Posts Tagged ‘Accounting’

Avoid Poor Financial Management: A Comprehensive Guide

Businesses are constantly being started and closed—it’s a natural cycle. Many fail because of competition, a lack of market demand, pricing, or similar issues. Meanwhile, specific internal issues are another significant reason businesses fail, even when external conditions are favorable. That was the case with Enron (a clear example of how even top performers can…

Read MoreSmall Business Tax Tips From the IRS

Every month, the Internal Revenue Service publishes resources and information helpful to small businesses and individual filers. Here are some of the latest tips from the IRS: Avoid misleading “Offer in Compromise” mills The IRS reminds businesses to beware of promoters that claim their services are necessary to resolve unpaid federal taxes while charging big…

Read MoreHow Much Should You Pay Your Accountant?

Finding the right accountant for your business, but so is making sure you pay the right amount. You don’t want to overpay, but your accountant also needs to hit his or her own income targets. Depending on your business situation and accounting needs, there are several arrangements to choose from.

Read MoreWhat Is a Corporate Expenditure Audit?

Beginning the journey of entrepreneurship or managing an established business requires navigating a maze of financial decisions and obligations. Whether you’re a new startup founder or an experienced industry veteran, one universal reality remains: successfully controlling your company’s expenses is critical to long-term success. In this detailed guide, we invite new business owners and seasoned professionals…

Read MoreTop Financial Management Tips for Businesses and Non-Profits

Effective financial management is so important if you want your business or non-profit organization to thrive and grow. It involves a lot of planning, organizing and control. You will also have to monitor your financial resources so you can achieve your objectives. Good money management will help your business to make effective use of its…

Read MoreUpcoming Tax Changes for 2024

Individuals and businesses need to be aware of the upcoming tax changes that will impact their financial planning. From adjustments in tax rates to updates in deductions and credits, understanding these changes can help taxpayers prepare and make informed decisions. In this overview, we will discuss the key tax changes that take effect in 2024, providing…

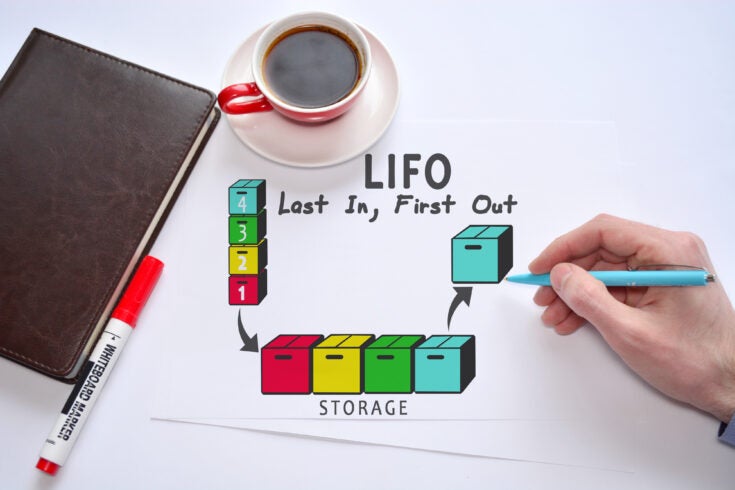

Read MoreLIFO Can Still Provide Tax Savings for 2023

While inflation is not at the high levels seen in the last couple of years, if you haven’t elected LIFO previously, now is the time to look at Last-In-First-Out (LIFO) accounting. If you have inventories of machinery and equipment, glass products or any concrete or cement inventory, there could be tax savings for 2023. Whether…

Read MoreThe Best B2B Services for Small Business Owners

For small business owners, tapping into the right business-to-business (B2B) services can mean the difference between stagnation and growth. In today’s bustling marketplace, small operations must leverage the power of other businesses to bolster their own services and bottom lines. Efficient B2B services enable small businesses to focus on their core operations while delegating ancillary…

Read MoreHiring a New Employee? Consider the Virtual Advantages

Navigating the growth of a small business is all about knowing when to take the next leap. Jump too soon or too far, and you’ll fall. Wait too long to make a move, and the industry might just leave you behind. Nothing illustrates this more clearly than how small companies approach hiring. Hiring a new…

Read MoreThe Accounting Cycle For Startups & Small Businesses

Navigating the financial landscape can be a challenge, especially if you’re setting up your first startup or running a small business. Among the many tasks that demand your attention, understanding and managing the accounting cycle stands out as critical and necessary. This cyclical process involves identifying, recording, analyzing, and reporting your company’s monetary transactions in…

Read More