Angel Investment vs. Bootstrap: Startup Sweet Spot

By: Tim Berry

Successful angel investment is a win-win for both sides, the startup founders and the investors. And I mean win-win right at the beginning, at the time of the investment, not the obvious win-win later when years have gone by and the business succeeds and investors exit. The win-win sweet spot exists from the beginning, when both sides agree that there’s an opportunity for deficit spending to produce dramatically accelerated growth. Simply put, it’s when the startup has an exciting use for other people’s money; it’s going to grow much faster with that money than without it. So much faster, in fact, that it’s a great way for investors to spend their money, and a great way for startup founders to spend (share) their ownership. Otherwise, bootstrap (build your startup with your own resources, not outside investors) is better.

Understanding the sweet spot for angel investment vs. bootstrap

At the sweet spot, years before failure or exit, investors have spent their money on a good risk-return ratio, and founders have given up ownership for good prospects of much better growth and much better end value than they’d get if they kept their ownership and didn’t spend the extra money.

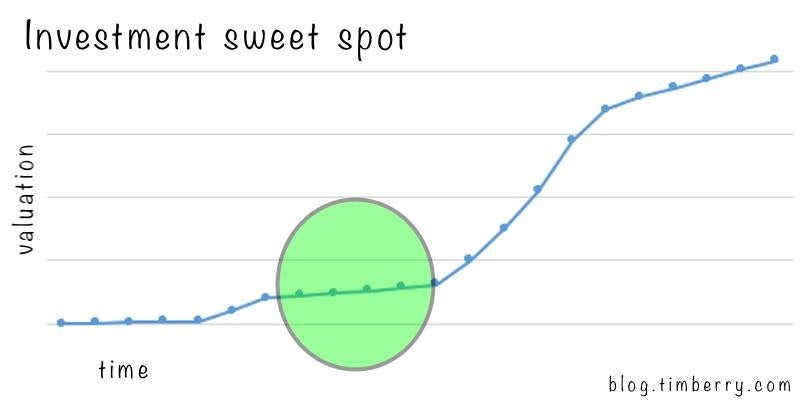

It’s about milestones and inflection points. Inflection points are when a business is suddenly worth more than it was, in a short time, because of factors like risks reduced, milestones met, assumptions validated, and so forth. In my simple chart here, the sweet spot shows up after startup founders have met some initial milestones to make their valuation better before they talk to investors. Those milestones are things like recruiting the team, testing the concept, developing the website, gaining traction, gaining users, registering the intellectual property. Then they turn to investors to get money they will use to meet new milestones which will produce another inflection point, when valuation pops up even more. Milestones depend on the specifics, but it might be getting the key people on board, developing the prototype, getting the first critical mass of users, going through some critical regulatory step, and so forth. In my chart here, we can see the first inflection point when the founders get going, the second inflection point when the investment money is put to good use, and the sweet spot, for both sides, in the middle.

In my illustration, valuation is that theoretical agreed-upon value that determines how much equity is exchanged for how much money. That’s a critical concept I explained in setting an initial valuation, an articles here on bplans.com.

There’s plenty of information about angel investors here on my blog, and elsewhere here at bplans.com, about what investors want, how to approach them, and so forth. But I think we miss the essential, fundamental concept of what makes a startup investment a win-win situation for startup founders and investors. It’s about both sides wanting the same thing, seeing the same opportunity, and betting, together, on the outcome. Win-win is easy to say afterwards, years later, when and if the business was successful. This sweet spot win-win is for beforehand, when the investment is made.

If you’re not in the sweet spot, don’t seek angel investment. Bootstrap.

What’s also important about the investment sweet spot is what to do if it doesn’t apply. For startup founders, if you don’t need the outsiders’ money to generate more growth than otherwise, then don’t seek investment. Never seek investment money unless you really need it. Other people’s money comes at a high cost in ownership, so you should only even consider it when it’s going to give you a much bigger value.

If you can do it yourself, and get there alone, do. Then you own the whole thing.

There’s a classic analogy that’s often used wrong. People will ask, “which is better, a piece of a watermelon, or a grape?” The rhetorical question is supposed to lead to a rhetorical answer in favor of the watermelon. That’s because it comes up in the context of startup founders sharing ownership with investors. But what if the better analogy is you have grapevine (your own business, entirely yours) vs. a piece of a watermelon?

Good angel investors don’t want to invest in a business that doesn’t need the money. And startup founders should not seek angel investment unless they need the money.