Tax Reform Creates Desire for the C Corporation

By: TaxConnections

When you first see a 21 percent tax rate for the C Corporation, you have to think this could be the choice of entity for your business operation. Further, when you find yourself in the out-of-favor group for the 20 percent deduction authorized by new tax code Section 199A, you naturally gravitate to thinking about the C Corporation, perhaps as a means of getting even.

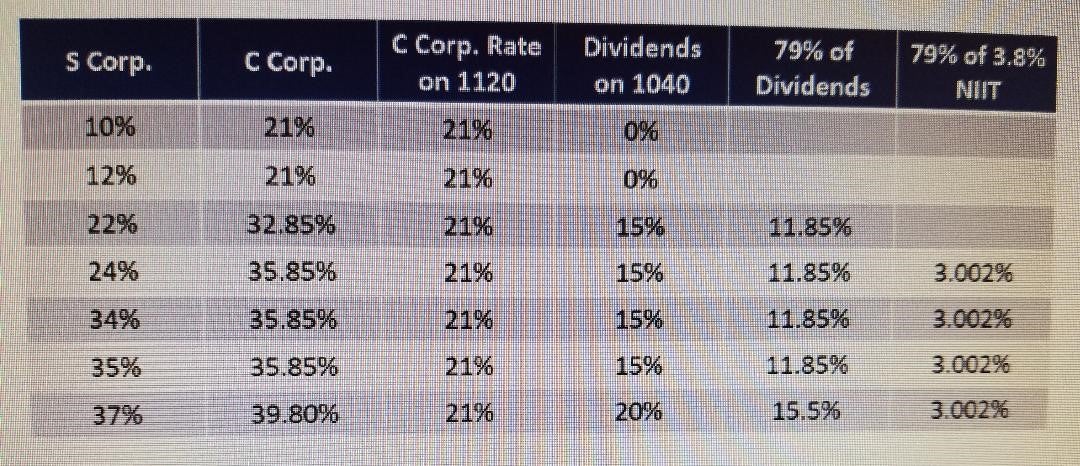

The table below gives you a good look at how you would pay taxes on your profits, depending on your Form 1040 tax bracket. In the S Corporation column, we listed the tax rates by the brackets that apply to individuals. To see exactly how this table works, let’s say that you are in the 34 percent tax bracket and have $100,000 in profits.

If you operate as an S Corporation, the profits come to you on a K-1 and you pay your Form 1040 taxes at the 34 percent rate, for a total tax of $34,000 on your S Corporation profits.

If you operate as a C Corporation, the profits are first taxed at the C Corporation level at a rate of 21 percent, for a tax of $21,000. This leaves you with $79,000 of the $100,000 in profits available for distribution as a dividend to you.

You are in your “give me the money” mode, so to get the cash, you endure the double taxation, starting with the dividend tax of 15 percent. This creates an $11,850 tax ($79,000 x 15 percent).

Your tax bracket also triggers the net investment income tax (NIIT) that applies because of your dividend income. The NIIT is $3,002 ($79,000 x 3.8 percent).

As a C Corporation, your total federal taxes on the $100,000 of income are $35,852, which consists of the following:

- C Corporation taxes of $21,000

- 1040 dividend taxes of $11,850

- 1040 NIIT of $3,002

Based on the same $100,000 in profits, operating as an S Corporation results in $34,000 to the government compared with the C Corporation, where you and the corporation combined pay $35,853. The winner: the S corporation.

You might ask: Why no NIIT on the S Corporation profits? Answer: If the shareholder materially participates in the S Corporation, the NIIT does not apply to the pass-through income derived from active business operations. In the table below, we treat you as materially participating in your S Corporation.

Okay, with this background, you can see how the table below works. You simply compare column 1 (S Corp.) with column 2 (C Corp.) to see the percentage taxes on the profits. And you will note that in all cases, the S Corporation pays less in taxes.

So, based on the tax rates alone, you have no reason to switch to the C Corporation because of the recent tax reform.

Have questions? Contact Brian Stoner.