Know your industry. In a recent post here, I wrote that the most common stumbling point I see in multiple business plans is absurdly unrealistic profitability. Specifically …

Most of the business plans I see project profits too high, or profits too early. In the real world, startups choose growth or profits, not both. The plans I see are aiming at angel investment. And for that, the investors win on growth, not profitability. Think about it: If a startup is profitable early on, it doesn’t need investors.

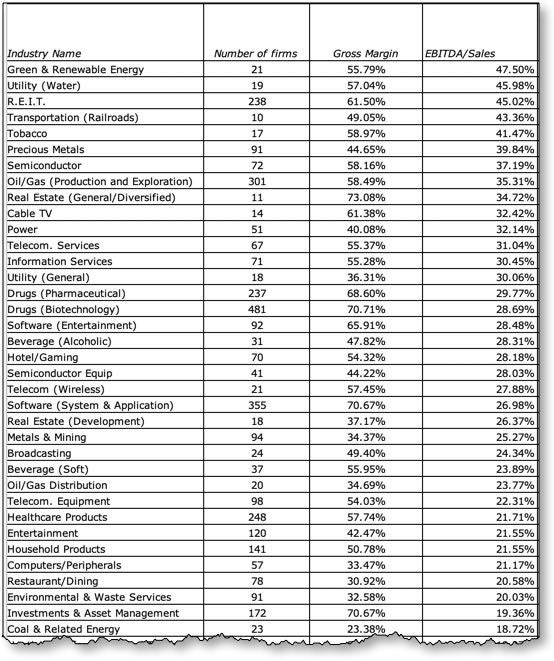

You can’t expect to make the same profits as the industry averages. Every business is unique. But you should still be aware of what’s reasonable, standard, or average. That information is readily available. You can go from there to what’s different in your specific case. I really like this NYU page OPERATING AND NET MARGINS. My thanks to the NYU STERN SCHOOL OF BUSINESS, specifically ASWATH DAMODARAN, who keeps this data up to date and makes it accessible.

Here’s a view of his data, the downloadable Excel file, sorted by EBITDA/Sales:

Or, if you are a LivePlan user, make sure you know about the LivePlan Industry Benchmarks that are built in.