Posts Tagged ‘Payroll’

SMB Bookkeeping: What to Do and When

Managing finances is a top priority for small and midsized business owners. Bookkeeping is a large part of that. Some bookkeeping tasks need to be done only once per year. Others require your attention more often—daily, weekly, or monthly. Here’s a guide to what bookkeeping tasks you need to do and when to do them.…

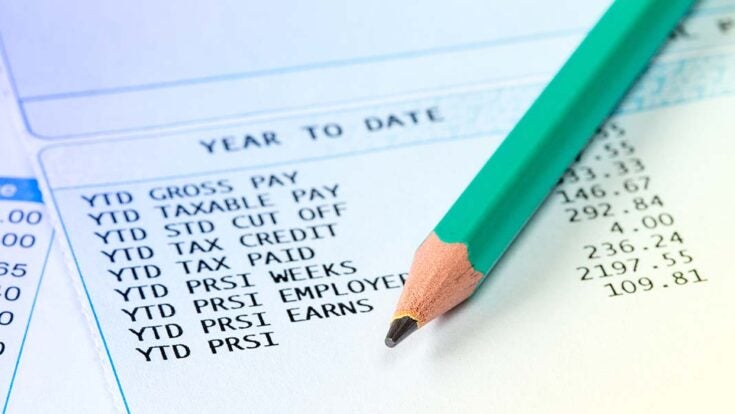

Read MoreIncome Tax vs. Payroll Tax: The Difference for US Payroll

Not all taxes are created equal—in terms of responsibilities, at least. When we see the words “income tax,” we may immediately associate them with our personal taxes we file each year. Or we even think of income taxes for businesses. But what really are payroll taxes? And are they really that different from the income taxes businesses…

Read More7 Tips for Managing Payroll When Cash Flow is a Problem

Money management is a core part of running a business of any size, but it can fall by the wayside when other tasks become distracting. If you stop ensuring that all your sums add up, you might not notice a difference immediately, but soon enough your operation will hit a wall. Worse still, that trouble…

Read MorePayroll Tax vs. Income Tax: How They Work for Canadian Payroll

Payroll tax and income tax. These two short, simple words are the source of so many payroll questions (and confusion). It’s really no wonder because as laypeople, we hear or read “income tax”—we think personal income tax or possibly business income tax. Payroll taxes, on the other hand, are often an unknown and rather eye-opening…

Read MoreWhy Did I Receive a Payroll Tax Notice?

Letters from the IRS are never fun. What makes it worse is not knowing why you got one in the first place. When it comes to payroll tax payments and potential fees, you want to get to the heart of the issue ASAP. But first, take a deep breath… It’s likely that you missed a simple…

Read MoreComparing Payroll Software: What You Need to Know

When you started your business, choosing online payroll for your small business probably wasn’t one of your most top-of-mind priorities. That is until you need to pay yourself or you hire your first employee. That’s when you quickly realize how much time it takes to run payroll manually. Perhaps this is why payroll is one…

Read MoreInsurance Policies That Can Protect Against Payroll Mistakes

Running any business is rewarding, but it also comes with risks. No matter how prepared you think you are, there will always be challenging instances. And you need to make sure you’re well-protected. From financial protection to preserving your brand and reputation, business insurance can help shield you from a business disaster. Insurance is crucial in any…

Read MorePayroll Tax Errors: Who Does the IRS Hold Accountable?

If you are an employer or employee who has fallen behind on payroll taxes and are now facing a hefty bill from the Internal Revenue Service, ignoring it will not make it go away. When it comes to unpaid payroll taxes, the IRS often comes down much harder on taxpayers than they do with unpaid…

Read More3 Payroll Nightmares You Might Have

Vampire Digit might not be too scary, but you know what is? Making payroll mistakes. *gasp* Payroll is a necessary and recurring task for all businesses with employees. So making mistakes can be detrimental for a lot of reasons: Taxes. You can get loads of fees piled on if you report your payroll taxes incorrectly. Even though…

Read MoreIn-House HR & Payroll vs. Outsourcing: The Key Decision

Every business owner will have to decide at a certain stage of organizational growth whether to create and maintain an in-house HR and payroll department, or to delegate these services to an outsource provider. Why is this question even important in the first place? An effective HR department ensures the hiring of employees that are…

Read More