Posts Tagged ‘Accounting’

Startup Checklist: What Should I Ask My Accountant?

It’s only numbers, right? How hard could it be? Think again. Your choice of an accountant can have a lasting impact on your business, often making the difference between success and failure. If you’re an entrepreneur just launching your first small business, you’ll likely need start-up accounting services, as well as ongoing accounting support to…

Read MoreHire Right: 4 Specialists That Can Bolster a Burgeoning Company

As a new company, success largely depends upon the people that you hire to help run it. If you’ve just established a startup, you might not think you can afford a lot of specialists to help you out, but some of them are really essential. These four specialists might be the kind of roles you…

Read More5 Services All Business Owners Should Consider for the New Financial Year

As we’re in the new next financial year, now is the perfect time for business owners to invest in the right services. The new financial year is a fresh start, and with it comes the opportunity to review current practices and make sure business is going to plan. Strategically designing the year ahead is vital…

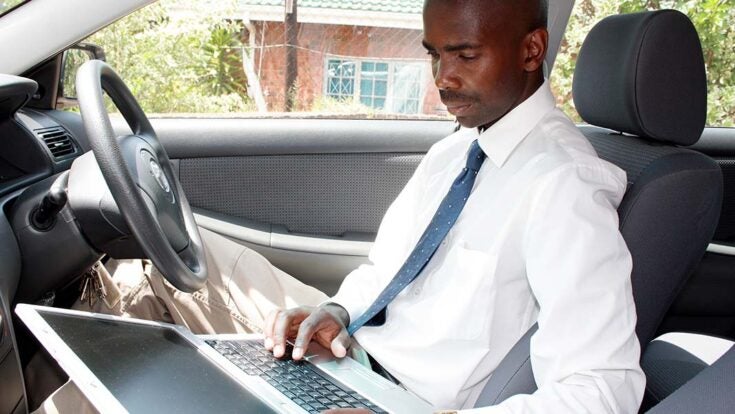

Read MoreVehicle Tax Deduction for Small Businesses

Whether you’re self-employed or run a small business, chances are you use a car to get from point A to point B. Luckily, during tax season, you can claim your vehicle when Uncle Sam comes barging in. We’re going to go over the qualifications and methods you can use to estimate your expenses so you…

Read MoreI’m a CEO: What Should I Outsource?

If you’re running a company, it probably means that you are A) incredibly adept at working well in a wide variety of disciplines, and B) incredibly worn out from taking care of aspects of your company better left to third parties. The good news is, you can redouble your efforts where you are needed most,…

Read MoreTax Rules for Bad Debts on a Balance Sheet

How do income tax rules treat bad debts? Facts: There are two provisions in the Income Tax Act (ITA) for bad debts. Discussion: The first way to claim a bad debt is covered in Section 20 of the ITA if the following requirements are met: the debt was owing to the taxpayer at the end…

Read MoreIs Xero the Right Accounting Software for You?

The task of managing all your accounting records can prove to be a serious challenge, particularly for a small business with a large quantity of transactions taking place throughout the course of a normal business day. Finding the right accounting software can be a huge boost to your productivity. One such service is Xero, which…

Read MoreTrue Story: Missing Assets Equal to a Year’s Sales

You don’t think finance and accounting matter in small business? Here’s a true story, and it’s about a small business like the ones I write about, in fact one I was involved in, not a large publicly traded company. $3 million worth of assets went missing, but nobody took them. Where do you think they…

Read MoreWhen Should I Book Revenues?

It’s the end of one year and the beginning of the next. Small Business owners have some discretion as to when they book revenues on the last day of the year. First you have to ask, what are you trying to accomplish? Do revenues need to look super strong for investors? Are you trying to…

Read MoreAccounting for Franchises: Tips to Help You Grow

Being a successful franchisee means having at least a general grasp on various aspects of running a business. You might not be an expert in marketing, management, or finance, but being well rounded enough to understand how each of these work will help you thrive with your franchise. Today, let’s talk about accounting. It’s absolutely…

Read More