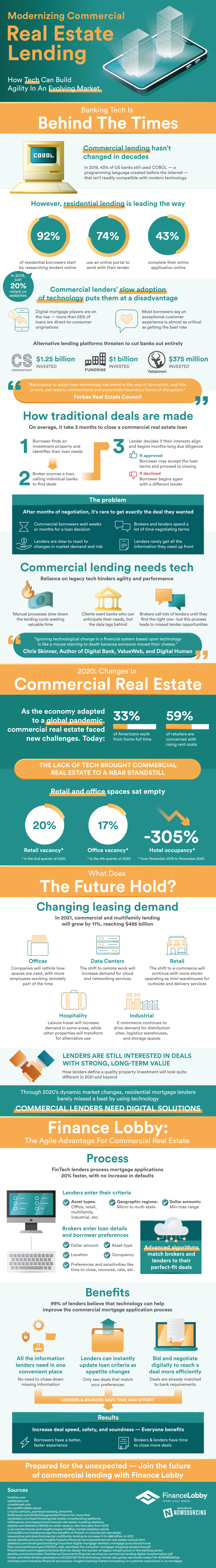

While residential real estate lending has been moving forward right along with technological advances, commercial real estate lending is seriously behind the times. It’s been decades since commercial lending has seen any updates. In fact, in 2019, 43% of US banks were still using COBOL, which is a programming language that was invented before the internet existed. Obviously, the rest of the world has changed a lot since then and COBOL programming isn’t easily compatible with modern technology.

Residential lending has kept up with the times and continues to advance. Currently, 92% of residential borrowers start by researching lenders online (compared to only 20% website usage just 6 years ago.) Seventy-four percent of residential borrowers use online portals to communicate with their lenders, and 43% complete their entire application online.

On the other hand, commercial lending processes are long and arduous and can take up to three months to complete. First the borrower finds an investment property and determines their loan needs. The broker calls individual banks to find the best deal. The lender then decides if they want to loan the money and begins the due diligence process, which could take months. If the borrower and lender can agree, then they proceed to closing, but if they can’t agree, then the borrower has to begin the whole process again. Unfortunately, with this method, borrowers rarely get the deal they were hoping for.

These antiquated processes are putting traditional banks at risk of being completely left behind as alternative lending platforms are continuing to gain ground. Commercial lending needs to adopt new technologies in order to stay in the game.

In addition to the normal issues that have risen from the dichotomy of outdated methods in the modern market, 2020 further exposed the issues facing standard commercial lending. As the pandemic enveloped the globe, residential lending was able to move forward without a hitch, but commercial lending was brought to a severe halt. Retail and office spaces were suddenly far less necessary and the move to remote work took a toll on commercial real estate occupancy.

The second quarter of 2020 saw 20% retail vacancy, and the fourth quarter saw 17% office vacancy. Hotel occupancy also took a nosedive at a 305% decrease from November 2019 to November 2020.

In 2021, commercial and multifamily lending is expected to grow by 11%, reaching $486 billion. Commercial lending absolutely must make necessary changes to adopt new technologies. Digital solutions are the answer to facing modern challenges with modern methods and staying in the lending game.

2188 Views