Content marketing is going to save the world! Customers will let their fingers do the digital walking, SEO, PPC and other techniques will enable those customers to find us, our marketing automation tools will capture and nurture those customers through their quest to learn, SDR’s will intercept them at just the right point and then we magically have a qualified opportunity.

At least that’s what many would have you believe.

If it produces enough qualified deals to achieve your growth goals, then I suppose, it’s not a bad strategy.

But I wonder about all the opportunities we miss, all the chances to provide leadership, to teach customers, to help them learn how to buy—to extend how we develop and create value. What are we doing to find those?

Let’s build a model just to illustrate the challenge and the missed opportunities. For simplicity, I’ll use the CEB model—yeah, it’s the tired old 57%, but it’s just for illustration. Choose whichever one you like and apply it to these ideas. (I’ll pile on the disclaimer here. There are lots of models, lots of intersection points, we can use any one. I also portray the process as linear. In reality it is about as far from linear as one can imagine, but it’s difficult to portray the ideas in anything but a linear model. Readers of this blog are wickedly smart, so you’ll be able to do the translation yourself. If you want some help, Hank Barnes’ The Squishy Buying Cycle is brilliant.)

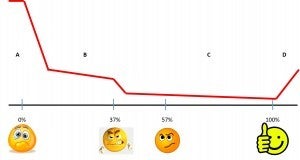

So let’s take a look at a simple model:

In this model, at some point, let’s call it “0” the customer becomes aware that things may not be going as well as possible. There might be a better way of doing things, there are problems they need to solve, there are opportunities they should be addressing. They slowly start a problem or opportunity solving process. We need to be clear, this doesn’t necessarily have anything to do with buying; that comes a little later when they know enough about their problem to start assessing solutions. So their buying process actually starts somewhere past “0.”

In the “0-30’s, several things are happening with the customer. First and hopefully, they are saying, “Our current state is unacceptable, we have to change.” They are spending time getting internal interest and support, assembling the problem/opportunity solving team, aligning priorities/agendas, defining the problem, identifying what to do, developing their action plan to address the problem and implement change. At some point, during this “0-30’s” they may get into buying process(es) exploring alternative solutions they may want to consider. It’s important, to know, they are probably not engaged in a singular buying process, but multiple parallel buying processes. We always focus on what we want them to buy for us, but there may be a whole lot of stuff going on. For example they may be interested in a software/SaaS solution, but also business process redesign, implementation services, and several other things–all focused on solving their problem.

During this “0-30’s” stage, they are doing some research, more learning about the problems, opportunities, issues they should be considering, benchmarking, and other stuff, they may be doing an early look at some solutions, but they aren’t likely to be diving really deep yet. So any SDR outreach is likely to be very low impact.

According to CEB data, problem solving teams tend to become unglued at roughly the 37% point. It has nothing to do with finding solutions, that’s probably way to early. They just get pissed off and frustrated with each other. They can’t align the different priorities and agendas, they can’t come to agreement on the problem, they can’t figure out their process for determining solutions for the problem and actions to go forward, or their priorities may have shifted the individuals to focus on other crises. So, almost before they’ve even started “buying” the dissolve their group and go on their separate ways.

If they are managing their way through these treacherous times, in addition to figuring out how they should manage themselves and the process, in the “30’s-57%” range, they are starting to research alternative solutions. It’s a content marketers dream, it’s what causes SDR’s to salivate. “Can we intercept them and bias them toward us, can we jumpstart their willingness to engage sales? Can we teach them about our solutions?”

Then we reach the mythical “57%,” content marketers and SDR’s are proud, they’ve accomplished their goal, we’re now 1 of 3. Sales people breathe a sigh of relief, they jump in and do their thing until the customer reaches 100%, issuing a PO.

So that’s the way this process works. Depending on your model, the place at which the customer transitions from one phase to another, may differ. There’s a lot of fuzziness about the “0-30’s,” it may go into the 40’s. Likewise, there’s fuzziness around the “30’s-57’s” and even fuzziness around the 57%. But you’ve got the rough idea.

Provocative, insight, challenger types of sales people may be getting involved early, anywhere in the “0’s-57%,” but I’ll come back to that in a moment.

But let’s step back and map the opportunity potential against this progression. I think it looks something like this:

This is where the fun begins! It turns out, most of the opportunity probably exists in the spaces where content marketing, SDR’s, and sales spend the least time. The largest part of the opportunity, is actually before “0%,” in the A region. It’s the people and organizations who are merrily going about their business not recognizing they are underperforming, can do better or are missing opportunities. They’re just showing up for work, perhaps struggling, but consumed in doing their jobs. Planners and strategists have a name for this, it’s called “TAM,” Total Addressable Market. The opportunity at this point is to create lots more opportunities! To disrupt the customer, shake them out of their blissful (or non-blissful state) and say, “You can do better!”

It’s probably really difficult for content marketing to do this, because these customers aren’t searching. Their fingers aren’t dancing over their keyboards, asking, “How do I improve, what am I missing,” because they don’t know they are missing anything. It’s actually really easy to find these people/organizations. If we understand the impact or the problems we solve on the overall performance of the organization, it’s easy to find organizations who are underperforming. Lots of analytic tools help us do this. One of my favorites is Decisionlink. However, once we’ve identified these people/organizations, we have to have something meaningful to say in order to disrupt their reverie and get them to think about change. That’s where concepts like Insight, first come to bear.

The opportunity is huge, but traditionally, we wait for it to find us. Someday, some year. We need to shift our strategies and hunt down these opportunities. Not just for the potential revenue we get, but because our customers need and deserve this! They struggle to grow, some struggle to survive. If we can engage them in thoughtful discussions about the challenges they face, and how they can improve, we’ve created huge value!

