Whether you’re at the helm of a startup or already running a small business, your home may double as your office space. This certainly has its perks. A home-based business can help keep your overhead low, especially if you work on your own or have a remote team. You’ll also save on commuting costs. But there are risks to running a home-based business — and they could leave you vulnerable to financial losses.

Business insurance can provide some protection, but one survey by small business insurer NEXT found that 29% of small business owners don’t have any coverage. Understanding how it works can help you determine what level of business insurance may be right for you.

Here are some unique insurance mistakes faced by home-based entrepreneurs.

1. Relying solely on homeowners or renters insurance

While your homeowners or renters insurance policy may cover certain situations, they’re far from comprehensive. That often leaves business owners on their own or with insufficient coverage.

For example, a standard homeowners insurance policy will only provide $2,500 of coverage for business equipment, according to the Insurance Information Institute (III). If your equipment is wiped out in a storm, you could face significant out-of-pocket costs. Similarly, if a client comes to your home for a business meeting and injures themselves, your homeowners insurance policy probably won’t cover it.

Having said that, most homeowners insurance policies will cover the following if you experience an insured event:

- The structure of your home

- Your personal belongings

- Lawsuits and medical bills related to injuries someone suffers on your property

- Property damage to someone else’s home that’s caused by someone from your household, including pets

- Additional living expenses if you’re unable to live in your home

2. Overlooking work-from-home risks

If you’re a home-based small business owner, there may be unique risks that haven’t crossed your mind yet. That can include:

- Property or inventory damage

- Someone getting injured on your property, whether it’s a customer, employee, delivery person or service worker

- Claims related to slander, libel, negligence, false advertising or inaccurate advice you provided

- Lost income if your home is damaged and it interrupts business operations

3. Not understanding essential coverage

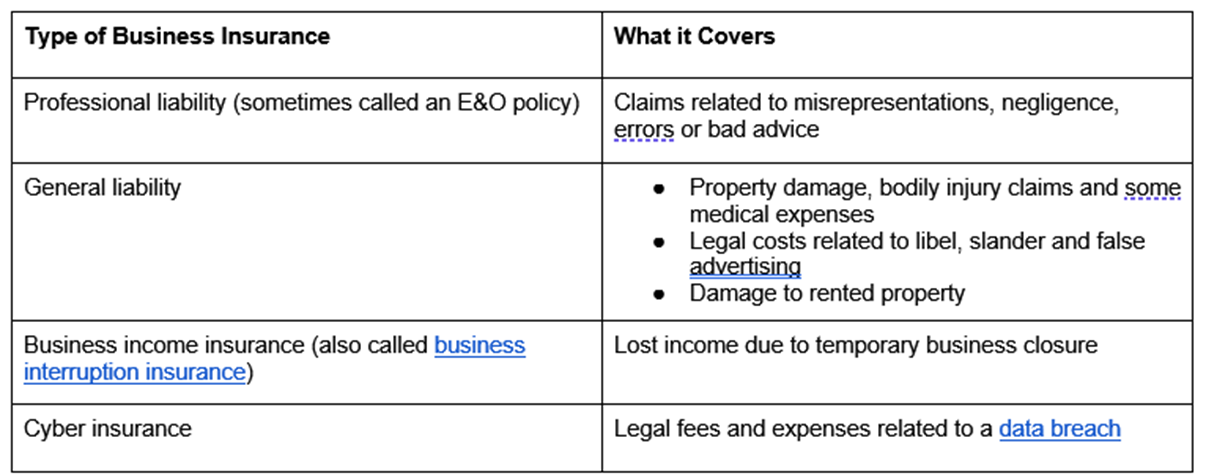

Every small business is different, and what’s essential for one may be irrelevant to another. With that in mind, here are several types of business insurance that may be worth considering if you have a home-based operation:

If you have employees, you’ll most likely have to carry workers’ compensation insurance as well. This covers medical and wage benefits for employees who get injured or sick while working.

Do I need home-based business insurance?

The answer will depend on the nature of your business, your financial situation and your risk tolerance. If you’re a freelance graphic designer, your insurance needs might not be as demanding as a business owner who has employees and meets with clients in their home. But you might consider adding some level of coverage if you:

- Have valuable business property, equipment or inventory that would be expensive to replace

- Store sensitive customer information and personal data

- Provide services that could leave you open to professional liability claims

What kind of home-based small business insurance to choose

Your coverage needs will be unique to you. According to the III, these are the most common types of coverage options. It may involve modifying your existing homeowners insurance policy or purchasing a standalone business insurance policy.

Homeowners Policy Endorsement

It might be possible to add an endorsement to your current homeowners policy to make it more robust. That can bump up your coverage limits to protect your business equipment and protect you from liability claims. This is typically an option for business owners who have few business-related visitors. State Farm adds that a homeowners policy endorsement might make sense if you anticipate keeping less than $4,999 worth of business property in your home.

In-home business policy

In terms of coverage, this is a step above a homeowners policy endorsement. It offers higher coverage limits for business equipment and liability. Some will also cover:

- Reimbursements if records or paperwork are lost in a covered event

- Lost income if your home is damaged to the point that you cannot conduct business there

- The cost of working from a temporary location

Business owners policy

This add-on takes liability, property and business interruption insurance and rolls them into one policy. You can expect a higher level of coverage when compared to an in-home policy. It can also be a good fit if you have several business locations.

Running a small business comes with risk, even if you’re a startup that’s operating out of your home office. The right business insurance can protect you from financial losses and help safeguard your personal assets.

74 Views