People often ask: What do business plan financials look like? You can get away with a sales forecast, spending budget, and cash flow plan. That’s enough for actually running your startup. It’s the essential numbers in a lean business plan.

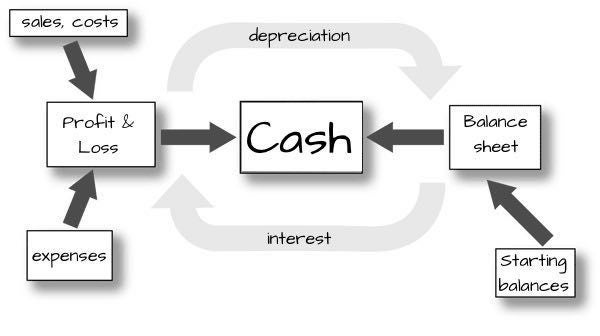

If you want to do it right you take it further and present projected (also called Pro Forma) versions of the three main business plan financial statements: Income Statement (also called Profit & Loss), Balance Sheet, and Cash Flow. Here’s how they are related to each other:

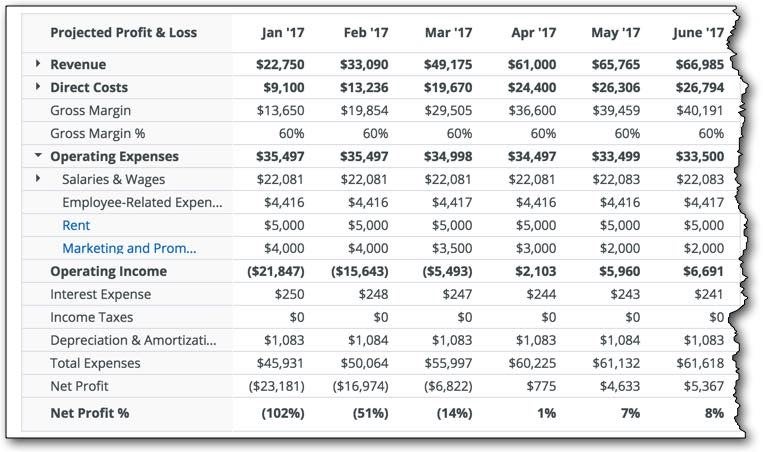

Projected Profit and Loss (also called Income)

This is where you project sales, costs, and expenses; and what’s left over is profits. Here is a general summary, and you might also check out Your Profits are Way Too High, How to Forecast Sales and Profits Without Just Guessing. Profits are the performance of the business over a specified period of time, like a month, quarter, or year. You project sales, direct costs, and expenses.

Here’s what it looks like in a plan.

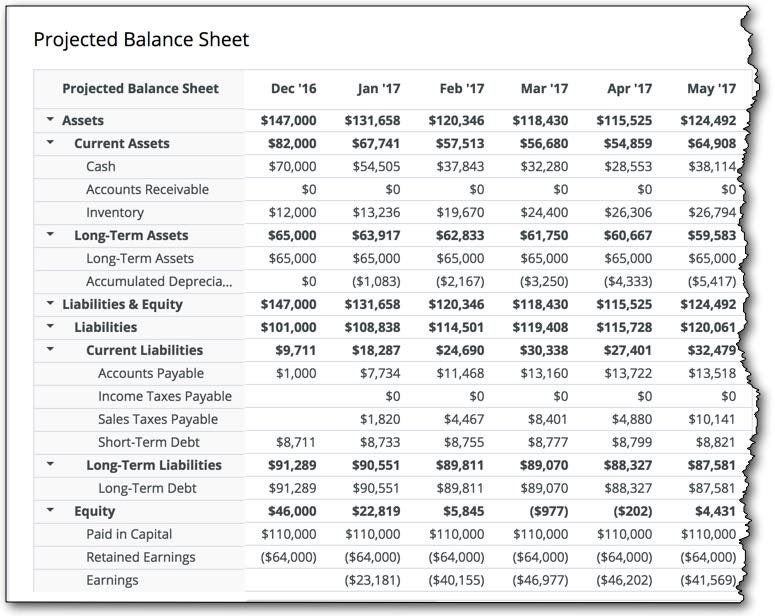

Projected Balance Sheet

The balance sheet shows your financial position at a specific time. That means assets and liabilities. For more on that, in detail, this post on how to do a projected balance sheet. And here’s what it looks like in a business plan:

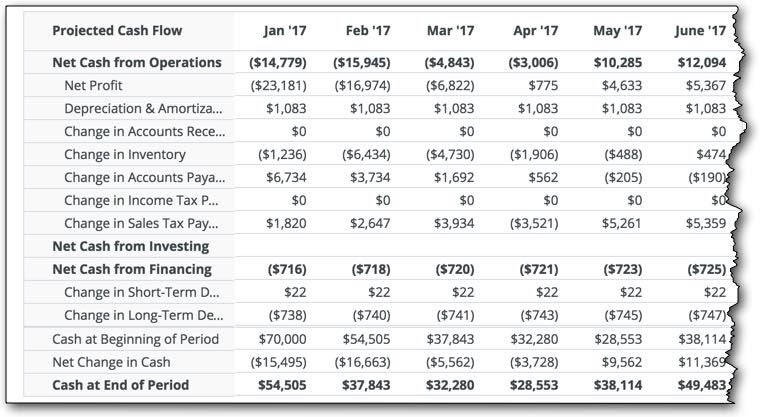

Projected Cash Flow

The cash flow is the most important, because your business lives on cash, not profits. You can project cash flow using the direct method, or the indirect method. Either way works if you do it right. Here’s an example of what an indirect cash flow projection looks like in a business plan.

Do It Right?

As I suggested in my opening, if you just want the bare minimum to run your business, you can get away with projected sales, spending, and cash flow, without the formal projections. But for a business plan that passes muster when you show it to outsiders, better to have the formal projected Profit and Loss, Balance Sheet, and Cash Flow, the way analysts expect to see them.