On August 8, 2020, to provide temporary assistance to workers who are facing financial burdens due to the pandemic, President Trump issued an executive order to defer the withholding, deposit and payment of certain payroll taxes until Jan. 1, 2021. On August 28, 2020, the IRS issued Notice 2020-65 (“Notice”) to provide implementation guidance.

What Employers Need to Know

What Benefit is Provided?

The executive order creates a new payroll tax deferral plan that allows employers to suspend the collection of certain Social Security payroll taxes from September 1, 2020 through December 31, 2020.

Is the Deferral Mandatory?

No. The deferral under the executive order/Notice is optional. There are no penalties for noncompliance.

What are the Deferral Dates?

The deferral applies to employee paychecks issued between September 1, 2020, and December 31, 2020, based on the payroll date, not the first day of the payroll period.

Is the Deferred Tax Waived?

No. Unless Congress authorizes forgiveness, any tax deferred under the Notice is NOT Waived. It is required to be collected and paid between January 1, 2021, and April 30, 2021. Accordingly, this amounts to an interest free loan while the payments are postponed.

Potential Penalties?

Employers that fail to pay any outstanding amounts by May 1, 2021, may be held liable for the tax, penalties, and interest. Employers are liable for unpaid deferred taxes even with respect to employees who are no longer with the employer.

Caution: The Notice does not defer the deposit obligation so if the employer continues to withhold as usual, the employer must timely deposit such amounts or risk “trust fund” liabilities of 100% placed on the responsible party.

What Payments are Eligible?

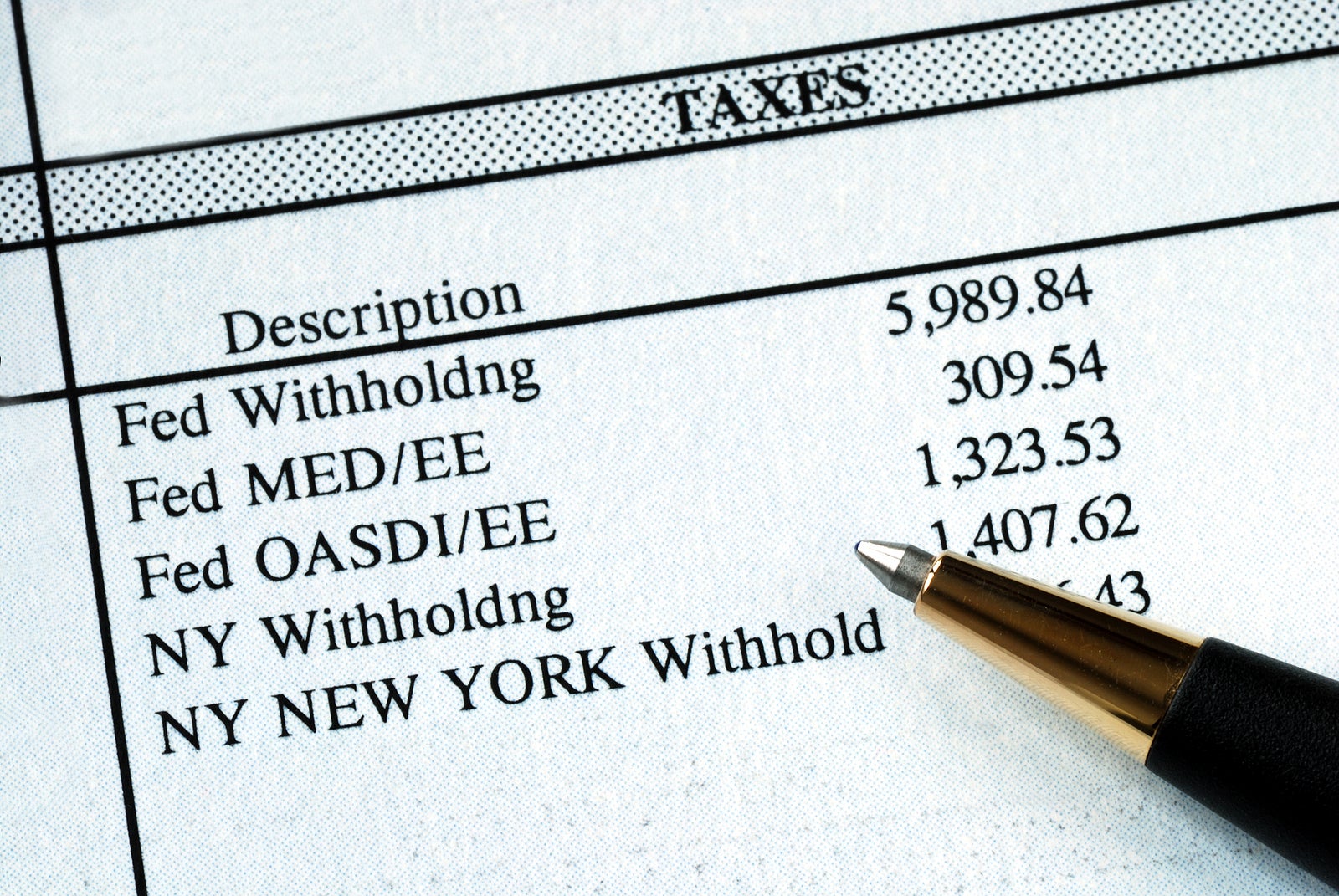

The Notice provides that employers may defer withholding the 6.2% employee portion of Social Security tax (which has a $137,7000 annual wage base limit for 2020). The suspension applies to employees whose wages are less than $4,000 for a biweekly pay period (approximately $104,000 per year) or the equivalent threshold amount with respect to other pay periods.

How Does this Deferral Interact with Other Legislation?

Previous Covid-19 legislation provides several tax incentives for employers through the payroll tax system, including relief measures established by the Families First Coronavirus Response Act (Families First Act), enacted March 18, 2020 and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted March 27, 2020.

The Notice applies to the employees’ Social Security obligations. It differs from the CARES Act deferral, which allows employers to defer payment of the employers’ portion of Social Security taxes through the end of 2020 and to pay such deferred amounts by the end of 2022.

Under the Notice, Applicable Wages exclude amounts of qualified sick leave or family leave wages, allocable qualified health plan expenses and creditable employer portion of FICA Medicare tax on such wages under the Families First Act. Applicable Wages also exclude the creditable portion of qualified wages, including allocable health plan expenses subject to an employee retention credit under the CARES Act.

Unanswered Questions

How exactly are eligible employees determined if wages are paid on non-bi-weekly periods (e.g., twice-monthly or monthly pay periods)?

How are bonuses, overtime pay and other extraordinary wages/compensation to be considered in the $4,000 per bi-weekly pay period analysis?

How does the employer report the deferred amount of taxes on the current Form W-2 or will the IRS modify Form W-2 to accommodate these changes?

Will the deferral be mandatory for all eligible employees or will employers give their employees a choice?

Given the difficulties of administering the benefit combined with the additional burden it will place on employees in 2021, will employers choose this benefit? Similarly, will payroll companies update their software or will employers need to maintain a separate set of books themselves?

Employer Compliance & Form 941

For reporting, the IRS has issued a draft of a revised Form 941, Employer’s Quarterly Federal Tax Return that adds a line to reflect any payroll tax deferrals. The form would need to be finalized before the third quarter reporting window opens on October 1, 2020.

To help employers, PayMe/TaxMe has automated the form 941 filing process, which will accommodate this change (as it has for all the other COVID-19 changes). Easy. Accurate. Secure.

If you need to e-file Form 941, don’t wait.

2074 Views