Your employees are stressed.

And it has nothing to do with the work you’re giving them or the office politics or whose cubicle is 2 inches bigger than anyone else’s.

Well, okay, that last one may be causing some additional stress…

But the truth is financial stress is on the rise, and there’s no way to keep it from seeping into the workplace. Listen to what this graphic artist told me recently:

“We can’t seem to keep up. We’re trying to be smart with our money. We’ve cut expenses to the bare minimum, and we’re saving as much as we can. But prices are rising faster than we can save. The problem is I don’t work as well when I’m stressed like this! All I can think about is how I ought to be making more money.”

Sound familiar?

Studies are uncovering just how dire the situation is. As it turns out, financial matters are the #1 stressor for all generations.

- 42% of Millennials

- 46% of Gen Xers

- 28% of Baby Boomers

And it gets worse every year.

The Willis Towers Watson 2017/2018 Global Benefits Attitudes Survey (GBAS) found a sharp rise in financial worries in the US.

Source: Willis Tower Watson

In Canada, the situation is similar. The survey revealed that only 4 in 10 Canadian workers were satisfied with their financial situation and 30% believe their money worries are negatively affecting their lives.

What causes these worries? In most cases, normal life events: divorce, medical expenses, “sandwich generation” responsibilities (caring for both children and aging parents), and increased debt.

It’s simply that financial obligations are growing faster than wage rates, stretching workers’ paychecks to the limit.

What can you, as an employer, can do to help?

Plenty.

Keep reading to learn more about your employees’ financial worries and the new employee benefit employers are offering with good success.

Living Paycheck to Paycheck

According to the GBAS, nearly half of workers report they live paycheck to paycheck: 40% of Canadian workers and 45% in the US. And that’s the most conservative figure I found. CareerBuilder put it at 78%.

CareerBuilder also confirms something we all know, that 71% of minimum wage workers aren’t able to make ends meet.

The struggle isn’t reserved for low-income workers, though. Even 6-figure earners are struggling to make their paychecks… well… pay.

- 52% of Canadian workers feel they’ll have the financial resources to live comfortably 25 years into retirement. 62% feel confident they’ll have enough resources 15 years in retirement.

- 52% of struggling workers over age 50 don’t expect to be able to retire before reaching their 70s, compared to 14% for employees without money worries.

Blogger ScaryMommy isn’t worried about retirement yet. She’s just trying to feed her family and afford her children’s school projects. She tells her story like this:

“Ever since we became parents, money has been a worry. A huge one, actually. Between child care costs and commuting, it never made sense for me to go back to work, and living off one income has been really difficult for us. For the first seven years of parenting, we lived in a one-bedroom apartment because that was all we could afford. At one point, my husband lost his job, and we relied on food stamps and Medicaid….

“We still live paycheck to paycheck. We still need to consider every single purchase we make and aren’t able to save any money. So as thankful as I am for what we have, and how far we’ve come, I’m tired of it all.”

That story could be anyone’s…

Everyone’s…

From the young couple paying off 2 student loans to the single-again mom working 3 jobs to make ends meet to the 50-something suddenly realizing he can’t afford to retire.

And these worries run so deep, they aren’t something that can be set aside while on the job.

The Impact at Work: Productivity’s Downward Spiral

Financial worries aren’t something your employees can leave at home. And they definitely affect productivity at work.

3 ways financial problems affect employees’ work performance.

A poll by Workplace Options revealed that a third of working Americans feel that financial stress keeps them from doing their job. And they aren’t doing a good job of hiding it. More than half of those polled (56%) believe their colleagues’ and co-workers’ job performance has been impacted by financial stress as well.

On the job, this stress manifests in a variety of ways, most notably, an inability to focus and increased absenteeism and tardiness.

But employees sometimes try to deal with their personal financial issues during work hours. According to Workplace Options, 85% of those polled admitted to occasionally doing this, while 41% say they do it multiple times a month.

Is there a solution?

Fortunately, there is.

Options for Employers: Benefits that Make a Real Difference

Workplace training and development is nothing new, but topics generally relate to on-the-job and interpersonal skills:

- Communications

- Computer skills

- Customer service

- Diversity

- Safety

- Sexual harassment

- Conflict resolution

Training is typically aimed at solving workplace issues, such as job performance, benchmarking progress or skill levels, or to level up an employee’s skills for a new role. Financial literacy and well-being haven’t been part of this mix because they’ve been seen as personal matters—not a job requirement.

But let’s be honest. When financial stress impacts your employees’ performance on the job, training in this area becomes a higher priority.

Much higher.

What Is A Financial Wellness Program?

Financial wellness training can cover specific financial areas or a wide range of topics, including:

- Financial planning

- Debt management

- Retirement planning and education, including asset selection

- Basic budgeting

- Identity theft

- Wealth building

- Insurance and healthcare planning

Generally, a complete financial training program helps employees develop a big picture of their financial status, as well as tactics for improving it.

