Giving an Employee Bonus: What You Need to Know

By: Wagepoint

As the year draws to an end, you may find yourself wanting to show your appreciation by offering an employee bonus. If it’s a fit for your company culture and budget, it’s a great thing. But it also made us curious about who gives employee bonuses and why?

General Trends for the Employee Bonus

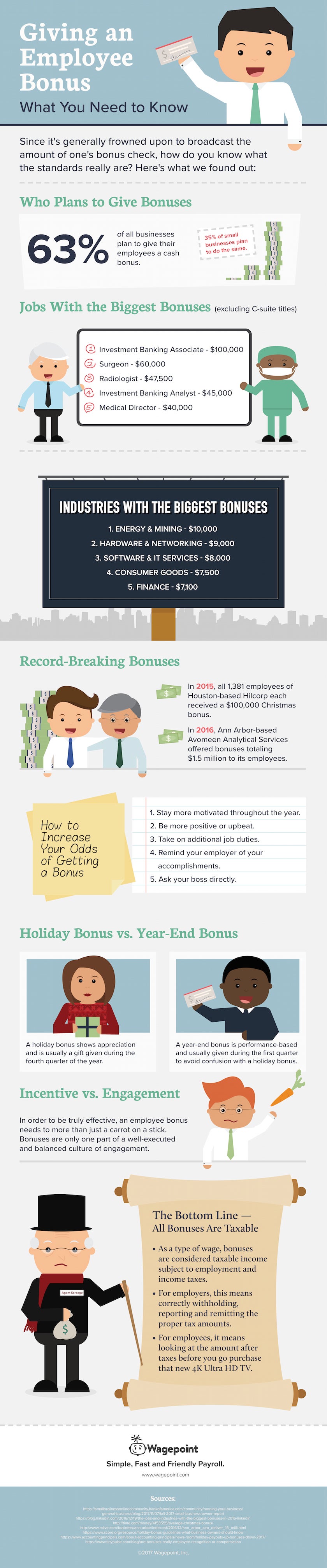

Accounting Principles, which surveys businesses of all sizes, found that 63% of all businesses (large and small) planned to give cash bonuses to their employees this year. While this is a 12% decrease from the 75% one year ago, the dollar amounts of the bonuses received where an average of $716 higher.*

For those companies opting not to provide cash bonuses, 39% will provide other perks throughout the year and 38% plan to give charitable donations instead of a cash bonus. Interestingly, the number of businesses replacing cash bonuses with charitable donations increased 31% from the previous year

In terms of small businesses, Bank of America’s Fall 2017 Small Business Owner Report showed that 35% of small businesses (with 100 employees or less) plan to give their employees cash bonuses this year. Bucking the trend as small businesses often do, this is a 4% increase over the 31% of small business who said they were giving bonuses last year.

For employers using specific calculations to determine an employee bonus amount, percentages varied by industry. Other employers used a flat amount, such as one to two weeks of salary.

The Non C-Suite Jobs With the Highest Employee Bonuses

Each year, LinkedIn publishes a report on the highest annual bonuses. According to the 2016 results, the top five jobs with the largest annual bonus were:

- Investment Banking Associate — $100,000 cash bonus

- Surgeon— $60,000 cash bonus

- Radiologist — $47,500 cash bonus

- Investment Banking Analyst — $45,000 cash bonus

- Medical Director — $40,000 cash bonus

The Industries With the Highest Cash Bonus Amounts

Rounding out the top five were:

- Energy & Mining — $10,000

- Hardware & Networking — $9,000

- Software & IT Services — $8,000

- Consumer Goods — $7,500

- Finance — $7,100

The Reasons Why an Employee Bonus is Given

Tiny Pulse wrote an interesting blog post that talks about the difference between using an employee bonus as recognition versus compensation.

If an annual or holiday bonus is just expected and not really earned through any extra effort, then it’s really just compensation. It doesn’t enhance the company culture or increase engagement.

However, if an employee bonus is tied to performance and is part of culturally relevant engagement program, it can be very effective in boosting productivity and strengthening retention. But, you need to make sure that you stick to and follow the performance requirements. If people only half-try and still get a bonus, what’s really going to inspire your highest performers?

Again, it’s all how it’s framed. If the focus is solely on monetary rewards (in the absence of a fully developed culture of recognition), a performance-based employee bonus alone is technically not a gift in the sense that it’s given freely or spontaneously.

The Benefits of Well-Structured Employee Recognition Program

It’s common sense that if you don’t feel valued, you’re not going to feel especially motivated either. It’s also reflected in these statistics:

- 50% of employees believe retention would be higher with greater investments in recognition.

- 40% of employees wouldn’t be inspired to put in extra effort if there’s really no promise of a tangible reward.

- 90% of employees really don’t feel engagedat work.

- 76% of employees who are recognized for their hard work are engaged.

