You’re a new small business and the world is at your feet—as are a 100 million other clichés and things to do.

Here lies the question: Should you spend hours calculating payroll and writing paper checks or would that time be better spent focusing on growing your business?

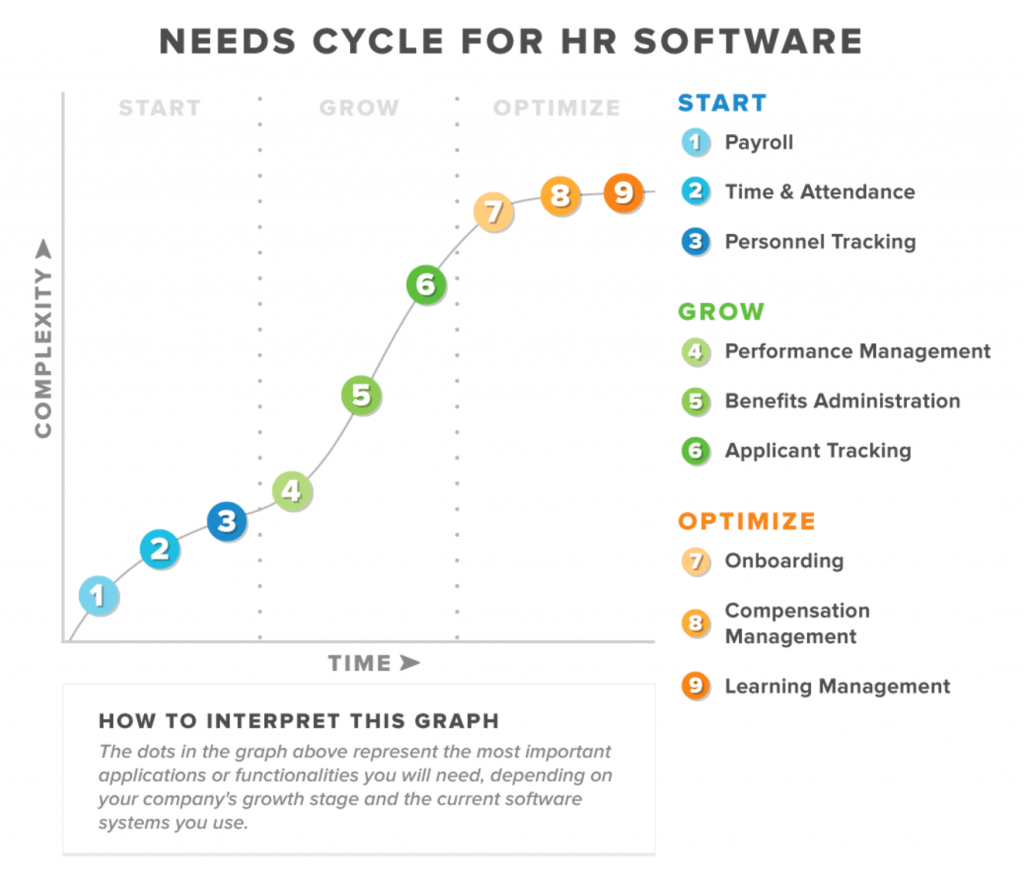

This is why the review site, Software Advice, looked at a random sample of 200 of software buyer interactions to create a first-of-its-kind Needs Cycle for Human Resources (HR) Software.

The First HR Software That Any New Small Business in the Growth Stage Needs is Payroll Software

As the Needs Cycle indicates, as a company grows its needs get more complex. By starting with payroll software that covers all the basics, new small businesses build a solid foundation for future HR processes.

New Small Businesses With 1-50 Employees Represent 42% of Buyers Requesting Payroll Software

The rule is to start small. Many small businesses with less than 50 employees are recognizing the need to automate their payroll with simple, effective software—fostering future growth by eliminating roadblocks, like unhappy workers with incorrect paychecks or angry tax authorities who got overlooked, before they happen.

Doing Payroll Manually is Time-Consuming and Prone to Mistakes

It’s really a numbers game and the statistics prove it. In its 2017 Small Business Taxation Survey, the National Small Business Association (NSBA) found that one in three small businesses report spending more than 80 hours, the equivalent of two full weeks of work—each year on federal taxes, which include payroll taxes (also known as employment taxes.)

While multiplying the number of hours times the rate of pay is pretty straightforward, payroll gets more complicated when you have to account for overtime, vacation, bonuses, benefits and other more advanced calculations. Then there are federal, state and sometimes even local payroll taxes that need to be applied with every payroll. Yes, every payroll.

On a federal level alone, you have:

- Federal income tax that’s withheld by the employer (on the employee’s behalf).

- Federal Insurance Contribution Act (FICA) taxes, which are Medicare and Social Security.

- These taxes are split evenly between the employee and the employer with the employer withholding 50% of the cost from the employee’s income and contributing the other 50% the cost.

- Federal Unemployment (FUTA) tax that is 100% employer-paid.

