I am very excited and pleased to introduce the online community to a great new company I’ve found. TaxJar is an amazing company that has created a tool nearly every online seller—and literally every Amazon FBA seller—can’t live without.

Online Sales Tax 101

In case you’ve been under a rock for the last few months, Online Sales Tax has become a huge issue in Congress and various state legislatures as of late. Recent news—such as Detroit’s bankruptcy—shows more than ever that states and local areas are desperate for income. Because of this, they are becoming more and more aggressive toward collecting sales tax from online sellers. Without being too much of a scare monger, if you are NOT already collecting sales tax from your buyers in states where you have nexus, you should really get started.

Uh oh. Got “Nexus?”

More and more, the average online seller is becoming multi-channel. Lately it is rare for me to meet a seller who sells only on eBay or only on Amazon. As sellers become multi-channel, they increase their exposure to the issue of nexus. Amazon FBA sellers are already versed in this issue, and that is a whole other article.

Nexus issues can require you to collect and remit sales tax in more than just the state where you live. As an FBA seller, I am currently filing in 12 states and am preparing to add 2 more (CA and AR).

Yet another issue for online sellers is whether a state collects based on ‘destination’ (your buyer’s address) or the percentage can be based on where your Nexus is within the state (for example the location of the Amazon warehouse). More states choose the complicated position, unfortunately. Here is a great blog post from TaxJar about this issue.

One last complication for you to consider, while the exact total number of tax districts is hard to pin down, it is safe to say that within these “United” States there are over 10,000. If you wonder where that number comes from, consider where you are living. You have to pay the ‘state’ tax (unless of course you live in a state with no sales tax), but then you are also paying a ‘county’ tax and usually a ‘city’ tax. In most areas there are even special tax districts for a school bond issue or some other local fund. In addition to these, we have the ‘Sales Tax Holidays’ which we just had here in AR for Back-to-School shopping. So, how is a small business to cope?