- High-performingemployees at successful companies share three characteristics — talent, engagement, and more than 10 years of service.

Even the Timing of an Employee Bonus Makes a Difference

According to SCORE, a holiday bonus is a gift to show appreciation that’s normally given during the Q4 holiday period. A performance-based (year-end) bonus is more likely to be given to employees at the start of the new year during Q1.

The timing helps to avoid confusion between the two kinds of employee bonuses. Although, properly communicating the nature of the bonus and its intent to employees is also recommended and highly effective as well.

Above All Else, Be Respectful

Look before you leap. Think before you act. Before you hand out a blanket holiday bonus, make sure you don’t exclude employees. Feeling left out isn’t exactly a Kum ba yah moment for anyone.

If your employee bonuses are performance-based, make sure that each employee knows the criteria and what’s expected right from the start. It’s hard to reach a goal when you don’t even know it exists.

If, for any reason, you choose not to offer a bonus after years of doing so, inform employees well in advance. If a holiday bonus has been a tradition, your employees are likely planning this into their holiday budgets. Respect this, explain the change and give everyone time to adapt.

Reassert the importance of confidentiality. If bonus amounts vary and merit-based, remind employees that compensation is a sensitive topic and it’s best to keep this information to themselves.

A Short List of Alternatives to Cash Bonuses

In researching this post, it became abundantly clear that an employee bonus doesn’t always have to be cash. Here are some of the best ideas:

- A simple thank you — In person, handwritten or sent via email. (Seriously, though a personal touch is always best.)

- A charitable donation— As culture is becoming more important, this option is gaining popularity.

- Flexibility— Understanding the world doesn’t operate in a vacuum dictated by a 9-to-5 schedule goes a long way.

- On-site events and meals— It doesn’t have to be fancy, just creative and meaningful.

- Extra time off — An added break can make a big difference during the summer, holidays or a peak season for your industry.

- Achievement awards— This could be printed certificates or even trophies of varying sizes. Everyone likes a little desk bling every now and then.

- Appreciation and a recognition of company values throughout the year— After all, recognizing someone once a year is like only seeing family at weddings and funerals.

When thinking of alternative tokens of appreciation, keep in mind that any cash gift is considered taxable — even if it’s not a bonus. As is any gift card. In fact, there are very few things that aren’t.

How Employees Can Earn a Bonus

As part of their annual survey, Accounting Principles asks what employees can do to help ensure that they get a bonus. The suggestions include:

- Staying more motivated throughout the year.

- Being more positive or upbeat.

- Taking on additional job duties.

- Reminding your employer of your accomplishments.

- Asking your boss directly. (Makes sense, but still a gutsy move.)

Remember, Bonuses Are Taxable Income

This is something both employees and employers should know. Employee bonuses are a form of income and are therefore taxable.

Businesses don’t want to find out the hard way that they owe taxes on the bonuses they’ve paid and employees need to take taxes into account so that they’re aware of exactly how much money they’ll have up front.

Employers can help employees understand this by communicating with them at the time the bonus is given.

The taxes that apply in the United States include:

- Federal, state and local income tax.

- Medicare and social security.

- Federal and state unemployment.

The taxes that apply in Canada include:

- Federal and provincial income tax.

- Canadian Pension Plan (CPP) contributions.

- Employment Insurance (EI) premiums.

A few of concepts and terms related to the taxation of employee bonuses that it helps to be familiar with are:

- Supplemental wages — Bonuses are considered supplemental wages. Another term you may also see is bonus wages. They all mean the same thing, income that’s earned in addition to regular wages.

- The taxes for most holiday or one-time bonuses are calculated separately from regular wages. Conversely, some planned or regular bonuses are calculated with regular wages. For more information and examples, see our post on calculating taxes on bonus wages.

- Discretionary bonuses — On a top-level, one-time holiday and performance bonuses, like the ones discussed in this post are discretionary.

- Non-discretionary bonuses — If a bonus is mandated by an employee’s contract, it’s not optional and may also be subject to overtime rules.

What are your thoughts? Are you for giving an employee bonus or dead set against it? Have a story to share or question to ask? Let’s have a conversation in the comments below.

Disclaimer: The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.

*If you saw a previous version of this infographic, it had a statistic that said that 75% of small businesses were planning to give cash bonuses this year. This source that provided this statistic has since been updated. Being unable to verify that percentage, we sought to offer you updated states from more credible sources.

Author: Blogmaster, content creator and inbound marketing guru at Wagepoint, Michelle Mire enjoys simplifying complex payroll topics and generating articles with actionable advice for small businesses and startups. When not at the keyboard, she enjoys chocolate, running and quality television (not always in that order).

Author: Blogmaster, content creator and inbound marketing guru at Wagepoint, Michelle Mire enjoys simplifying complex payroll topics and generating articles with actionable advice for small businesses and startups. When not at the keyboard, she enjoys chocolate, running and quality television (not always in that order).