Tax and Accounting

Beating Payroll Scope Creep To The Gate (Bookkeeper’s Guide)

If you offer payroll services at your accounting or bookkeeping firm, you want to know how to sell it while turning a profit. Likewise, if you provide payroll services to clients, then you are likely…

Taxes: Why Do I Owe A Penalty And What Can I Do About It?

I sent a payment to the IRS. Why did I get a bill? If you mailed a payment to the IRS on or before July 15, it may still be unopened in the backlog of…

5 Small Business Budgeting Tools

Starting and running a small business is a stressful, but rewarding job if you keep up on everything. The financial aspect of a business can seem overwhelming, and hiring an accountant may not be in…

Small Business Update: Trump’s Executive Order to Defer Payroll Taxes

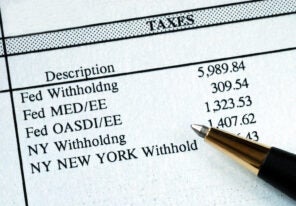

On August 8, 2020, to provide temporary assistance to workers who are facing financial burdens due to the pandemic, President Trump issued an executive order to defer the withholding, deposit and payment of certain payroll…

Bookkeeping 101: A Crash Course in Record Keeping for Small Businesses

Bookkeeping often confuses many business owners. It is not typically associated with the idea of business operation. However, bookkeeping, recordkeeping, and their intricacies can yield significant benefits for small business owners. Here is what…

IRS Warns Tax Pros to Be Alert to These Scams

Working Virtually: Avoid Phishing Scams The Internal Revenue Service and the Security Summit partners warned tax professionals to be alert to new phishing scams that try to take advantage of COVID-19, Economic Impact Payments and…

Here’s What You Need to Know About the Home Office Deduction

The home office deduction allows qualifying taxpayers to deduct certain home expenses on their tax return. With more people working from home than ever before, some taxpayers may be wondering if they can claim a home…

An economics lesson for growing companies

Catching up from past insights Growing companies usually require more working capital during their periods of rapid growth. In past insights we have calculated the amount of additional capital needed for a business as it…

Helpful Tips for Any Small Business to Prepare for ASC 606

On December 15, 2018, all small businesses were instructed to implement Accounting Standard Codification to file their 2019 income taxes. This change requires some preparation because it completely revamps the current revenue reporting guidelines. The…

10 Facts Employers Need to Know About Payroll Tax Incentives

Recent Covid-19 legislation creates new payroll tax incentives for employers, which fall into two main categories: Payroll Credits and Tax Deferral. All these relief measures were established by the Families First Coronavirus Response Act (Families…