TaxJar Helps You Put a Lid on Sales Tax

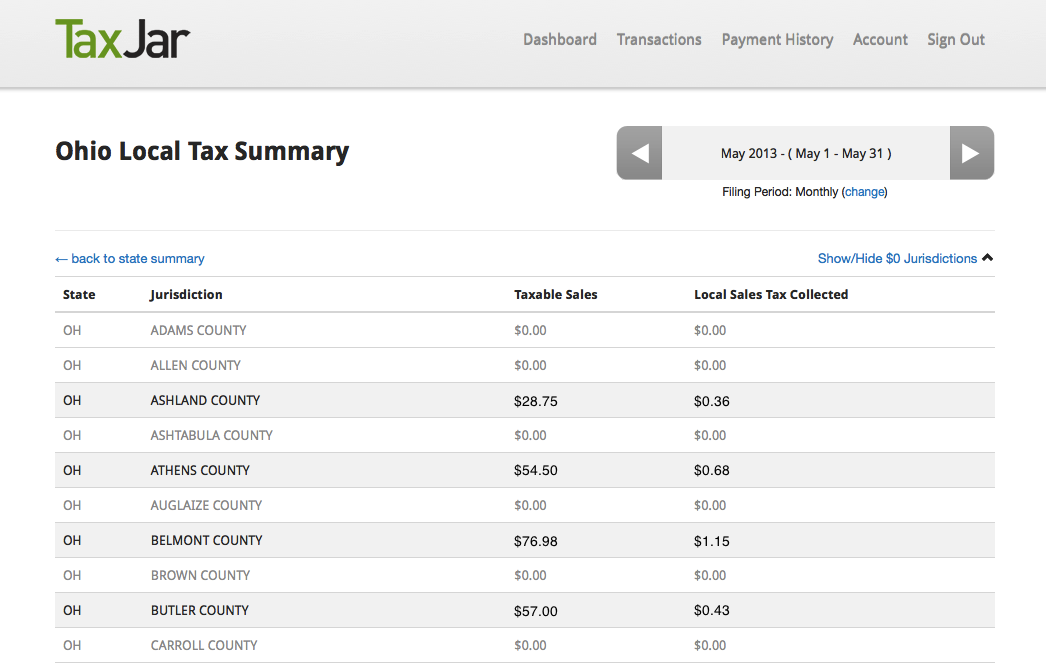

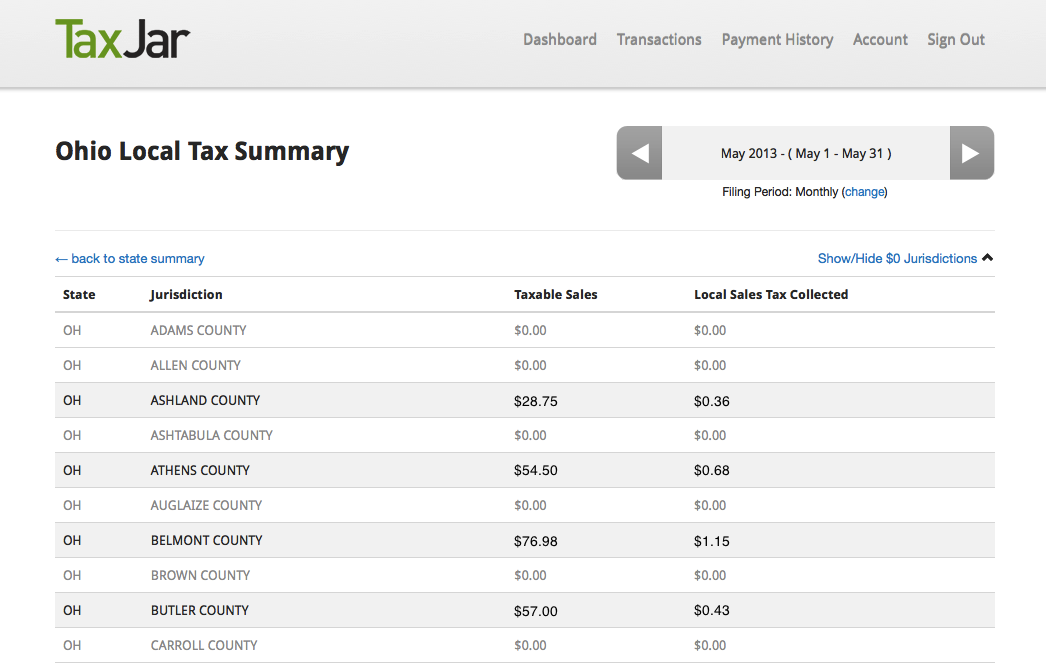

Well, this is where Tax Jar comes to the rescue! Here is a screenshot of the local taxes report in an example state (OH).

It’s not just difficult to determine how much to collect, but it is incredibly difficult and time consuming to figure out how much you collected, add it all between the multiple channels where you sell, get the data into the correct format for the state where you are filing (each state has somewhat different requirements), understand the filing deadlines, keep track of who you have paid and when, and then do it all over again next month! This is the issue TaxJar solves.

All you have to do is sign up for TaxJar, connect your eBay, Amazon, Shopify and PayPal accounts and TaxJar will pull in all the data, organize it by state and help you fill out the reports you need. At this time TaxJar won’t allow you to file from their site but that is coming!

I met the founders of Outright when they were just starting the company and I knew right away they would be a game changer for small sellers like me. I had that same feeling when I got to know Mark Faggiano, the founder of TaxJar (Editor’s Note: and a former Outright blogger!). This product has become a huge help for my business as I continue to try and comply with U. S. sales tax law. Whether or not the Marketplace Fairness Act passes, taxes are only going to get more complicated. I feel much better knowing that I have TaxJar to help keep me in compliance.

Please check out TaxJar and leave your comments here, I’d love to know what you are thinking about TaxJar, Online Sales Tax and the Marketplace Fairness Act.

This article was originally published by Outright

Respected as a trusted eCommerce speaker, educator, and entrepreneur, Kat Simpson has been a successful eCommerce merchant for over 10 years. She is an eBay Education Specialist and Silver Level PowerSeller, who also maintains stores on Addoway, Bonanza, Buy.com, and iOffer. Currently Kat is the producer of popular weekly Amazon FBA Podcast FBA Radio along with Chris Green of FBAPower.

Published: September 12, 2013

2938 Views

2938 Views