Direct selling tax deductions are one of the top advantages of working from home.

Operating a direct selling business from home opens the door for many income tax deductions.

Did you ever notice that all rich people have a business?

- Did the business make them rich?

- Or did they get a business because they were rich?

Chances are they developed a business so that they could take advantage of certain tax benefits and that in turn assisted them in gaining more wealth.

The home business is a legitimate income tax reduction program that the IRS/CRA/ATO (or whatever the tax agency is called where you live) has put into place.

Anyone who owns a home business has a legal income tax reduction package to utilize to their advantage.

Direct Selling Tax Deductions = Recruiting Tool

The direct selling tax deductions are an AWESOME recruiting incentive!!

We discuss this in great detail in many of the Cash Flow Show programs. The full business plan template is included in the The Complete Program On How To Do Direct Sales program.

Starting a business sounds like a lot of work but saving money… well, who could say no?!

If you are an individual or family struggling financially, the quickest way to increase your cash flow without a major time commitment is to start a direct sales or network marketing business.

The income generated from your new business will of course be helpful and the immediate income tax reduction will increase your cash flow substantially!

When a direct seller writes a direct sales marketing plan that shows an intent to profit, they will save tax dollars!

Save With Direct Selling Tax Deductions

For example in a direct selling business many of the things you are now spending money on will become an income tax deduction.

- Cell phones: even shared family plans

- Magazine subscriptions or cable TV, depending on your company, can be considered as market research

- Mileage to and from general errands that you are doing for your family can be deductions provided you intersperse business errands and lead-collecting in with the daily activities. Imagine deducting 60-80% of all your miles traveled, at 53.5 cents a mile…. That will really add up quickly!

- Meals out and entertainment can also be deducted provided you talk business and ask for referrals from your friends.

- Are you taking vitamins? When you are in a vitamin network marketing company, the vitamins may be deductible.

- Do you buy groceries? In a food-related company, a good part of your grocery bill may be deductible for market research, even if your family is eating the food.

- Are you giving the kids an allowance? Are your kids ages 7-17? How would you like to pay them for errands around the house, or helpful things they do, then take those payments as an income tax reduction?

NOTE: We are not giving you legal advice or advising you on your income tax. Please talk to a knowledgeable direct sales-specific accountant regarding your personal situation.

Are you starting to see why all people with money have a business?

These are things you will always spend money on. When you have a direct selling business they become income tax deductions.

That alone will increase your cash flow, even if your business does not make money immediately.

Income Tax Deduction – Home Office

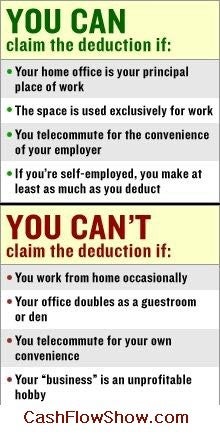

Another income tax reduction strategy available to direct sales consultants who set up a home office is the home office deduction.

It never ceases to amaze me how many people do not take advantage of this strategy.

Many successful individuals say, “I do not want to send up a red flag.” Or “My accountant won’t let me because it is a red flag.”

The government does not create laws just to “catch” people and get them in trouble when someone uses the law as it is written.

There are no flagpoles down at the tax office!

Think about this…

When you open a store at the mall or in a shopping center, you will buy toilet paper, floor cleaners, light bulbs, maybe put up a sign, and even wash the windows, take out the trash, pay rent or cut the grass.

As a business owner you can deduct all of those from your taxes. This will not put up a red flag because these are business expenses.

Everyone can understand that.

In your home business, you still have all those expenses affiliated with your business. Only now they are a percentage of your home expenses.

The home office deduction recognizes that as a home business owner, you can deduct a percentage of your electric, your gas, your garbage, your telephone, toilet paper, cleaning supplies, etc.

This is the home office deduction.

Recruiting with the Direct Selling Tax Deduction

The direct selling tax deduction should be a major focus in sharing your opportunity.

Small sprinkles in your show to create desire about paying less taxes will go a long way toward creating desire for the opportunity.

Saving money sounds easier than starting a business!!

Share this article with your team and teach them how to recruit by leading with the tax savings!

A little education goes a long way when you are focusing on growing a team.

NOTE: We are not giving you legal advice or advising you on your income tax. Please talk to a knowledgeable direct sales-specific accountant regarding your personal situation.