Posts Tagged ‘Payroll Tax’

IRS Changes Payroll Form 941 for 2nd Quarter 2021

Recent legislation, designed to help small businesses harmed by COVID-19, has dramatically altered Form 941. The June 2021 changes add over ten new lines and five new worksheets to an already complicated form. In general, Form 941 was updated to reflect provisions under the American Rescue Plan Act (ARP), enacted March 11, 2021. While the…

Read MoreEmployers Beware–Payroll Tax Form Has Changed Yet Again

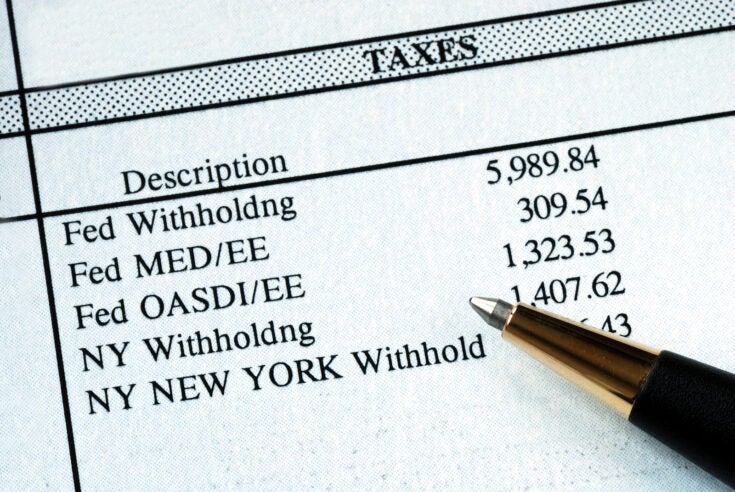

On September 30, 2020, the IRS updated Form 941, Employer’s Quarterly Federal Tax Return, for the second time in as many quarters to accommodate President Trump’s executive order. Recall, employers use Form 941 to report income taxes, Social Security tax, or Medicare tax withheld from employee’s paychecks. Employers should use this version to file their…

Read MoreSmall Business Update: Trump’s Executive Order to Defer Payroll Taxes

On August 8, 2020, to provide temporary assistance to workers who are facing financial burdens due to the pandemic, President Trump issued an executive order to defer the withholding, deposit and payment of certain payroll taxes until Jan. 1, 2021. On August 28, 2020, the IRS issued Notice 2020-65 (“Notice”) to provide implementation guidance. What…

Read More10 Facts Employers Need to Know About Payroll Tax Incentives

Recent Covid-19 legislation creates new payroll tax incentives for employers, which fall into two main categories: Payroll Credits and Tax Deferral. All these relief measures were established by the Families First Coronavirus Response Act (Families First Act), enacted March 18, 2020 and the Coronavirus Aid, Relief, and Economic Security (CARES) Act, enacted March 27, 2020.…

Read MoreHow to File Schedule B for Form 941

Starting your own business and hiring employees means dipping your feet into the deep, dark pool of payroll tax filing. Making a filing mistake that may lead to extra penalties and fees is daunting to think about. However, knowing which forms you’re required to file and when they apply is a big part of getting things right,…

Read More