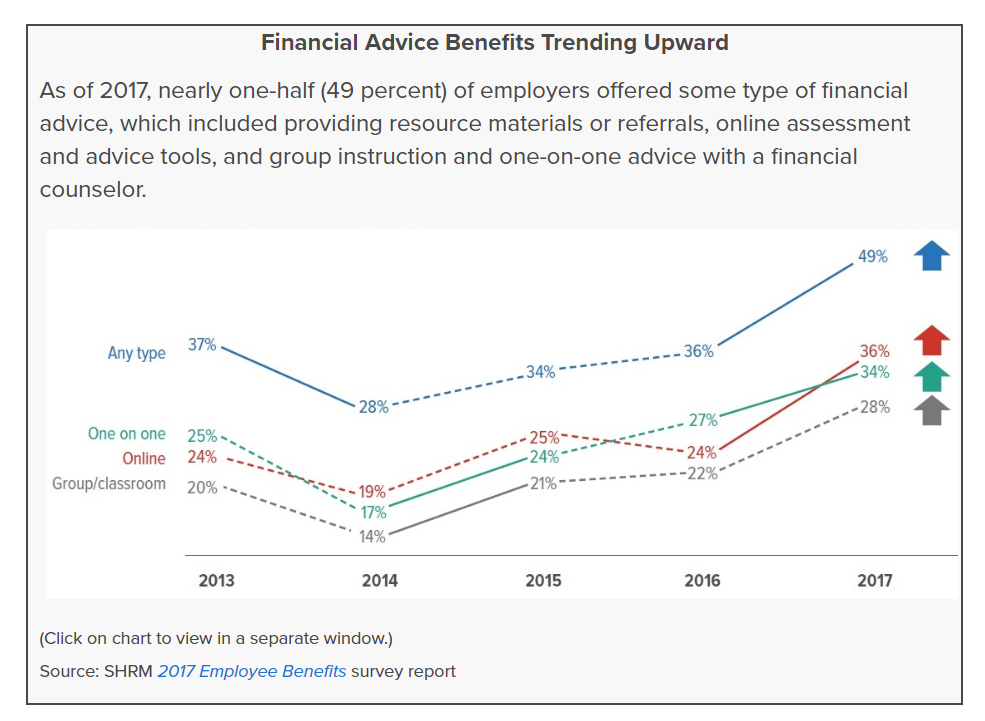

And it’s becoming a popular addition to Employee Benefits packages. Half of employers now provide some type of financial wellness as an employee benefit.

Setting up your training program is easy.

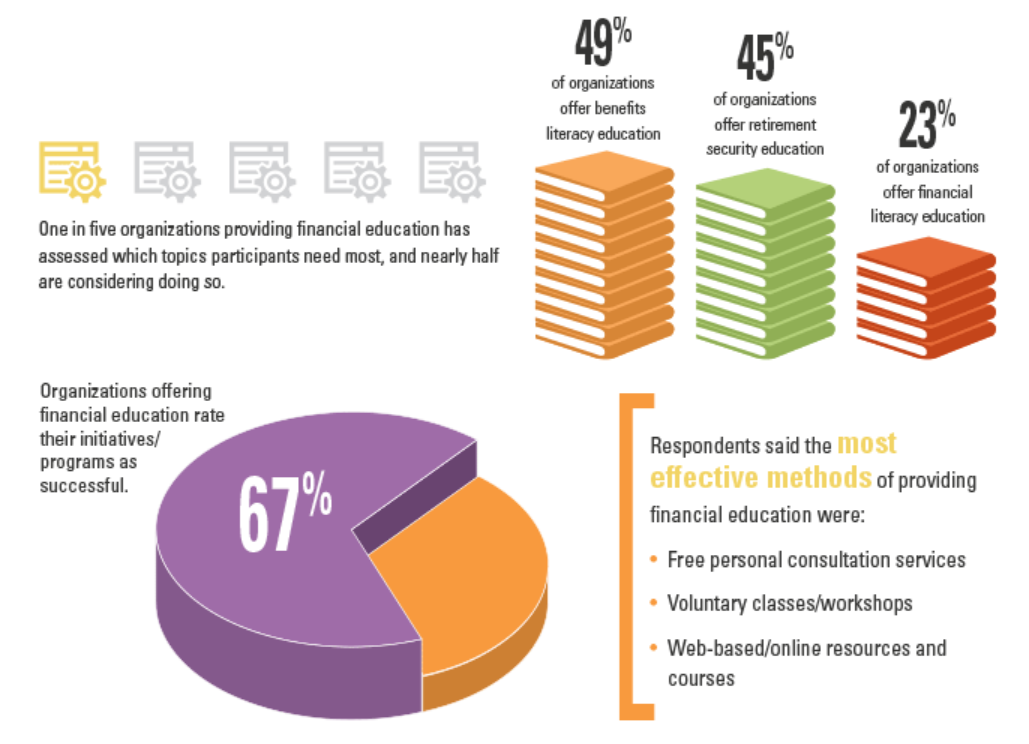

The Society of Human Resource Management lists these popular education methods:

- Voluntary classes

- Projected account balance statements

- Retirement income calculators

- Online resources

- Free personal consultation services

Some employers are providing debt counseling as well—either through an independent financial planner, an employee assistance program, or within one of their financial wellness programs.

