The number of small businesses operating in the US is growing fast. Small businesses employ 47.5% of American private-sector workers, and that number keeps increasing as more people move away from corporate life.

Although small businesses are popping up on every corner, they still face challenges from tight budgets and sparse resources. With that comes the need to get a little more creative with compensation for employees, including offering benefits packages that compete with bigger companies.

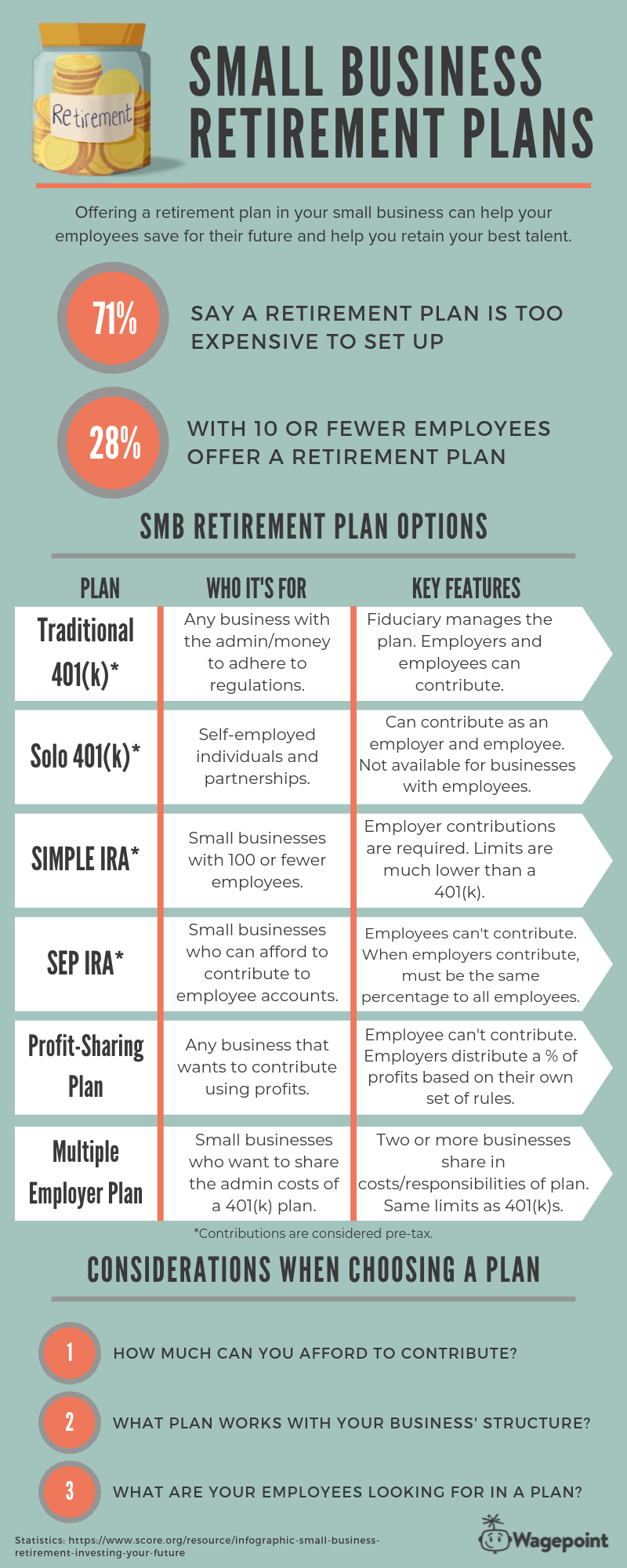

As a small business owner or manager, offering a retirement plan can help ease employee stress and boost retention.

Why retirement plans matter for small business employees

While many employees may be able to handle paying for their own private insurance packages, the lack of retirement plans becomes a big roadblock in securing the best talent for your small business. In fact, only 28% of businesses with 10 or fewer employees offer a retirement plan.

Lucky for you, there are some plan options that you can offer your employees to give them more peace of mind for their future.

And if you can’t afford to offer a plan, giving your employees more education about their options as individuals can prove your investment in them as people—which gives you another one-up in terms of company culture.

“The LIMRA research highlights the fact that Americans’ top financial concern is affording a comfortable retirement — and that they believe access to a workplace savings plan is the most effective way to get people to start to save for retirement. However, according to the LIMRA, among employers with fewer than 99 employees, only 42% offer retirement benefits.”

— John Manganaro, PlanSponsor

Small business retirement plans you can offer employees

Believe it or not, employers don’t have to shell out tons of money to put a retirement plan in place for their employees. In some cases, they don’t even need to make contributions to allow employees access to the benefits of a retirement plan. It all just depends on the type of plan you decide to implement.