- All of these taxes must be paid to the IRSon time, reported on a quarterly basis and reflected in year-end W-2s.

Then there are state-level taxes that include income tax (for all but a handful of states), unemployment tax (every state) and local taxes (city or regional income taxes, school board taxes, transportation fees, etc.).

The IRS Punishes 1 in 3 Small Businesses for Payroll Errors

Inc. Magazine’s article, “How to Choose a Payroll Service” serves up this stunning statistic. It also contains this wisdom from business services expert Rhonda Abrams, “One of my rules is if you have one employee, get a payroll service. The penalties for screwing up are so much more expensive than the cost for payroll.”

What to Look for in Small Business Payroll Software

In its Small Business Payroll Software Guide, Software Advice explains that one vital step in choosing payroll software is to look at your needs. Do you only need the basic payroll functions or do you need more features, like a company that will help you automate your federal, state and local payroll taxes?

Many of payroll software providers now offer online platforms. These cloud-based solutions (also known as software as a service or SaaS) are cost-effective because you don’t have to invest in hardware, like servers, or physical software packages. Instead you simply subscribe to the service. Other perks include the fact that upgrades are done automatically as well as rigorous security standards.

As payroll is business software, you are more than within your right to ask a prospective provider about their security standards. For example, Wagepoint offers provide 256-bit SSL encryption. (In security speak, the strength of the security increases with the number of bits of encryption—and the number of possible combinations created by 256-bit encryption is greater than the number of atoms in the universe. Thanks, Gigaom!)

Other factors to consider include customer service, integrations and reach. Before you choose your small business payroll software, call your top choices and speak to their customer service team. Do you feel valued and that they’re there for you? If so, that’s part of your answer.

If you are looking into payroll software, you likely also have accounting software. To put it lightly, it’s nice when they can talk to each other. Make sure that the payroll software you choose is compatible with the accounting program you use or plan to use.

Integrations (also known as APIs) also help you connect your payroll software with other tools like time-tracking and scheduling apps. Otherwise, it’s like when you have off-brand blocks mixed in with your LEGO.

Finally, there’s reach. Do you do business in one state or several? The United States, Canada or both? For example, some small business payroll providers only offer services for the United States or even select states, while others serve both the United States and Canada.

The best advice is to take the time to find the payroll software that fits your present and future needs best. Another perk, many providers will also give you a free 30-day trial.

The Onboarding Process — Always Ask About The Onboarding Process

Whether you’re starting from scratch or switching providers, find out what you’ll need to do to get your business and your employees set up to run payroll. You’ll also need to allow time to gather the proper information and put it in place before pressing go.

The Benefits of Small Business Payroll Software

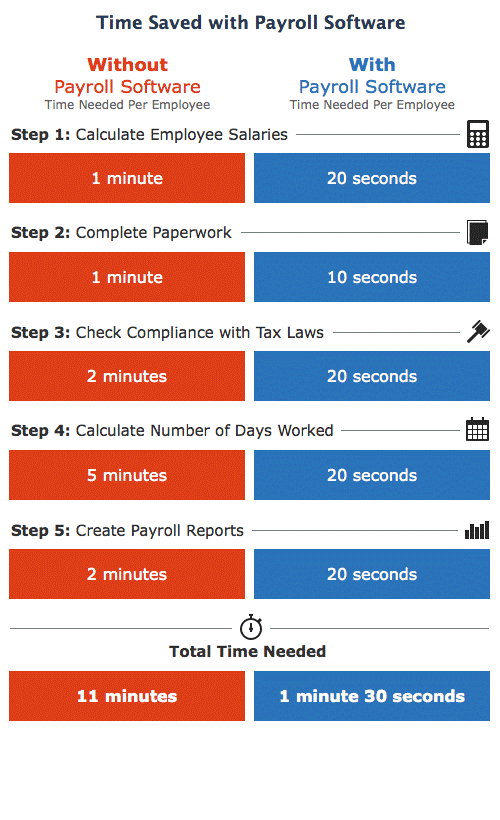

You’ve done your research, you’ve picked a provider and you’re set up. Now it’s time to see the benefits. Again the biggest benefits will be the time you save and the peace of mind that you’re getting things right. The infographic below gives an example of how much time you can save.

If your provider offers an employee portal, each time your employees are paid, they’ll receive an email with a link to their payroll amounts and other details. This same portal can also provide end-of-year documents, like W-2s.

If your payroll is the same every time, you might even be able to set it to run while you’re away. Or, regardless of how simple or complex your payroll is, you can give your approval from almost anywhere you roam.

It’s a happy day when payroll is all about the joy of a job well done rather than a piece of work that never stops demanding your attention.

Author: Blogmaster, content expert and marketing guru at Wagepoint, Michelle Mire is having fun (seriously I am) extolling the virtues of small business payroll and generating articles with actionable advice for small businesses and startups. Michelle probably needs to get out a little more often.