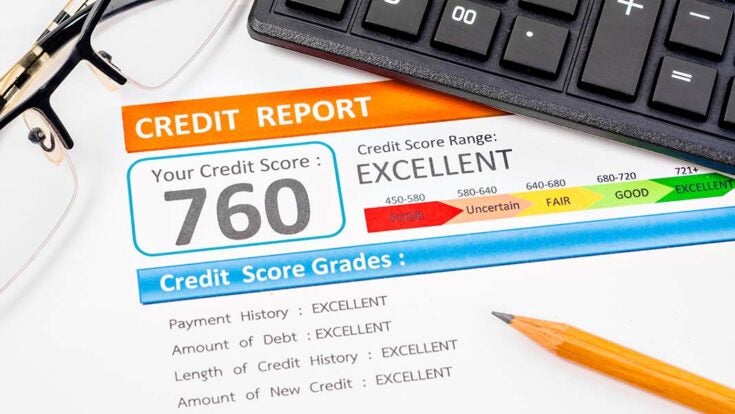

Most people have a decent understanding of their personal credit score, but not so many are as familiar with their business credit scores. Your business credit score is crucial in determining whether or not your enterprise is fit to borrow, how much interest you’ll have to pay on credit, and in some cases, whether or…

Read MorePrepayment Penalties: When the Early Bird Doesn’t Get the Worm

It’s every small business owner’s dream: you took out a business loan to start or expand your small business, and it really paid off. Business is booming, cash is flowing, and you suddenly find yourself in the coveted position of being able to pay off your loan far before you anticipated. While you’ve always wanted…

Read MoreYour Personal Credit Score Matters More Than You Realize to Your Business

As an entrepreneur, it is assumed that you are aware that your business credit matters. It makes a difference in applying for loans, it affects your credit score, and improves your ability to apply for credit with your vendors. But How Aware Are You? Lenders of all kinds, especially banks, will look at how your…

Read MoreThe Tax Mistake That Can Wreck Your Credit

If your business is privately held, as most small businesses are, your business finances are generally hidden from sight. But there is a way other businesses can get an idea of how healthy your business is financially, and that’s by reviewing your business credit reports. Anyone can check the credit report of your business, so…

Read MoreWhat is a Credit Inquiry and Why is it Important?

There are a lot of factors that go into determining your credit score. While you’re likely aware that being tardy in repayments or declaring bankruptcy are the kinds of things that can damage your credit score, are you aware of the impact that a credit inquiry can have on your score? Below we’ll take a…

Read More5 Ways You Could Be Damaging Your Company’s Credit Score

Almost every small company needs to borrow at one point or another, and ideally sooner than later. And when you do, your credit score will dictate who does business with you and at what interest rate. So it’s in your interest to keep your score as high as possible. Here are a few common pitfalls…

Read More4 Ways to Make the Most of Your Business Credit Card Rewards

Many small business owners have come to depend on their business credit card—and for good reason. Beyond providing a revolving line of credit and a simple way to improve your business credit score, they can also help you cover your business expenses (and track them for claiming your tax deductions). By responsibly using a business credit card…

Read More