Home > Run and Grow > Operations >

Where Should You House Payroll for Your Small Business?

By: Biz2Credit.com

Every business must have payroll in some form or other. Traditionally, payroll has been one of the most outsourced processes in the business world. Giants like Automatic Data Processing, Inc (ADP), Paychex and Ceridian have been tapped by businesses large and small to take charge of cutting checks for their employees.

But small and medium-sized businesses have wrested market share from these companies. The brands recognized as titans have had to adjust their services to meet these clients’ needs, while new technologies have led to an increasing number of payroll solutions for small businesses. The result: an increasing number of payroll options for SMBs. But despite the number of solutions available, the choice boils down to a simple dichotomy—keep your payroll in the hands of in-house administrators, or outsource your payroll to a traditional payroll service.

Which should your small business choose? In the end, you’ll have to determine if the time saved by outsourcing payroll trumps the money you’ll likely save by keeping it in-house.

Time Savings of Outsourced Payroll vs. Money Saved on In-House Payroll

The US National Small Business Association asked 1,500 small businesses owners how they do payroll. Forty percent said they outsourced their payroll function, while 60 percent said they handled it internally.

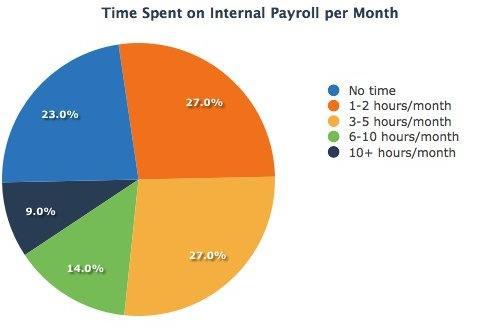

Among those handling payroll in-house, nearly 25 percent reported spending more than six hours on payroll per month. That’s at least 72 hours per year—nearly two full workweeks. If we look at the 2012 data from the US Bureau of Labor Statistics, we can assume the cost of an internal payroll staff to be $36/hour. That means those 72 hours translate to $2,592 per year.

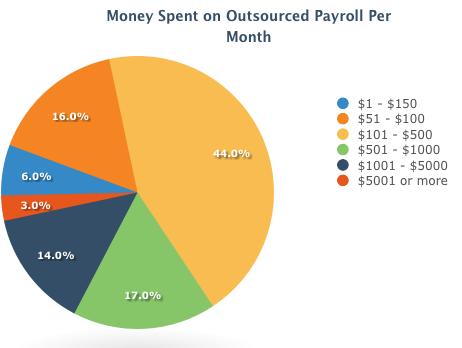

On the other hand, more than a third of the small businesses that outsource their payroll report spending more than $500 per month–that’s more than $6,000 in outsourced payroll per year.

So, the SMBs processing payroll themselves are saving money but spending their own man-hours, while those who outsource believe it’s worth the additional cost to save time by having someone else do it.

Benefits of Outsourcing v. Benefits of In-House Payroll

Benefits of Outsourcing

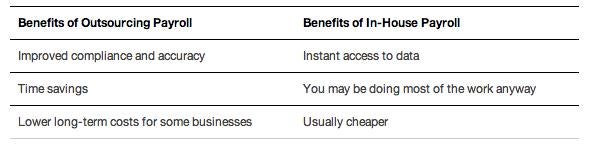

As the data show, 40 percent of SMBs outsource payroll. For T. Rod Rodriguez, the owner of Gamajoto.com, a light manufacturing and distribution business, the choice between in-house and outsourced solutions came down to what is most efficient and cost-effective for the size of his operation. “For a small business of around 10 people,” Rodriguez says, “I have found that the cost of paying an outside agency to manage payroll, tax liabilities, documentation, and process the physical checks is less expensive than having an internal dedicated person.”

In addition to saving time, there are compliance and accuracy issues to consider. Keeping up with changes to tax codes can be a burden for many small businesses, and as a result payroll mistakes are commonplace. When those mistakes occur, business owners might have to seek financial or legal restitution, which—to some—may make the more expensive price of outsourced payroll services worth the somewhat heftier initial price tag.

Benefits of In-House Payroll

However, despite the time involved and the additional responsibility of staying in compliance with changing tax codes, there are definite upsides to keeping payroll in-house. Advancements in payroll software have vastly improved the ability of SMBs to cut checks themselves, and with that ability come several benefits.

You have instant access to your data. If you have a question about payroll, you don’t have to go through an account representative. Instead, you can quickly and easily find answers to your questions on your own time. Also, in-house payroll is usually cheaper. There are plenty of low-cost solutions, and the field is expanding. Finally, it’s important to consider that you may be doing most of the work yourself when you outsource payroll. You’ll still have to have someone on staff compile and enter the data—often through an online interface. But if you’re already compiling the data, why not process it yourself and save some money?

Bottom Line

In the end, there’s no easy answer. You’ll have to take into consideration several factors: the number of employees and locations you have, the benefits you offer, and how you handle accounting. You’ll then need to decide whether you want to spend your time (or pay someone else to spend their time) cutting paychecks when you could be focusing on your business’s core competencies instead.

This article was originally published by Biz2Credit

This guest post was adapted for The Small Business Blog by Erin Osterhaus, Managing Editor at Software Advice, a company that serves as an online resource for HR professionals seeking to buy software. The original post by Marshall Jones, a contributor to The New Talent Times, can be seen here.

Published: June 17, 2013

3590 Views

3590 Views