TaxConnections

TaxConnections Worldwide Directory of Tax Professionals is an authority site of tax advisors from around the world. As the leaders in our market vertical, you can find and interact with tax professionals in corporations, law firms, public accounting firms, tax services firms, government and academia in one click. Through our innovative technology, we maximize the exposure of a tax professional’s expertise and services to the more than one billion people who go online for tax advice each year.

Latest

What To Do With Your Tax Refund

Receiving a tax refund can feel like a windfall, a sudden infusion of cash that arrives with a sense of possibility. This unexpected financial boost allows you to make strategic decisions that significantly impact your…

College Athletes: Know Your Tax Obligations in NIL Agreements

Collegiate athletics is a competitive and popular multibillion dollar business industry. With television rights deals, conference realignment, recruitment, and much more, collegiate athletics garner significant media coverage. One topic receiving significant recent attention is the…

Hiring For A Tax Organization: A.I. Versus Human Recruiters

As a thirty-year veteran in executive search for tax professionals, I have a special set of skills. Remember the Liam Neeson movie quote in Ransom: “What I do have are a very particular set of skills,…

Upcoming Tax Changes for 2024

Individuals and businesses need to be aware of the upcoming tax changes that will impact their financial planning. From adjustments in tax rates to updates in deductions and credits, understanding these changes can help taxpayers prepare…

2024 Tax Planning: A Guide For CPAs, CFOs, & Business Owners

Tax year planning for state and local taxes is a critical aspect of financial management for individuals and businesses alike. By mastering the complexities of state and local tax regulations, CPAs, CFOs, and business owners…

Understanding The R&D Tax Credit And How To Claim It

The R&D tax credit is a valuable incentive provided by the government to encourage businesses to invest in research and development activities. It is a tax break that rewards companies for their innovation and technological…

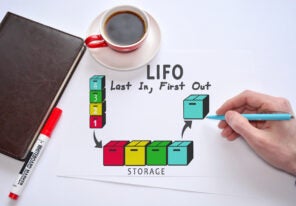

LIFO Can Still Provide Tax Savings for 2023

While inflation is not at the high levels seen in the last couple of years, if you haven’t elected LIFO previously, now is the time to look at Last-In-First-Out (LIFO) accounting. If you have inventories…

IRS Focused On Partnerships, Corporations, High-Income

IRS has announced sweeping efforts to restore fairness to tax system with Inflation Reduction Act funding; new compliance efforts have the IRS focused on partnerships, corporations, high-income, and promoters abusing tax rules on the books….

Navigating the Sales and Use Tax Audit

What do you do when your company receives a letter that it has been selected for a sales and use tax audit? There are things that you should and should not do before the audit…

Understanding Nexus Sales Tax Compliance

How do you know when you should collect sales tax? Do I have to collect sales taxes in states where I don’t have a physical presence? What is nexus, physical nexus, and economic nexus? In…