Tax and Accounting

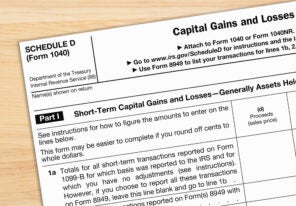

IRS Announces Jan. 27 Start to 2025 Tax Filing Season

The 2025 tax filing season starts on Monday, Jan. 27, 2025 for Form 1040 filers, and will feature expanded and enhanced tools to help taxpayers as a result of the agency’s historic modernization efforts. These…

10 Year-End Tax Tips for Business Owners

As a business owner, you know that staying on top of your finances is no small task. But don’t worry—today, I’m going to hit 10 strategies to consider for your year-tax planning. No need to…

Small Business Tax Tips From the IRS

Every month, the Internal Revenue Service publishes resources and information helpful to small businesses and individual filers. Here are some of the latest tips from the IRS: Avoid misleading “Offer in Compromise” mills The IRS…

How HR Departments Can Simplify Tax Compliance for Employees

In today’s complex world of regulations, getting to be and remaining tax-compliant can be a challenge for both employees and employers. For employees, wrapping your head around all the details of tax regulations, understanding deductions,…

5 Timely IRS Tips and Reminders for Small Businesses

Every month, the IRS releases helpful tips and reminders for small businesses. The IRS also provides tax news and alerts in Spanish. Here are some of the latest IRS tips for small business tax information:…

Streamline Business Tax Filing With These Regular Tasks

Prepping your small business for tax filing doesn’t have to be a headache. By implementing certain tasks consistently throughout the year, you can simplify the process and avoid the last-minute rush. Here are five essential…

Why Hiring Your Kids This Summer Is a No-Brainer (Video)

Hiring your kids for summer or holiday jobs isn’t just a parental power move. It’s a savvy business strategy that screams “tax savings!” On-the-Job Experience First off, when you hire your kids, you’re not just…

How Much Should You Pay Your Accountant?

Finding the right accountant for your business, but so is making sure you pay the right amount. You don’t want to overpay, but your accountant also needs to hit his or her own income targets. Depending on your business situation and accounting needs, there are several arrangements to choose from.

Tax Breaks To Suggest to Rental Property Owners

Rental properties are an excellent and ongoing investment but are even better when the owner of the property understands the number of tax credits and other breaks they can apply for. Let your rental property…