The second big opportunity to find more opportunities is in the B region. I’ve loosely called this the “0-30’s” stage. Look at the drop off in opportunities, moving from B to C! Most of the reason is the dysfunction that sits in the ability of the customer to manage their own problem solving process. It has nothing to do with selection of the solution (buying) but their own ability to get their act together and solve problems!

Think of the impact to our own pipelines and funnels if customers didn’t go off the cliff somewhere around 37%! There are far more opportunities in which to compete!

But here again, most content marketing doesn’t address this. Most content, at this point is probably focusing on “our ability to solve the problem.” Yes, customers are starting to look at this, but they don’t have a unified view of the process, the problem they are going to solve, and so forth. So the content we generally provide isn’t the most relevant, helpful or impactful content because it isn’t addressing the issues they struggle with.

Challenger Customer actually cites some very innovative practices. Some companies are creating content and conversations around the process of aligning, getting buy in and figuring out how to solve our problem. This can be very powerful.

But there is still a huge opportunity for sales engagement here!

It’s great for our customers to see how others have approached this, but they still struggle, “We’re different, But what should we be doing specifically, How do we get past this?” Here’s where sales can create huge value, yet again. But it’s different than talking about how well our solutions can solve their problem. We have to keep them from going off that cliff to No Decision Made!

At this point sales has to help them organize, align, and put in a process for identifying and solving their problem (as distinct from choosing solutions). It’s actually quite a different set of skills and a different engagement model than we traditionally think of.

I’ll skip through section “C,” we’ve all been there, done that. We need to improve and do it better. Targeted, relevant content (industry, persona, problem, buying stage focused) is critical. Great sales engagement is critical. But remember, we’re 1 in 3. This is the area where we are challenged, because any of the 3 is OK for the customer. If we only participate in the “C” region, we’ve minimized our value creation and differentiation potential.

Plus, we’re competing in the smallest part of the addressable opportunity. It’s only those customers who’ve been able to get this far in the process.

At some point, someone, hopefully us, gets the PO.

We move into region “D.” Yep, the opportunity grows again! It’s the upsell, cross sell. It’s the opportunity to work with the customer to continually improve. It’s the opportunity to look at the account, expanding our share of account. After all, if we are doing the right job, it’s our God-given right to 100% share of account. Too often, we forget, moving onto another opportunity, asking, “Are they at 57% yet?”

How do we make this actionable?

I’ve waxed on, hopefully somewhat eloquently, about all the opportunity we’re missing. But what do we do about it? How do we begin attacking it and seizing some of it?

Thankfully, most of it is readily achievable, but demands rethinking our sales deployment models, skills and competencies we build and how our marketing, content, and sales work together.

Here are a few ideas:

- Identifying the opportunities in the “A” region is actually pretty easy. We have to clearly understand the problems we are the best in the world at solving, who has those problems, and who has those problems now. If we connect the dots between the problems we solve the impact on overall corporate performance, you can identify and target customers in the “A” region. Call the guys up at Decisionlink. They can give you a stack ranked list of the customers having the biggest problems and represent prime targets for you to target.

- We need to have a special engagement with customers in the “A” region. I believe we need to rethink our models of SDR’s, perhaps putting our very best Challengers in SDR roles, focused purely on creating opportunities in the A region. In a couple of days, I’ll be publishing a post on “Rethinking the SDR.” What’s really good about this, is we don’t need a lot of them, and their work is very targeted. Leveraging collaborative and teamed approaches to selling, we can leverage other resources to manage the rest of the deal.

- If we’ve captured the customer at “A,” we continue to engage them through “B, C, D.” B is a bit of a challenge. It’s possibly a different set of skills, focused on facilitation, critical thinking, problem solving, and project management. Here, again, we might look at a different deployment model, leveraging a small pool of specialists to support our customers in this stage. Their goal is to get more customers from B to C, with fewer falling off a cliff.

- There are also shifts in our content. It’s less about how we solve their problem but more about the process of solving problems, organizing and aligning the organization to take action. Again, Challenger Customer has some interesting examples their clients have leveraged.

- My biggest problem with the “B” region, is “How do you find them, if you weren’t there at the start?” Some customers decide they need to change and start the process without our help. They probably aren’t visible through their searches and engagement at our digital outposts, so how do we find them. Right now, I don’t know the answer–but I’ll figure it out. Brent and I are chatting soon, so I’ll challenge him on this. If you have ideas, I’d love to hear your comments. I think this is a breakthrough area in finding new opportunities, I just haven’t figured the breakthrough yet.

- Moving into “C,” we’ve all been there, done that, need to do it better. I’ll leave it at that.

- Finally “D,” we need to systematically hunt for ways to improve and expand. This is not account maintenance, this is developing a road map for the customer about how we can help them continue to achieve their goals more effectively. It’s a hunter, not a farmer!

I’ll be sharing more over the coming weeks. Thanks for hanging in for this very long post. I’d love your feedback and ideas.

For those who want to make it happen, we’ve been working with a small number of organizations who are doing many of these things right now–creating stunning results. Glad to share some of their success with you and help you on your journey!

Postscript, Finding The B’s: As is common with all of us, sometimes I get caught up in overthinking things. Thanks to Don Mulhern, he pointed out the answer that was right in front of me all the time. When we are prospecting for the A’s, we actually don’t know whether they are in the A or B region. But our prospecting should uncover this and we should be able to engage the customer wherever they are at. The Insight driven conversation on changing for the A’s, the “How do you align agendas, priorities and develop a plan to solver your problem,” for the B’s. Thank you Don!