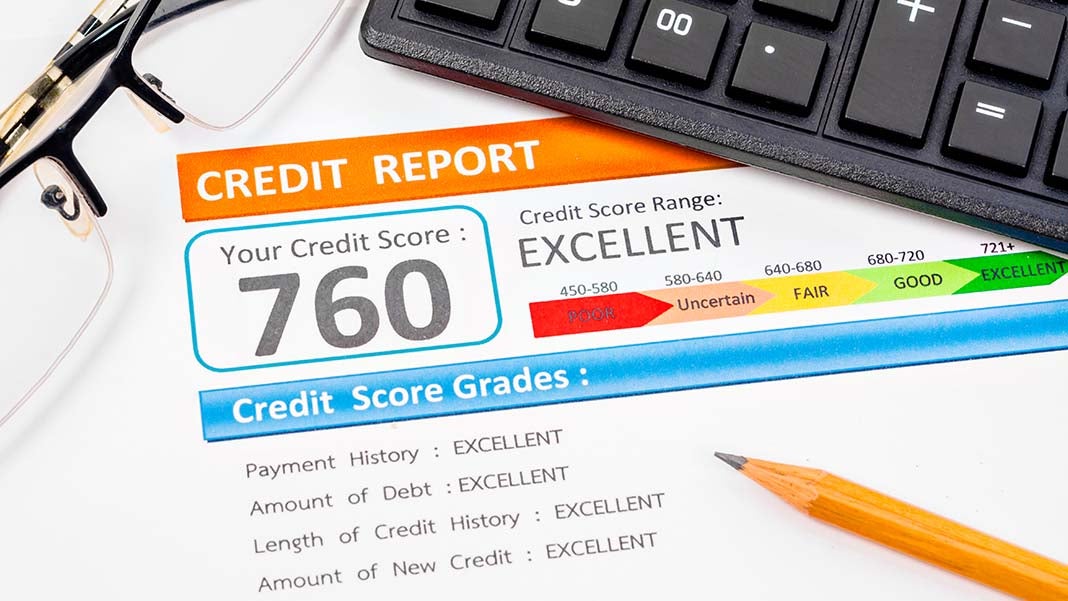

Almost every small company needs to borrow at one point or another, and ideally sooner than later. And when you do, your credit score will dictate who does business with you and at what interest rate. So it’s in your interest to keep your score as high as possible. Here are a few common pitfalls to avoid.

1. Paying your suppliers late

It’s obvious to anyone that repaying debts late (or worse, not at all) is going to destroy both your credibility and your credit score. However, some entrepreneurs fail to realize that not adhering to suppliers’ payment terms can also be detrimental. Even missing the due date by one day can damage your score. In fact, Dun & Bradstreet’s PAYDEX score – used by vendors to gauge potential customers’ creditworthiness – is based solely on how you pay your suppliers. To get a score of 80 out of 100, you’ll need to pay on time, every time. To get above 80, you’ll need to pay ahead of schedule.

2. Failing to monitor your score

With many more pressing activities to deal with, checking your business credit score may not be at the top of your ‘to-do’ list. However, it’s well worth finding the time to do so: after all, your vendors and potential lenders will be tracking this closely. Free business credit monitoring tools can keep an eye on things for you and automatically send you alerts when something changes. If your score suddenly drops drastically, it could mean that you’ve suffered identity theft, so forewarned is very much forearmed.

3. Maxing out your credit cards

Business credit cards are an exceptionally flexible (if particularly expensive) way to borrow. However, if you use them too much, this can damage your credit score: credit bureaus regard usage of this type of flexible credit as riskier than taking out a structured loan. To maximize your score, try to keep your credit card limits high and usage at around 30% of the total available.

4. Forgetting to correct any errors in your report

Mistakes in business credit scores aren’t that uncommon: in a recent survey, around one in four small businesses found something wrong in their credit report. The error can be something as simple as misreported data or anything as serious as the wrong company’s credit history assigned to your firm. Make sure you check regularly and quickly address any errors.

5. Using your personal credit for business purposes

When you first launch your business, you may have no choice but to use personal credit to fund the start-up. However, if you keep doing this then you won’t build up a business credit score – and no score is a damaging as a poor score. It’s worth remembering that a business can typically borrow between 10 and 100 times as much as an individual, so it’s definitely in your interest to build your business credit score – and take the necessary steps to protect it.

This page might contain affiliate links, so we may receive a small commission if you make a purchase after clicking on the link.

Author: Carl Faulds, managing director of Cashsolv offers advice and alternative finance support to overcome cash flow problems. See how Cashsolv can help provide quick finance and ensure a positive future for your business. Follow @cashsolv on Twitter.

3175 Views