Posts Tagged ‘Taxes’

10 Year-End Tax Tips for Business Owners

As a business owner, you know that staying on top of your finances is no small task. But don’t worry—today, I’m going to hit 10 strategies to consider for your year-tax planning. No need to panic—we’re here to make taxes a little less taxing. Let’s kick things off with something that sounds a bit boring…

Read MoreSmall Business Tax Tips From the IRS

Every month, the Internal Revenue Service publishes resources and information helpful to small businesses and individual filers. Here are some of the latest tips from the IRS: Avoid misleading “Offer in Compromise” mills The IRS reminds businesses to beware of promoters that claim their services are necessary to resolve unpaid federal taxes while charging big…

Read More12 Nasty Tax Scams and How to Prevent Them

Let’s agree on this: Most of what’s written below will NEVER happen to you. Why? Because you are reading this now and your propensity to consume security-related content keeps you current on tax scams and how to prevent them. So, this means you have a responsibility as a security conscious citizen to spread the prevention…

Read MoreHow HR Departments Can Simplify Tax Compliance for Employees

In today’s complex world of regulations, getting to be and remaining tax-compliant can be a challenge for both employees and employers. For employees, wrapping your head around all the details of tax regulations, understanding deductions, and filing accurate returns can be overwhelming. HR departments play a crucial role in making it easier for employees to…

Read MoreSmart Strategies for Business Owners: How to Minimize Social Security Taxes

As a small business owner, planning for retirement requires more than just saving diligently—it also involves preparing for the tax implications on your Social Security benefits. In many states, Social Security income is subject to both federal and state taxes, which can reduce the amount you actually receive during retirement. This is especially important for…

Read More4 Noticeable Trends Impacting Small Business Today

As markets continue to shift, American small businesses remain focused on growing their businesses this year. Though, while small businesses (with 19 or fewer employees) are hiring according to recent data from the ADP National Employment Report, they are still faced with challenges when growing their business. In fact, in a recent ADP Market Pulse Study,…

Read MoreStreamline Business Tax Filing With These Regular Tasks

Prepping your small business for tax filing doesn’t have to be a headache. By implementing certain tasks consistently throughout the year, you can simplify the process and avoid the last-minute rush. Here are five essential tasks to streamline tax filing for your business: Maintain Accurate Records Keeping meticulous records is crucial for speeding up tax…

Read MoreCollege Athletes: Know Your Tax Obligations in NIL Agreements

Collegiate athletics is a competitive and popular multibillion dollar business industry. With television rights deals, conference realignment, recruitment, and much more, collegiate athletics garner significant media coverage. One topic receiving significant recent attention is the area of Name, Image, and Likeness (NIL) agreements, which allow student-athletes to financially benefit from their NIL. Due to the…

Read MoreUpcoming Tax Changes for 2024

Individuals and businesses need to be aware of the upcoming tax changes that will impact their financial planning. From adjustments in tax rates to updates in deductions and credits, understanding these changes can help taxpayers prepare and make informed decisions. In this overview, we will discuss the key tax changes that take effect in 2024, providing…

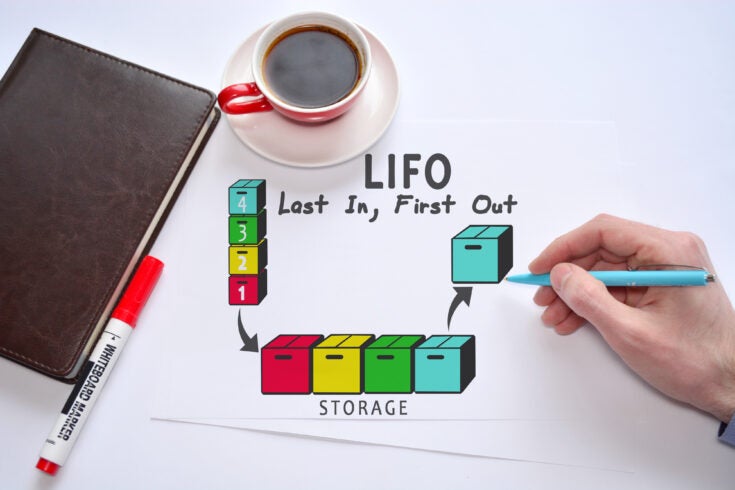

Read MoreLIFO Can Still Provide Tax Savings for 2023

While inflation is not at the high levels seen in the last couple of years, if you haven’t elected LIFO previously, now is the time to look at Last-In-First-Out (LIFO) accounting. If you have inventories of machinery and equipment, glass products or any concrete or cement inventory, there could be tax savings for 2023. Whether…

Read More