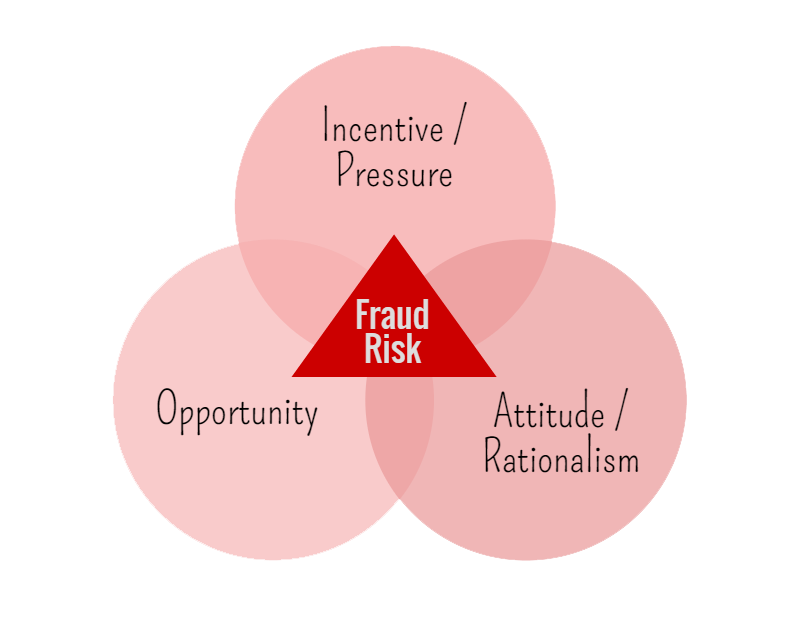

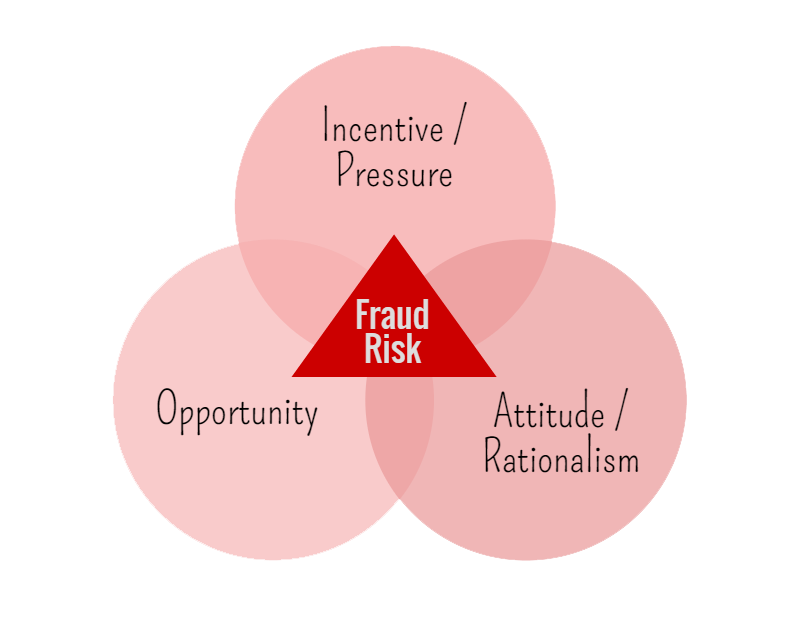

Fraud can be hugely costly for a business, and any organization strives to detect and defend against business fraud. The factors that drive people and employees to commit fraud are complex, but a lot of theorists boil down the causes to three main drives, which are better known as the Fraud Triangle.

Cause One: Pressure/Incentive

The first “corner” of our fraud triangle is the factor of pressure. This is usually an external force that will cause the employee to consider committing fraud in the first place. These can include factors such as: gambling debts, the inability to pay a bill, a desire for status, a need to meet targets at work or problems that they do not feel that they confide in others. This idea that the problem is not shareable is quite key; it may be a source of shame, or matter of pride, that means our fraudster will resort to illegitimate means to solve it.

Cause Two: Opportunity

This is the moment at which the fraudster will work out how the crime can be committed. Fraud will always be committed in such a way that the fraudster will place as little risk on themselves as possible. As we have already seen, fraudsters are often keen to keep their problems as secret as possible.

Related Article: Fraud is No Small Business

Cause Three: Attitude/Rationalization

The vast majority of fraud is committed by people who are first time offenders. They do not see themselves as people with criminal or nefarious intentions, but will often have some kind of (often mistaken) moral grounding in what they are doing. They will often believe that they have been cheated out of money or something that is rightfully theirs. They may believe that the company is dishonest, not them. This rationalization is key to the fraudster’s motives.

It should be noted that the Fraud Triangle more often applies to people for whom fraud is a first-time offence and is less applicable to serious fraudsters, or people for whom fraud is a “long game,” i.e. dishonest people who may have taken a job to deliberately steal from or embezzle an employer.

We have already examined how fraud is justified and some of the underlying psychological reasons that lead to it. But how can businesses protect themselves from, and indeed learn to prevent, acts of fraud?

1. Reduce pressures that cause fraud.

A good employer can dispel the three causes of fraud as determined by the fraud triangle we’ve discussed. Reduce any work related pressures that may cause a worker to commit fraud and encourage open and honest work practices which mean that the rationalizations of fraud are minimalized. This will most likely also mean that the opportunities to commit fraud will also be lessened.

2. Make compliance a central priority.

Make sure that fraud compliance is communicated thoroughly to all employees. Everyone in your organization should be up to date with all anti-fraud and corruption practices, and training should be a mandatory part of new employees’ training, especially in businesses such as financial services, or businesses that look after people’s data.

With big banks under the microscope for fraudulent activity, such as the recent HSBC laundering charges, in recent years, companies need to be seen as complying with anti-fraud and anti-money laundering legislation as much as possible.

Businesses and senior management need to be seen to be taking ownership of anti-fraud policies, rather than reacting to events, or merely “ticking boxes.”

3. Focus resources.

Following on from point number two, make sure that you are focusing resources, from senior level management downwards, on communicating the benefits of anti-fraud measures. Foster a culture of ethical behavior and make sure that you are promoting transparency. Make sure that third party auditing is a key part of your corporate culture, and constantly appraise and re-appraise your compliance practices.

Organizations that offer fraud training and solutions are dedicated to helping companies with their fraud detection and compliance policies. This CGMA report makes clear that some businesses believe their anti-fraud policies to be more effective than they really are, and that perceptions differ considerably between management and non-management employees.

Author: Alan Blaney is a provider of investigation and fraud awareness training courses, as part of Focus Training UK.

Published: June 22, 2015

5140 Views

5140 Views