Here are six different plan options you can use in your small business.

1. Traditional 401(k)

While many small business owners assume a traditional 401(k) plan is out of reach, new developments in cloud financing are making it more viable and affordable than before. (Wagepoint has started using Ubiquity, a flat-fee 401(k) provider).

A 401(k) is the most common type of retirement plan for businesses with employees, which is why they are heavily regulated by the IRS. Because of this, there are some additional tax forms to complete and additional hoops to jump through to ensure you’re distributing benefits up to standard.

Who it’s for: Any employer looking for flexibility in the design of their retirement plan, with the time and resources to meet the standards of its regulations.

Contribution limits:

- Employees: $18,500 or 100% of compensation, whichever is less. $6,000 max catch-up contribution available for employees over 50.

- Employers: 25% of compensation up to $55,000. Limit gets bumped up to $61,000 for employees over 50. Contributions are not required.

The pros:

- Employer and employees control their contributions.

- Pass off the burden of managing the plan to a fiduciary.

- Contributions are considered pre-tax.

The cons:

- Heavily regulated.

- Requires a separate fiduciary to monitor contributions/investments.

- Requires a non-discriminationtest or Safe Harbor plan.

2. Solo 401(k)

While a traditional 401(k) is built for employers with a number of employees, sole-proprietorships and partnerships can go the Solo route to get all the benefits of a business retirement plan. It has similar contribution limits and regulations as a traditional 401(k) without the need for company sponsorship. Note that the “employee” and “employer” here are the same person—the difference in contribution stems from where the money is actually coming from (individual compensation vs. business earnings).

Who it’s for: Self-employed individuals or partnerships.

Contribution limits:

- Employees: $18,500 or 100% of compensation, whichever is less. $6,000 max catch-up contribution available for employees over 50.

- Employers: 25% of compensation up to $55,000. Limit gets bumped up to $61,000 for employees over 50. Contributions are not required.

The pros:

- You can make contributions as an employer and as an employee.

- The contribution limits is higher than an IRA, just like a traditional 401(k).

- An employed spouse can also make contributions.

- Contributions are considered pre-tax.

The cons:

- You can’t open this plan if you have employees.

- Must file Form 5500-EZ after assets reach $250,000.

3. SIMPLE IRA

SIMPLE stands for Savings Incentive Match Plan for Employees Individual Retirement Account. (What a mouthful.) Though similar to a traditional 401(k), the contribution limits and catch-up provisions are much lower. Employers have the choice to either match up to 3% of an employee’s contribution or add up to 2% of the employee’s pay.

Who it’s for: Small businesses with 100 or fewer employees.

Contribution limits:

- Employees: $12,500 or 100% of compensation, whichever is less. $3,000 max catch-up contribution available for employees over 50.

- Employers: Either a 2% compensation contribution or matching up to 3%. This can change annually if IRS guidelinesare followed.

The pros:

- Employees manage their own investments.

- No tax filings required.

- Employers have two different contribution options.

- Contributions are considered pre-tax.

The cons:

- Employer contributions are required.

- Contribution limits are much lower than a traditional 401(k) or SEP IRA (discussed next).

4. SEP IRA

The Simplified Employee Pension Individual Retirement Account (SEP IRA) sounds complicated, but it can work wonders for small business employees. It’s set up individually like a normal IRA but only employers are able to make contributions.

Who it’s for: Small businesses who have some extra money to funnel into employee compensation packages.

Contribution limits:

- Employees: Contributions not allowed.

- Employers: Max 25% of compensation up to $55,000. Contributions are not required, but if they are made, the same percentage must go to every eligible employee.

The pros:

- Employers are not required to make contributions every year.

- Contribution limits are higher than traditional IRAs.

- No tax filing required.

- Contributions are considered pre-tax.

The cons:

- Completely employer-funded—employees cannot contribute.

- Employers must contribute the same percentage to alleligible employees.

5. Profit-Sharing Plan

Also known as a deferred profit-sharing plan (DPSP), this type of plan distributes retirement contributions from a percentage of the company’s profits. Employers usually decide how much to pay each employee using the comp-to-comp method—this takes the employee’s salary, compares it to the total amount paid to all employees, and uses that percentage to apply to the total profit amount to be distributed to the plan.

Who it’s for: Any business that wants to distribute profits as an alternative retirement savings outlet.

Contribution limits:

- Employees: Contributions not allowed.

- Employers: Max 25% of compensation up to $56,000. Limit gets bumped up to $62,000 for employees over 50. The compensation limit for consideration is $280,000. Contributions are not required.

