The question on Quora was “What do investors ‘get’ that other people don’t?” I answered that question from the point of view of angel investors, specifically … not just investors.

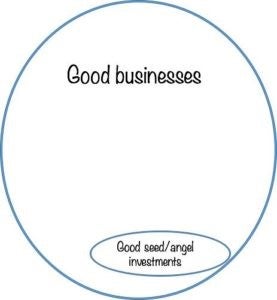

1. Some of the healthiest businesses are not good investments

Many people think that a good business makes a good investment. The truth is not necessarily. Many real good businesses are bad investments …

For example, the founder-driven business that generates enough cash to fund its own growth. Its founders may choose to not exit soon enough to offer a good return for investors. In these cases, founders are better off without investors. And investors have higher risk of never seeing an exit.

2. Angel investors make money on exits, not profits.

Investors own shares in the business, not revenue, and not profits. They make money when they sell their ownership for money. Increasing valuation generates a return on investment. Profits, without the exit, don’t flow to investors in normal startup situations; dividends are for stable companies, not profits.

Angel investors make money on growth, not profits.

3. There is an interesting underlying trade off between growth and profits; you can’t optimize both. It’s one or the other.

A company that loses money but grows well in terms of revenues, users, subscribers, and so forth can be an excellent investment because most valuations in high-tech startups are based on revenue, not profits.

Ironically, investors may be better off with high-growth that loses money because their money becomes more valuable, and more important, when it is all that stands between growth and not growth. Investment is more likely optimized when it funds growth.

4. Angel investors shoot for the big win, not a minimum

All serious angel investors know that most startups fail. They don’t look for the low risk investment that might yield a more reliable return, because those startups fail too. So they look for the big win, the next big bonanza, the huge success that will pay for all the failures.

5. Angel investors want to see your numbers but don’t believe them

Market estimates, market share potential, sales, costs, and all the rest … investors want to see them because they show what you’re thinking and how well you understand the business. Ideally it shows that you understand the drivers and the fixed costs, plus cash flow problems, and all the rest.

Regarding market numbers, they are going to review them but they will look at your assumptions and decide whether they believe them or not. The best market estimates trigger the dream and the imagination of the investors.

6. Angel investors scoff at analyses like NPV and IRR

Note above that angel investors don’t believe your numbers. How naive to think a number generated by assumptions compounding on assumptions has any actual metric value. My personal opinion is that when startups believe their IRR matters, they are too green, not long enough out of school.