It’s a smart move, too. A study by Lockton shows that employees feel their stress levels would go down if they got help with their financial planning.

Financial wellness topics employees would like covered. Source: Lockton

Is Financial Wellness Training Worth the Investment?

The International Foundation of Employee Benefit Plans (IFEBP) says yes. In fact, nearly 70% report their initiatives are successful.

Here’s why…

We already know that employee training in general boosts job satisfaction and morale while reducing employee turnover.

With financial wellness training, it goes deeper than that.

Employees who feel their employer is “for” them are far more likely to remain loyal, working harder and grumbling less.

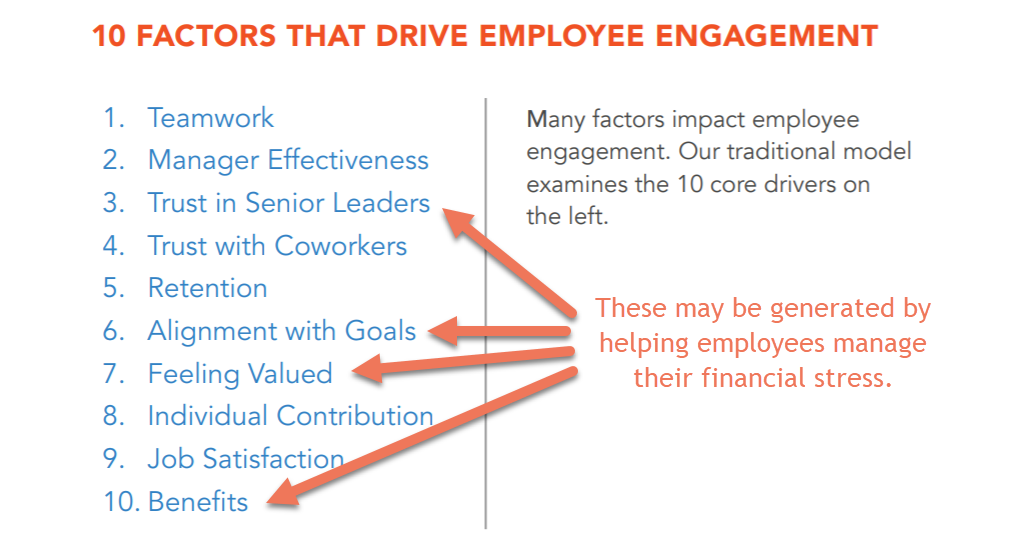

In fact, Quantum Workplace put together a list of 10 core drivers for employee engagement. Review the list below. I think you’ll agree that 4 of the 10 may actually be generated by proactively addressing financial stress with financial wellness training.

But Do They Want It?

Yes. A survey by Quantum Workplace and Limeade revealed that 40% of employees under age 25 wanted their employer to provide financial wellness training. They’re eager to learn!

Which means there’s no reason to put it off.

Paying your employees on time and being generous with paid time off and vacation isn’t enough. They need financial training as well, so they’re able to make wise spending decisions that will reduce their debt — and stress.

How to Get Started with Your Financial Wellness Plan

For starters, share our “Understanding your Paycheck” infographic with your employees.

This will help them understand what goes into (and gets taken out of) their paychecks. That’s going to build a solid foundation for budgeting and decision making.

But don’t stop there.

Look into programs that tackle your employee’s biggest areas of concern. Most likely it’s paying off credit card debt.

Then keep it up. Provide the financial wellness training your employees need and see the difference in higher productivity. It’s definitely a benefit that pays dividends!

Resources

2017/2018 Global Benefits Attitudes Survey

Reduce Employee Financial Stress, The SHRM Blog, July 2017

Workplace Well-Being: Provide Meaningful Benefits to Energize Employee Health, Engagement, and Performance, a survey by Quantum Workplace and Limeade.

Finding the Links Between Retirement, Stress, and Health, Lockton Whitepaper

Top Financial Wellness Programs, a list

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.

Author: Kathryn Aragon is an award-winning content strategist, copywriter, and author. As Wagepoint’s Content Manager, she’s dedicated to sharing helpful strategies that simplify payroll and business management. In her spare time, you’ll find her exploring her random and ever-changing interests, from bird-watching to weed-pulling to gourmet cooking and more.