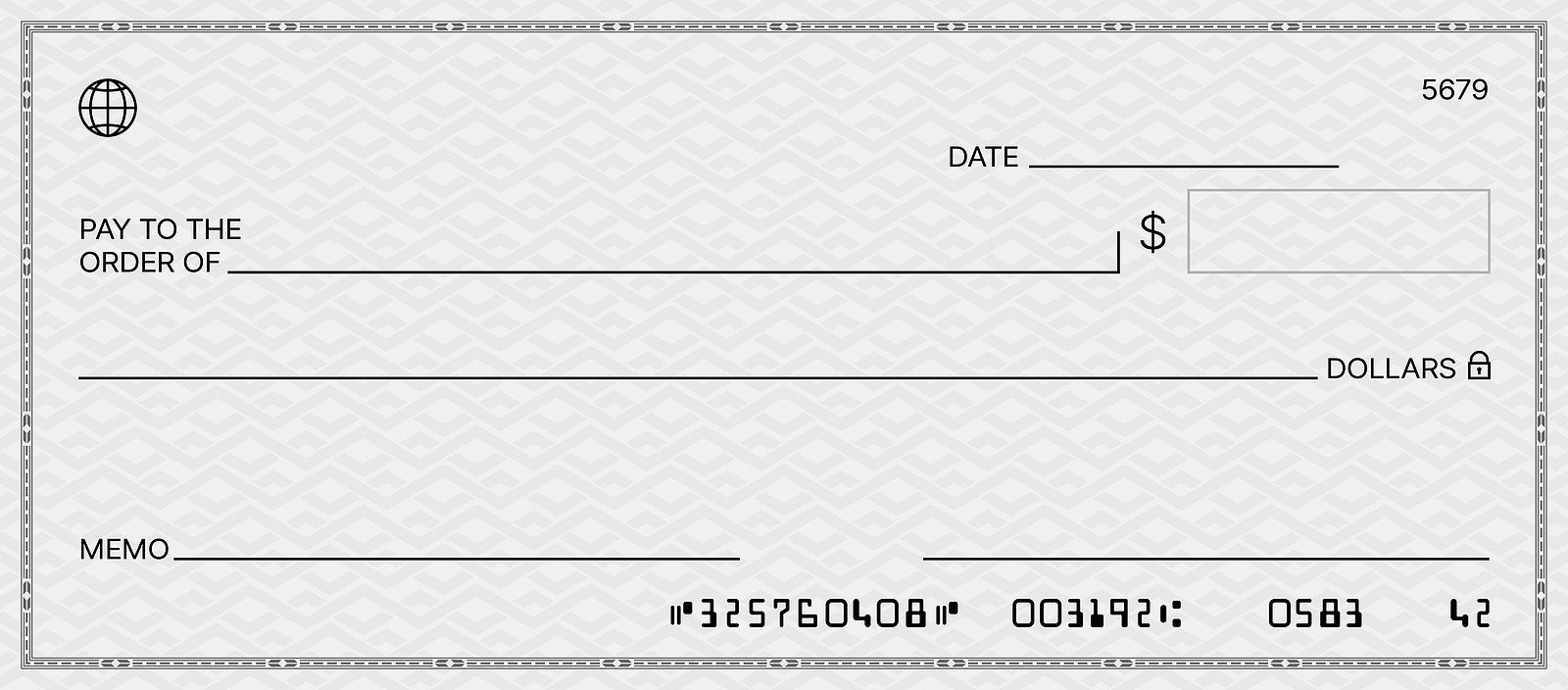

While there are many different types of checks, seven are the most common. These include personal checks, official checks, tax refund checks, cashier’s checks, insurance checks, commercial checks, certified checks, money orders, and traveler’s checks. Each type of check has its unique purposes and features. In this post, we’ll run through seven different types of checks, so you can know which one is right for you.

Personal Check

Personal checks are the most common type of check. They are typically used for everyday expenses like paying rent, groceries, gas, and utility bills. A personal check can also be used to withdraw funds from a TD bank account and make other payments. The main downside of personal checks is that they can sometimes bounce if you have insufficient funds in your personal account. Click here to learn more about the different kinds of personal checks.

Cashier’s Check

Also known as business checks or bank checks, cashier’s checks are a type of payment that the issuing financial institution guarantees. This means that the payee does not have to worry about whether or not the check will clear – the funds are already available. However, cashier’s checks can only be used to purchase goods or services from businesses in the same state as the issuing bank or credit union. So if you’re trying to use a bank check to buy something from a company in a different state, you’ll likely run into some problems.

Out-of-State Checks

As the name suggests, out-of-state checks are checks issued by a business bank account located in a different state than the payee’s account. These checks can be used to purchase goods or services from businesses in either the payee’s home state or the state where the check was issued. However, it’s important to note that an out-of-state check can take longer to clear than a cashier’s check.

Certified Checks

Just like government checks, a certified check is a check that has been verified by a bank to be legitimate and backed by funds. This type of check is generally used for large payments, such as tax payments or insurance company payments. Sometimes, a certified check can be used to secure a loan or pay off an overdraft fee. To get a certified check, you must first have an account with a bank. The bank will then verify the funds in your account and confirm that the check is legitimate. Once the check has been verified, the bank will stamp it with a certification seal. The account number will also be printed on the check, which allows the bank to track the funds

Traveler’s Checks

Traveler’s checks are a popular choice for traveling people because they are a secure form of payment. You can get traveler’s checks from a bank or a third-party website. When you use a traveler’s check, the bank issues a signed instrument that guarantees the payment. The bank will pay you back if the traveler’s check is lost or stolen.

Payroll Check

Like an electronic check, payroll checks are issued by the employer and drawn on a bank whose checking account is set up in the company’s name. A payroll check may also be issued through direct deposit payroll systems. With this type of deposit check issuance, a business gives a bank its payroll data and either authorizes a bank employee to create a payroll check from this data, or allows the bank to complete, sign, and deposit all payroll checks electronically on its behalf.

Electronic Checks (E-Checks)

Unlike a money order, electronic checks, also known as ACH (automated clearing house) transfers, are processed through your personal bank account and can be used with debit cards or credit cards. If you buy something online, this means that instead of having to wait for the item to be delivered before paying for it (which could take several days), all you have to do is sign up for an account at the website where you made your purchase, then enter your personal information into their system along with payment details such as amount owed and date purchased. Other types of checks include insurance check, government check, out-of-state check, business check, physical check, and tax refund check, among many others.

Credit building loans play a crucial role in the financial landscape for the UK, particularly for individuals relying on checks to pay their bills. For many, access to traditional lines of credit may be limited due to a lack of credit history or poor credit scores. In such circumstances, credit building loans offer a lifeline by providing a structured means to establish or rebuild creditworthiness.

Individuals relying on checks to pay bills often face hurdles in accessing mainstream financial services. Without a robust credit history, they may find it challenging to secure loans or credit cards from traditional lenders. This exclusion exacerbates financial vulnerability, limiting opportunities for economic advancement and perpetuating cycles of financial instability.

In essence, credit building loans in the UK serve as a critical tool for individuals relying on checks to pay their bills, offering a pathway to financial inclusion, stability, and ultimately, prosperity.

10506 Views