Every year that goes by, the world seems to get smaller. For anyone in the business realm, expanding out of your area can be as simple as hopping online or creating a website. When that expansion tempts franchises in the states, it’s not as simple as adding a new tab to the website.

It’s important to know the different state requirements for franchises. While each state will have their own nuances, there are three main classifications that states fall into: registration states, filing states, and non-registration states. Before fulfilling that itch to expand outside your current state, take a moment to familiarize yourself with the basics of each classification.

Registration States

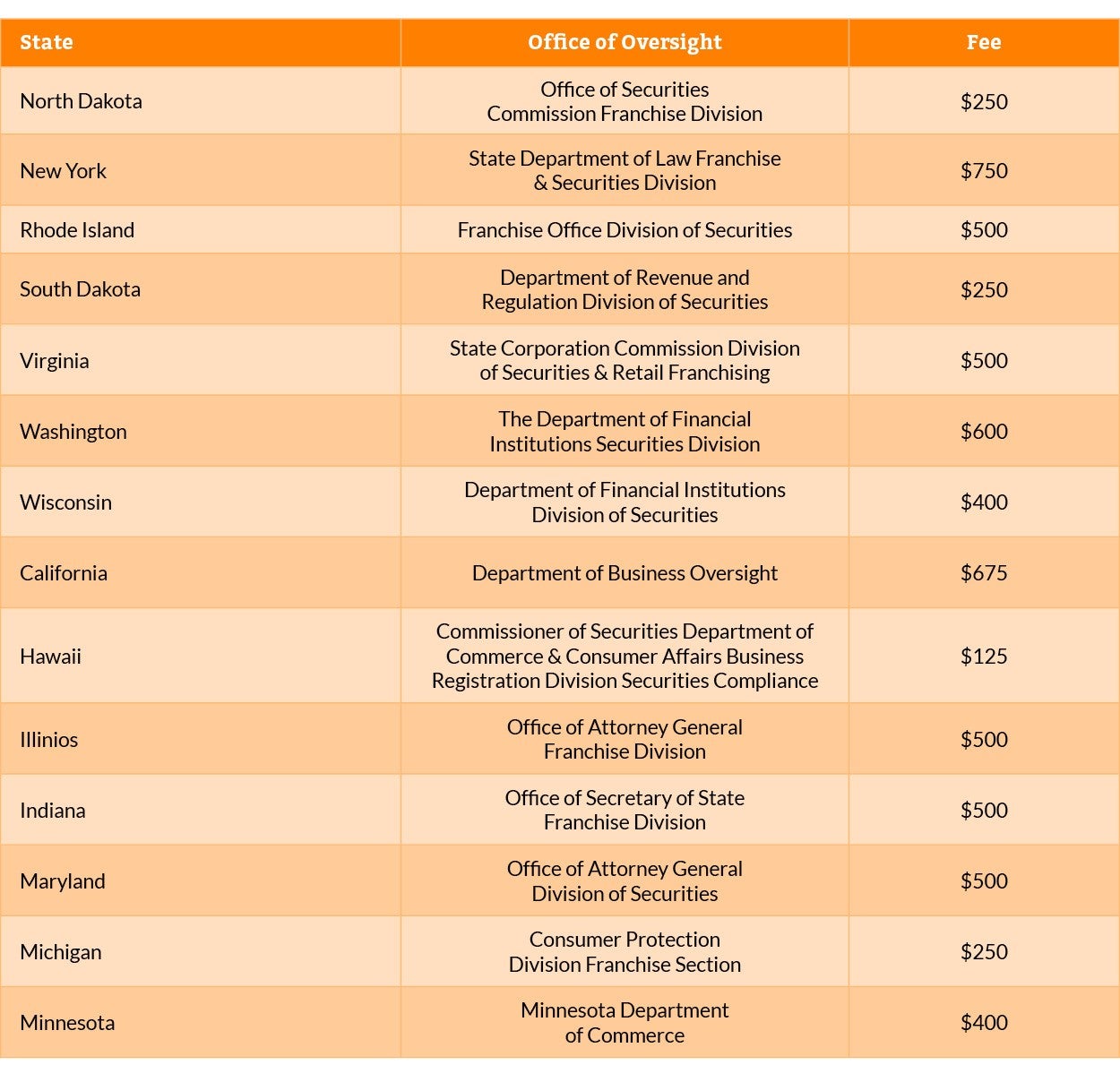

We’ll kick off this list with the states that scrutinize franchises the most: registration states. In this category we find fourteen states that work to provide added protection to their citizens looking to buy into a franchise.

Each state in this category requires franchises looking to operate within their borders to register their FDD, receive approval, and pay a fee. Individual state fees range between $125 and $750.

Each registration state will have a governmental office or institution overseeing franchises in that state. For example, in California that office is The Department of Business Oversight. An examiner from that office will review the FDD, oftentimes giving feedback or even requiring changes. The registration is good for one year, at which time you’ll be required to go through the approval process again.

