Business owners and managers do financial forecasting to enhance management. Anticipate essential flows of money to manage them better. Forecasting is a necessary first step towards managing plan vs. actual results, which means course corrections. It’s like steering a business.

A Quick Example

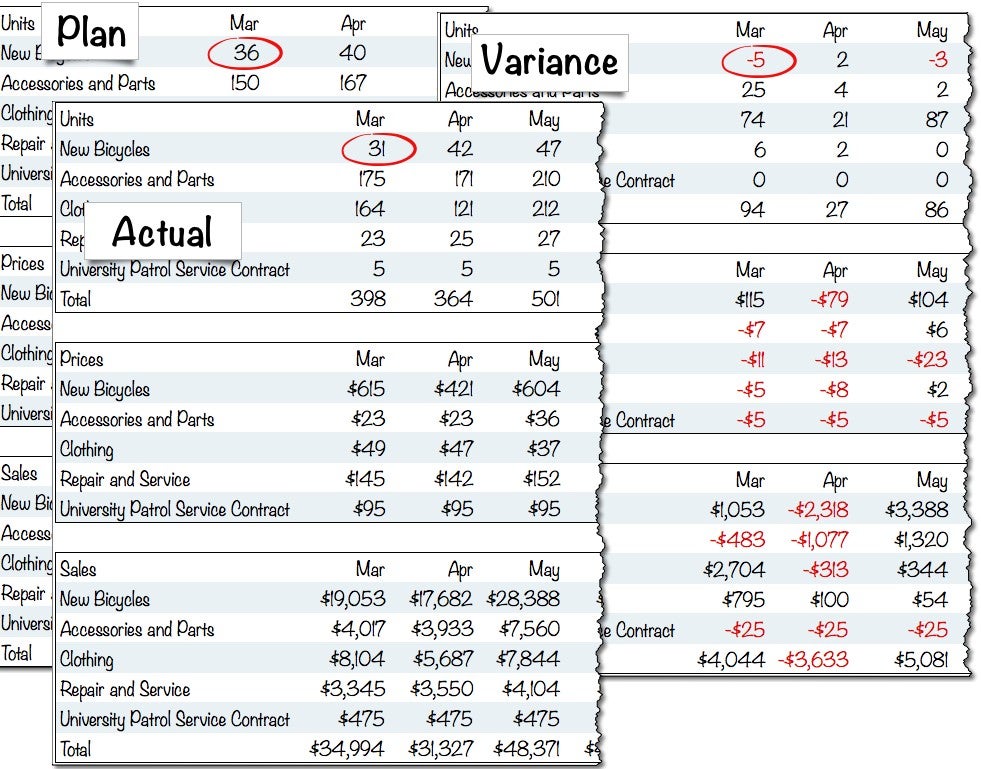

Consider this simple illustration:

You can’t identify changes in flow if you don’t have a forecast to refer back to as you review and revises according to changes.

Real management is a matter of minding the details while working towards the right long-term directions. Step by step. Forecasting is part of the management process. When sales are different from planned, you look at the connected spending, and adjust. Change the resource allocation when things are going well or poorly. Identify problems with execution, and opportunities that result from the unexpected.

You should note also that the value of the forecast isn’t a matter of accurately predicting the future. We’re human. We don’t do that well. Instead, it’s a matter of identifying the connections between sales and spending, and managing the ongoing interaction involved. In the example above, bike unit sales were less than planned, but the dollar sales were higher. Is that good news or bad? It’s not necessarily either one, right? And it is also quite possibly highlighting a market trend that management should be aware of.

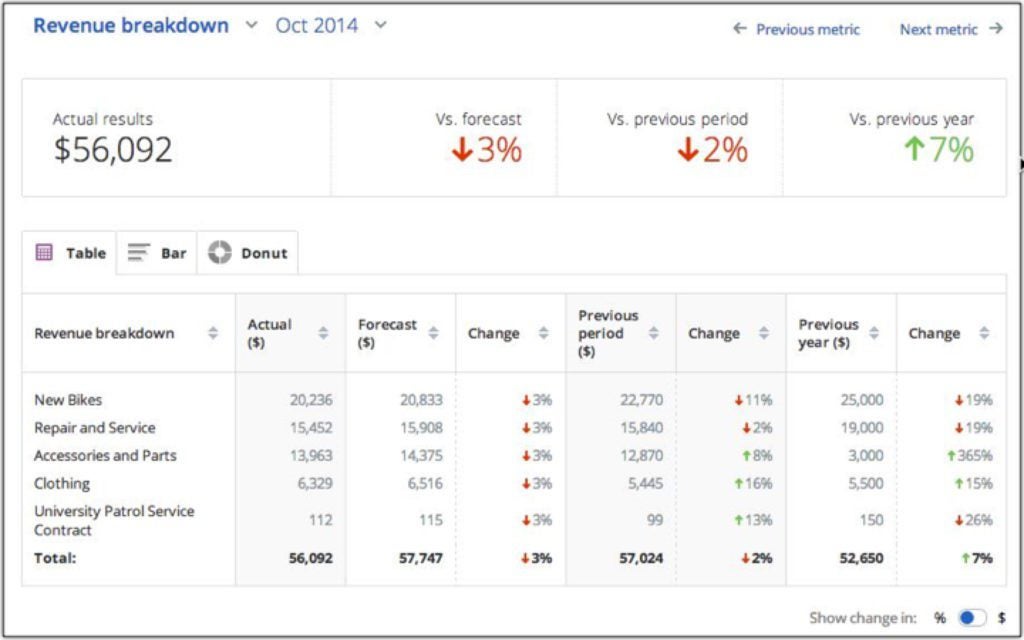

A LivePlan Example

Another example, from LivePlan: Monthly sales are below the plan, but above the previous year. Accessories and clothing are better than the previous year, but bicycles sales are below the previous year. Is that a trend to manage? The numbers don’t say, but the people should know. The numbers are there to begin the discussion.