Is there a ‘right time’ for applying for a personal loan? Perhaps it’s easier to think about when it’s the wrong time to take out a loan. You don’t have to wait until your situation becomes desperate – careful planning for a loan could be a very wise thing for you to do. Here are some examples of when (and when not) to consider if a personal loan is right for you at the time.

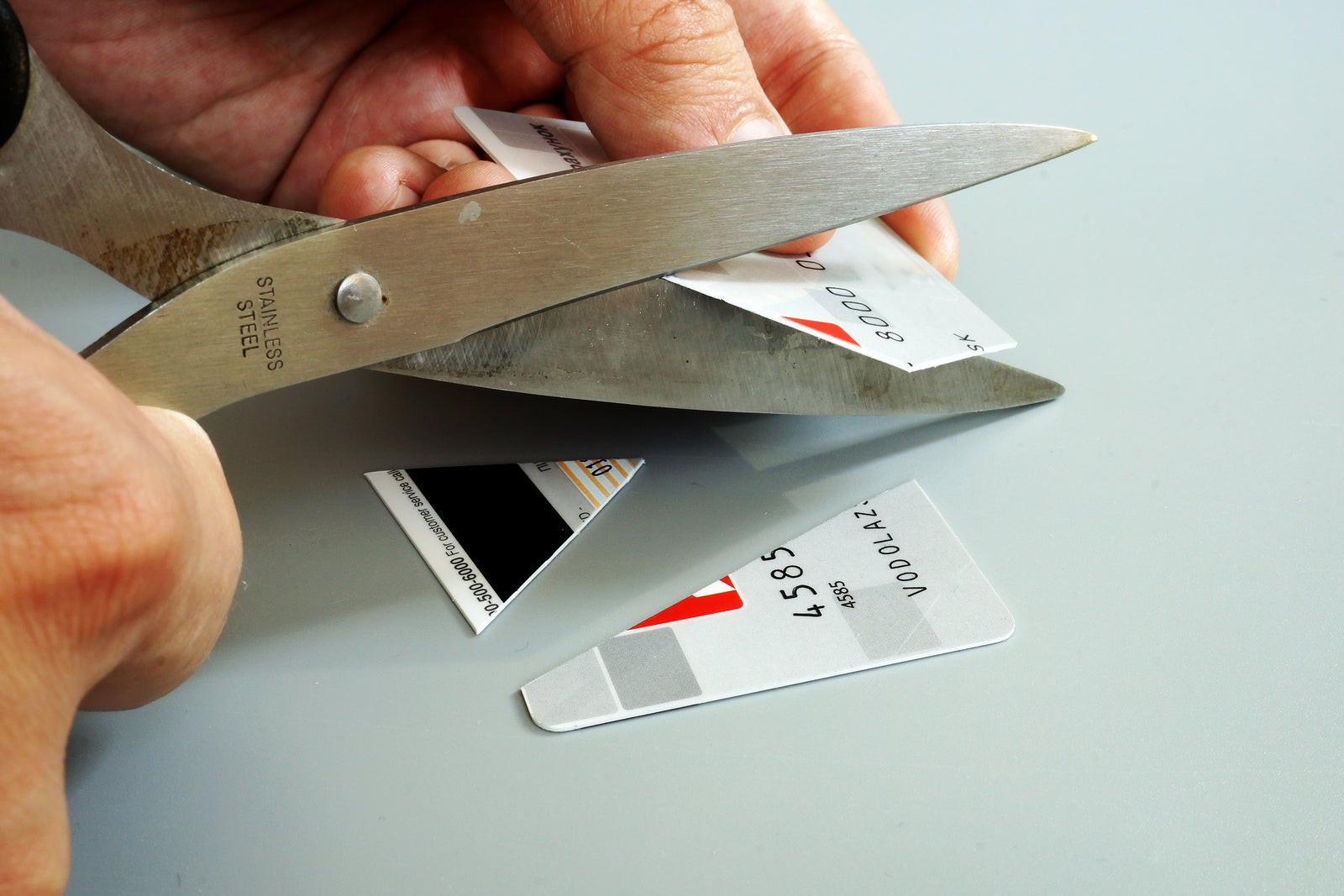

Wrong Time: When you have maxed out your credit cards

Right Time: Before you use your credit cards as a long-term loan

Using credit-cards to purchase items or pay bills that you don’t intend to pay off soon is generally considered as a bad idea, even though lots of people do it. Credit cards are not designed to be used for long-term payments, because their interest rates (relative to other forms of credit) are very high. Their convenience makes it super-easy for us to slip into long-term debt, and we pay the much higher price.

If you think that you will require long term credit then it’s best to act quickly and seek a loan that offers better interest rates and a more structured, affordable repayment method than your card will. If you have to act fast, before the loan application is accepted and its advance is paid to you, then you could make your purchases on your card now and pay off the balance with the loan as soon as it is in your bank. This depends very much on your circumstances, and self-discipline, which is critical with this tactic: be wary of spending the loan cash instead of paying off the card balance!

Wrong Time: When you need cash TODAY

Right Time: When you need cash SOON

The problem with needing cash right now is that your options might be limited to lenders that can send you the money now, but charge you sky-high interest rates, arrangement fees and other charges. Urgency creates leverage. An urgent loan suggests that you, as the borrower, is not that good at managing your finances, so, lenders will reduce the effect of that risk by charging you heavily for it.

Instead, as much as possible, make your decision to use a loan as the right solution for you slightly earlier than being desperate for it. The more lead time you have, the more you can shop around and the less you will be leveraged by lenders. Lenders like everydayloans.co.uk, will discuss their best deals with you giving you the time to choose the loan that suits your situation, rather being in a desperate situation and picking the first offer that comes your way.

Wrong Time: When you need to pay off the interest of other loans

Right Time: To avoid getting into further debt

The spiralling of debt is a big problem for a lot of people. A spiral of debt is a complex situation where an individual sees an ever-increasing amount of debt. The debt (and the interest on that debt) becomes more and more unsustainable. It eventually results in the defaulting on that debt.

In practical terms, what happens is that loans are taken out to service the interest payments of other loans – each subsequent loan getting more expensive and the debt much larger, and eventually being much more than what is affordable, even with affordability checks (which is why credit cards are often the last form of debt in the chain.)

If you intend to restructure your debts by taking out one loan to resolve a critical debt problem, it is probably the best solution for you to use a single loan that pays off all your others with a single, regular payment at an interest rate you can afford. You can plan for this. It needn’t be something you do when you’re desperate.

2813 Views