The registration process is not a one-size-fits-all. Regardless if a franchise has already gone through the registration process in a different state, the business will need to complete the process in each state they want to operate in.

Here is a list of the registration states, their fees, and the oversight office:

Filing States

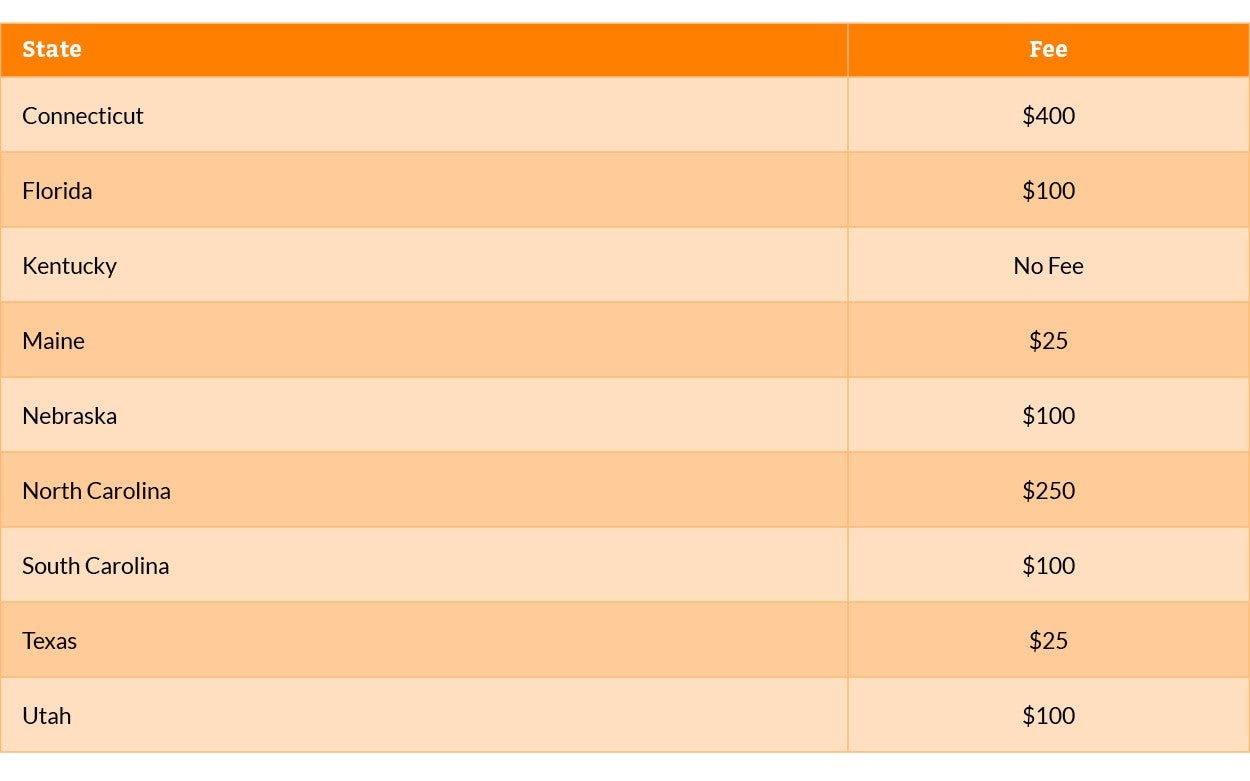

Next down the list we have filing states. These states require the franchise pay a fee and file in the state, but they don’t require the franchise to submit documents or give feedback on the FDD. Typically, the filing form is a single-page form. As long as the franchise has a registered trademark, has an FDD, and doesn’t fall into the business opportunities category, you’re good to go.

Each state varies on if it is a one-time registration fee or annual requirement. For example, Texas has a one-time $25 filing fee whereas Florida has an annual $100 fee.

Here’s a breakdown of the related fees by state:

Non-Registration States

Lastly, we have non-registration states. These twenty-seven states and the District of Columbia don’t require registration or filing. As long as you have an FDD with a registered trademark, you’re free to sell the franchise without any state government intervention. These states rely on the Federal Fair Trade Commission to regulate and monitor franchises.

Here’s a list of non-registration states:

Determining Which States Make Sense

Some franchises go national right out of the gate. Those typically are well-funded organizations, as the fifty state strategy costs upwards of $8,000 for just the registration or filing fees. Many of those costs are annual fees.

In short, there are a lot of considerations to weigh when planning out which states to expand to. This doesn’t even factor in updating the FDD for the registration states, filling out the forms, maintaining the registrations and the other work that goes into keeping the franchise operating legally in each state. Many franchises choose to partner with a franchise lawyer to keep the franchise in tow with each state’s franchise requirements.