Starting your own business and hiring employees means dipping your feet into the deep, dark pool of payroll tax filing.

Making a filing mistake that may lead to extra penalties and fees is daunting to think about. However, knowing which forms you’re required to file and when they apply is a big part of getting things right, also known as compliance. For most employers, this includes Form 941, which is filed quarterly. Then there’s this add-on called a Schedule B.

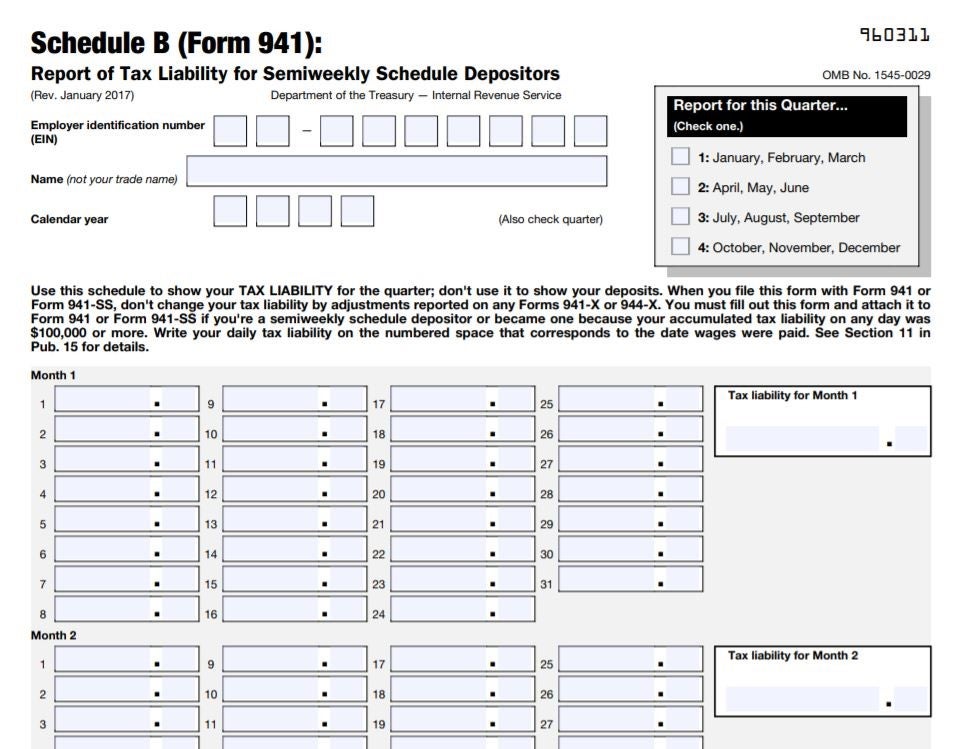

What is Form 941 Schedule B?

When you pay your employees, you are required to manage the applicable employee deductions and employer contributions for federal, state, and local payroll taxes. Income tax, Medicare, Social Security, and unemployment insurance are all included under this umbrella.

Form 941, Employer’s Quarterly Federal Tax Return, is the quarterly review of the federal-level amounts you’ve either withheld or contributed for payroll taxes. It lists the number of employees you have, how much you’ve paid in wages, and the amount of taxes withheld for the quarter. It summarizes all this information for the corresponding 3-month period of the year.

Schedule B for Form 941, Report of Tax Liability for Semi-weekly Schedule Depositors, is an additional form that has to be filed with Form 941 each quarter. (If your total payroll tax amounts are $50,000 or more or if you had a tax liability of $100,000 or more this year or the year before—you are a semi-weekly depositor.)

Your Schedule B outlines the taxes paid by you as the employer on each day of the 3-month period. You’re only required to fill out tax liability for the days you actually pay wages to your employees, not necessarily the tax liability accrued for each and every day.

Who files Form 941 each quarter?

Most employers are required to file Form 941 each quarter. There are a few exceptions to the rule, though.

Businesses who are seasonal and don’t pay out any taxable wages during a portion of the year will not have to file a Form 941 if it’s not necessary (like a pool who hires lifeguards in the summer but closes during the winter months). They simply mark box 18 when they file to tell the IRS not to expect a form each and every quarter.

Contractors won’t be included on your Form 941 since there are no payroll taxes withheld from their paychecks.

Other exceptions also include houseworkers (like maids and nannies) and farm workers as each group has its own set of regulations.

