It is undoubtedly the case that research and development (R&D) tax relief is something that many businesses overlook. A huge range of companies won’t even consider the possibility that they might be eligible for R&D tax credits because of a misunderstanding about what is meant by the term R&D.

“Despite being launched all the way back in 2000, research and development tax credit is still woefully underutilised,” says Simon Bulteel of Cooden Tax Consulting, specialists in R&D tax credits “there are many companies in the creative, manufacturing and technological industries that are still unaware of the money they could be claiming through the scheme”.

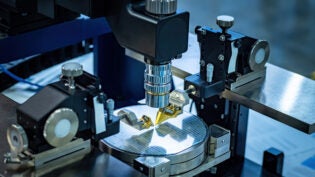

A large number of organisations believe that R&D is exclusively taken up by science and pharmaceutical companies – but this isn’t the case at all. In fact, any company can claim R&D tax relief, as long as they meet the criteria of the scheme.

Here we take a look at the steps you need to take if you are interested in applying for R&D tax relief.

1. Work with R&D specialists

Firstly, it should be stated that if you are new to R&D tax claims, it is advisable to work with a company that specialises in it. It is true that anyone is able to apply for the R&D schemes that are available – however, there is a large number of complexities and complicating factors.

Working with R&D professionals can help you navigate the complex process of making a claim, reducing the mistakes made in the application and even helping to optimise it to ensure that you are getting exactly what you should be owed.

2. Understand which scheme you need

It is worth pointing out here that there are actually two different R&D schemes, and you need to make sure that you are making your claim towards the correct one. The two schemes are the SME R&D Tax Relief and the Research and Development Expenditure Credit (RDEC). Functionally, you can think of the first being designed for small businesses, and the second being designed for larger businesses.

For the purposes of the scheme, you are considered to be a small business if you have fewer than 500 members of staff, and turnover less than €100 million.

3. Finalise the financial aspects

The next step is to select the projects that you are going to be claiming R&D tax relief for. Note that it is a specific part of your work that you claim tax relief on, not the whole of your operation. As a part of your claim, you make clear to HMRC which projects in your businesses require R&D tax credit – and it is on these that the claim is made. The projects you choose must meet the definition of R&D from the perspective of HMRC.

You must then add up the costs of the projects that you have chosen – these count as your qualifying expenditure. For the majority of businesses, the largest expenses are staff, subcontractors, and consumables, including software licences.

4. Create a technical narrative

The next step is the technical narrative which outlines in writing the nature of the work that was undertaken as a part of your R&D projects, noting the challenges that you faced. This can be another area where it is advisable to work with R&D specialists, as they will be able to provide you with guidance.

Technical narratives are not mandatory, but correctly writing one and submitting it with your application can make the whole process smoother.

5. Complete your tax return

You can now complete your company tax return with your CT600 form – you may do this with your traditional accountant, so it can be sensible to get them to liaise with the R&D tax specialist that you are working with.

Final thoughts

Completing an R&D tax relief claim can be hugely financially significant for your business – you shouldn’t miss out on money that you are owed simply because it looks complicated to make a claim. In truth, you can easily put this in the hands of an R&D tax specialist and the tax relief claimed will more than make up for their costs.

2060 Views