Is the Future of Auto Insurance a Good Deal?

By: Brian Wallace

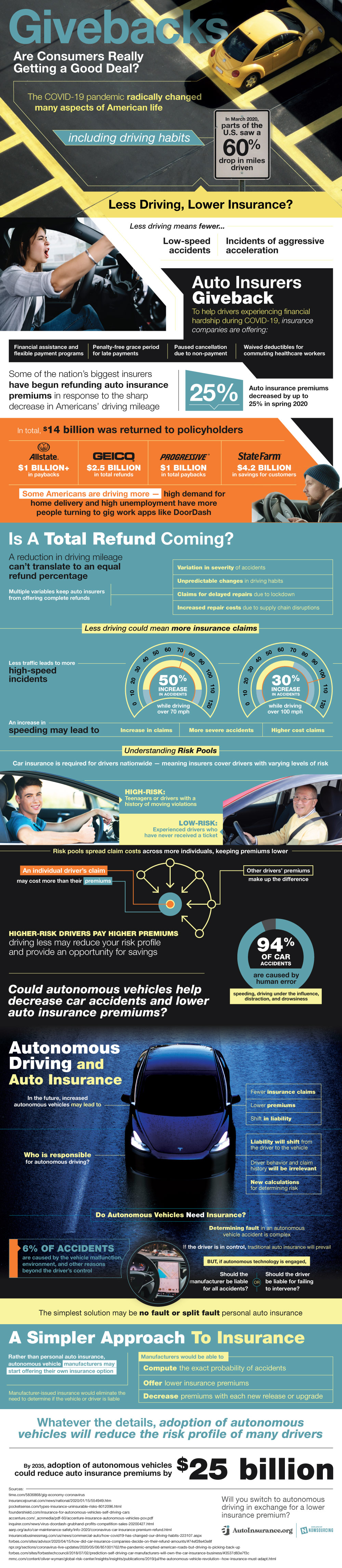

Of the many things that changed in 2020, a major one amongst Americans was driving habits. According to Autoinsurance.org, some parts of America saw a 60 percent drop in mileage in March. With less driving, there were fewer low-speed accidents.

With fewer accidents and an increase in financial struggles, many auto insurers gave back to their policyholders in 2020. Companies are offering paused cancellation due to non-payment, penalty-free grace period for late payments, financial assistance and flexible payment programs, and waived deductibles for commuting healthcare workers.

Larger companies like Geico and Progressive have begun to issue refunds for premiums due to the reduction in mileage. The refunds totaled $14 billion. However, due to the lockdowns, deliveries have become more in demand. Because of this, some Americans are actually driving more than before. Gig worker apps like DoorDash have people driving about to make money.

How Big of a Refund?

Due to these reasons, a full refund will most likely not happen. Variables that make this difficult include: unpredictable changes in driving habits, variation in severity of accidents, increased repair costs due to supply chain disruptions, and claims for delayed repairs due to lockdown.

And while fewer people are driving, this could actually lead to an increase in insurance claims. With less people on the road, those who are driving are more likely to speed. An increase in speeding could lead to an increase in claims, more severe accidents, and higher cost claims. There was a 50 percent increase in accidents while driving over 70 mph and a 30 percent increase in accidents while driving over 100 mph.

The Rise of Autonomous Vehicles

In addition to the COVID-19 pandemic, another big change to auto insurance is the rise in autonomous vehicles. Ninety-five percent of accidents are caused by human error so it stands to reason that autonomous vehicles could drastically change premiums and even liability. If the car is in control at the time of the accident, is the driver at fault or the manufacturer? It is a complex problem that fortunately has a simple solution.

Instead of private auto insurance companies, the car manufacturer would provide the insurance. This would eliminate the question of liability. This would also completely eliminate the need to take into account driver history (which traditional insurance uses to price premiums). Also, manufacturers would also be able to compute the possibility of an accident and decrease premiums with each new release or upgrade.

By 2035, autonomous vehicles could reduce premiums by $25 billion.

1748 Views

Source: Infographic reprinted with permission of Autoinsurance.org