The pros:

- Employers are not required to contribute every year.

- Employees have a sense of ownership of the company since contributions are a direct result of profits.

- Can be used in addition to other retirement plans.

The cons:

- If you do contribute, you have to outline a plan for distributing to eligible employees.

- Not always a consistent way for employees to save for retirement.

6. Multiple Employer Plans

Just as it sounds, Multiple Employer Plans (MEPs) are a retirement option where two or more companies pool their administrative resources to be able to afford a 401(k) plan. this is great for small employers who want to provide a plan without coughing up 100% of the cost and responsibility. There are many different types of MEPs—including those that are open to unrelated companies or closed to businesses within a trade organization.

Who it’s for: Small businesses who want to provide a 401(k) plan without paying 100% of the cost.

Contribution limits: Same as 401(k) limits, just uses a different sponsor for the plan.

The pros:

- Shared assets can mean a lower cost for the business.

- Still provides all the benefits of a 401(k) to your employees.

The cons:

- It’s extremely difficult to get out of an MEP since it’s a group plan.

- May not be a cheaper option now that technology is making individual plans more affordable.

Individual retirement plans for your employees

If none of these options are right for your business, you can always encourage your employees to take their retirement into their own hands. The more education you provide for them, the more they can see that you’re invested in their future—even if you’re not able to financially contribute to it.

Types of individual plans

There are retirement options out there for the individual. Both of these options can be used in addition to an employer-backed plan, or by themselves without one. Either way, these plans give the individual the power to control their own retirement savings by choosing what works best for them.

Individual Retirement Account (IRA)

An IRA is pretty common among American workers, even if their employer offers a formal retirement plan. They are built solely by the individual, and not taxed until the money is withdrawn upon retirement.

Contribution limits: $6,000 a year (or $7,000 if individual is 50 or older). If an individual also has a Roth IRA, the limit applies for total contributions across all accounts.

The pros:

- Allows an individual to start saving for retirement regardless of if their employer offers a plan.

- Contributions are tax-deductible in the year they are made.

- Contributions are considered pre-tax.

The cons:

- You pay taxes on your withdrawals in the future—and can’t guarantee that income tax rates won’t be higher then.

- There are required withdrawals after age 70½, and all contributions must stop at that point.

- Early withdrawal penalties of 10% start before the age of 59½ unless you qualify for specific distribution exceptions. These withdrawals will also be taxed as income.

Roth IRA

Roth IRAs are a slightly more flexible version of the traditional IRA. The biggest difference is when you pay taxes on your investment earnings. For a Roth, you pay taxes as you earn investment income so your withdrawals in the future are completely tax-free.

Contribution limits: $6,000 a year ($7,000 if individual is 50 or older). If you are above a certain income threshold, you may not qualify to contribute. If an individual also has a traditional IRA, the limit applies for total contributions across all accounts.

The pros:

- Allows an individual to start saving for retirement regardless of if their employer offers a plan.

- Taxes are paid in the year you make contributions, so withdrawals are tax-free in the future.

- There are no require withdrawal minimums and you can contribute as long as you want.

- Contributions are considered pre-tax.

The cons:

- You must be under a certain income threshold to be able to contribute to a Roth.

- Since the account is taxed on the front-end, there is no short-term tax break.

- Early withdrawal penalties of 10% start before the age of 59½ unless you qualify for specific distribution exceptions.

Payroll Deduction IRA

This type of IRA is not necessarily different from the Roth or traditional IRA. It just allows the employer to directly deduct an employee’s contribution from their paycheck to be deposited into their IRA account of choice. This doesn’t take any additional financial responsibility from the employer, and therefore can be a good option to offer your employees. They just set up their own IRA account (Roth or traditional), and the employer authorizes the direct transfer.

Look out for your employees’ futures

Small businesses have tight budgets, but investing in the futures of your employees is key to keeping them around. Even if you’re not able to provide them with an employer-backed plan, showing them all their options will help them save and know you have their backs.

The information we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.

Author: Erika Yohn is a savvy Millennial on Wagepoint’s marketing team. Now a retired soccer player, she spends a lot of time browsing Twitter to stay updated on the current trends – especially when it comes to memes. With a hand in all things marketing, she likes to keep things fun and useful for Wagepoint’s customers.

Author: Erika Yohn is a savvy Millennial on Wagepoint’s marketing team. Now a retired soccer player, she spends a lot of time browsing Twitter to stay updated on the current trends – especially when it comes to memes. With a hand in all things marketing, she likes to keep things fun and useful for Wagepoint’s customers.