Lastly, employers who receive instructions to file a different form instead of the 941 logically wouldn’t have to file it each quarter. This includes those instructed to file Form 944 annually instead.

How do I know if I need the Schedule B for Form 941?

Not every employer had to file a Schedule B with their quarterly Form 941. It’s specifically for employers who fall into one of two tax liability categories:

- You are on the semi-weekly deposit schedule— When looking at your annual tax documents from the last tax year, you paid $50,000 or more in payroll taxes to the federal government. If this is the case, you are labeled a semi-weekly depositor and will have to remit (pay) your taxes according to the schedule corresponding to your payroll pay dates. You can find this schedule in the IRS Pub. 931 or in our payroll calendar.

- You accumulate $100,000 or more in taxes on any given day— No matter your normal depositing schedule, if you end a day with $100,000 in taxes owed, you are required to make a next-day deposit to the federal government. This liability will need to be documented on within the Schedule B.

If you don’t check either of these boxes, you don’t need to worry about the Schedule B. For instance, if you’re a new business and new employer, you’re likely a monthly depositor. If one of the above examples does apply to you, though, it’s an absolute necessity to making sure your taxes are reported correctly so you avoid penalties.

(If you don’t know your tax deposit schedule, you can find out and check other important payroll tax deadlines here.)

How to fill out Schedule B for Form 941

As mentioned before, the Schedule B for Form 941 lists each day in the 3-month quarter. Your responsibility when filing it out is to enter the tax liabilities for each day when your employees are paid.

For example, you pay your employees bi-weekly on Fridays, meaning every two weeks. For the first month of the year, the paydays fall on January 5 and 19. On your Schedule B, you will list the tax liability (or taxes withheld + your employer contributions) for each of those paydays since that is when the tax liability is incurred.

The frequency of your payrolls affects how many boxes you’ll fill on Schedule B. Someone paying their employees bi-weekly will have more paydays than a monthly pay schedule, and their Schedule B will reflect that difference.

How to file Schedule B and Form 941

When paying your federal taxes and filing forms throughout the year, you have two different options: Physical paper filing and electronic filing.

Filing your Schedule B and Form 941 each quarter is most easily done electronically. Filing is done through the e-file system, and tax payments are made through the Electronic Federal Tax Payments System (EFTPS).

When filing through the mail, you will have to fill both Form 941 and the Schedule B and send them to the correct treasury address depending on your business’ home state. You can find a list of those addresses here. Note that there are different addresses depending on the quarter and depending on if you are including a payment with your forms.

Deadlines to file Form 941 and Schedule B

You are required to file Schedule B and Form 941 by the last day of the month following the end of the quarter. In general, that means:

- Quarter 1 (January through March) are due April 30

- Quarter 2 (April through June) are due July 31

- Quarter 3 (July through September) are due October 31

- Quarter 4 (October through December) are due January 31 of the following year

If the deadline falls on a weekend, the forms are due the next business day.

You can check the due dates for Form 941 and Schedule B and other important tax reports on our payroll calendar.

Correcting Schedule B for Form 941

Making changes to your Schedule B is pretty simple. Just fill out a second Schedule B form with the correct information, and write “AMENDED” at the top. The IRS will note those changes and make adjustments as necessary when they receive it.

If you’re looking to make changes to your Form 941 as well, you will have to file Form 941-X. Any time you are amending Form 941 and consequently owe more than you paid to cover your correct tax liability, you will have to include the additional payment with your X form.

Changes to your Form 941 will likely mean a change in your Schedule B. Check the instructions on both correction forms to determine if you need to file an amended Schedule B with your Form 941-X.

Get your quarterly filing in order

Especially when it comes to payroll taxes, knowledge is power. Understanding the mounds of paperwork you fill each quarter and year is paramount to staying compliant and avoiding unnecessary fees from the government.

If you’re using Wagepoint to run your payroll, we go ahead and file your Form 941 and Schedule B for you (One of the many perks of using payroll software). That’s one less thing on your tax to-do list each quarter. ✅)

The information we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.

Author: Erika Yohn is a savvy Millenial on Wagepoint’s marketing team. Now a retired soccer player, she spends a lot of time browsing Twitter to stay updated on the current trends – especially when it comes to memes. With a hand in all things marketing, she likes to keep things fun and useful for Wagepoint’s customers.