Tax and Accounting

What Is a Corporate Expenditure Audit?

Beginning the journey of entrepreneurship or managing an established business requires navigating a maze of financial decisions and obligations. Whether you’re a new startup founder or an experienced industry veteran, one universal reality remains: successfully…

Real Estate Investing Tax Benefits: Maximize Returns While Minimizing Liabilities

Real estate investing is a great way to diversify your portfolio and generate relatively passive income. There can be significant real estate tax benefits, as well. Although each individual situation is unique—and it’s always a…

What to Expect When Prepping Your Businesses Taxes

Prepping your small business taxes is never fun. The first time you try to do it, the experience can also be overwhelming. If you thought filing personal taxes was challenging, you’re sure not going to…

How to File Your Beneficial Ownership Report in 11 Easy Steps

By this point, you’ve probably already heard about the new Beneficial Ownership reporting requirement and started thinking about who in your business qualifies as a beneficial owner. The regulation helps FinCEN maintain a better picture…

College Athletes: Know Your Tax Obligations in NIL Agreements

Collegiate athletics is a competitive and popular multibillion dollar business industry. With television rights deals, conference realignment, recruitment, and much more, collegiate athletics garner significant media coverage. One topic receiving significant recent attention is the…

Upcoming Tax Changes for 2024

Individuals and businesses need to be aware of the upcoming tax changes that will impact their financial planning. From adjustments in tax rates to updates in deductions and credits, understanding these changes can help taxpayers prepare…

2024 Tax Planning: A Guide For CPAs, CFOs, & Business Owners

Tax year planning for state and local taxes is a critical aspect of financial management for individuals and businesses alike. By mastering the complexities of state and local tax regulations, CPAs, CFOs, and business owners…

Understanding The R&D Tax Credit And How To Claim It

The R&D tax credit is a valuable incentive provided by the government to encourage businesses to invest in research and development activities. It is a tax break that rewards companies for their innovation and technological…

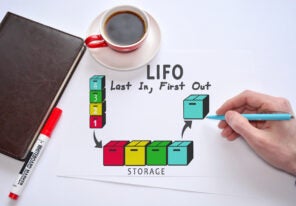

LIFO Can Still Provide Tax Savings for 2023

While inflation is not at the high levels seen in the last couple of years, if you haven’t elected LIFO previously, now is the time to look at Last-In-First-Out (LIFO) accounting. If you have inventories…

IRS Focused On Partnerships, Corporations, High-Income

IRS has announced sweeping efforts to restore fairness to tax system with Inflation Reduction Act funding; new compliance efforts have the IRS focused on partnerships, corporations, high-income, and promoters abusing tax rules on the books….