Posts Tagged ‘Business Credit’

Does Credit Monitoring Truly Prevent Identity Theft? What You Need to Know

The problem of identity theft is a very real one. More than 10,000 identity fraud rings are estimated to be operating in the United States alone. Not surprisingly, identity theft has been the most dominant type of consumer fraud complaint to the Federal Trade Commission. The federal government has already made moves to combat this…

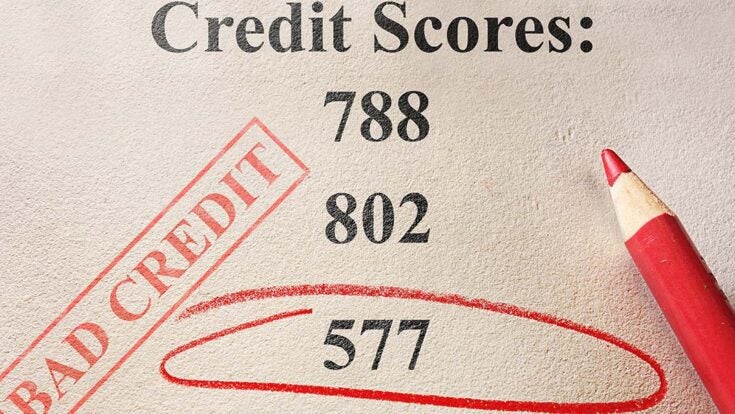

Read More4 Tips for Starting a Business When You Have Bad Credit

Having a poor credit history does not mean you cannot start your own business. If the time is right and you need to jump now, there is hope. Start Repairing Your Credit Get to work on this now. It will take a while and you want to start as soon as possible. You can still…

Read More5 Easy Ways You Can Improve Your Company Credit Score

Success and sustainability as a small business often have a lot to do with maintaining ready access to cash and coping with financial pressures as they come along.

Read More How to Start a Business Even with Bad Credit

If you have bad credit you may think there is no way you can start your own business. This isn’t really the case at all. Of course it may be a little harder, and you will have to be diligent in managing your finances.

Read More How to Know if Borrowing is Right for Your Business

Big bank lending to small businesses is increasing. In addition to traditional loans, you may find yourself receiving unsolicited credit card offers from major banks.

Read More Protecting Your Business from Credit Reporting Errors

Given the importance of a strong credit rating to a small business owner, any possible error that might occur on a business’s credit report might have a devastating effect on that business’s future prospects.

Read More Why the Merchant Cash Advance May Be Right for You

Poor or nonexistent credit history is the thorn in many a new entrepreneur’s side. It can be frustrating enough starting a brand-new business from scratch, but having a credit history that does not shine makes things even more difficult. Without a strong credit history, acquiring a loan is not easy.

Read More Is a Merchant Cash Advance the Best Option for You?

The idea of merchant cash advances may seem quite appealing. Merchant cash advances tend to be known for their quick approval, acceptance of poorer credit scores, and reasonable repayment schedule.

Read More Financing Challenges for Flower Shop Owners

Has your flower shop repeatedly applied for funding only to be denied? You’re not alone. Many small business owners—including florists—are reporting limited access to capital, making it difficult for them to aggressively pursue growth opportunities.

Read More How to Get a Business Loan: What You Might Not Know

A lot of what it takes to get a business loan is common sense. Get your credit in order, be professional, and make certain you can provide your own investment. These seem like no-brainers, right?

Read More