From time to time business owners will replace vehicles used in their business. When replacing a business vehicle, the tax ramifications are different when selling the old vehicle and when trading it in for a new vehicle. If the vehicle is sold, the result is reported on the taxpayer’s return as an above-the-line gain or loss. Since a trade-in is treated as an exchange, any gain or loss is absorbed into the replacement vehicle’s depreciable basis, thereby avoiding any current taxable gain or reportable loss.

Thus, it is generally better to trade in a vehicle that would result in a gain if it were sold and to sell a vehicle if doing so would result in a loss.

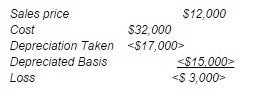

Let’s say a taxpayer sells a 100%-business-use vehicle for $12,000. The original purchase price was $32,000, and $17,000 is taken in depreciation. As illustrated below, the sale results in a loss, so it generally would be better to sell the vehicle and deduct the loss rather than trade in the vehicle.

On the other hand, had the business owner sold the vehicle for $16,000, the sale would result in a $1,000 taxable gain, and trading it in would be a better option. Caution: Sales to the same dealer are treated as trade-ins.

If a vehicle is used for both business and personal purposes, the loss or gain must be prorated for the proportion of business use, as the personal portion of any loss is not deductible.

Since trade-in values are generally less than the sales value of the vehicle, the trade-in decision must also consider whether the tax benefits will exceed the additional money received from selling the old business vehicle. Of course, there is always the hassle of selling a car to be considered as well.

If you are considering trading a vehicle in, determine whether the tax benefits exceed the additional money received from selling the old business vehicle, as trade-in values are generally less than actual sales values. You should also consider the time and energy it will take to sell the vehicle on your own.

This concept can also be used when selling or disposing of other business assets. If you have questions about how this tax strategy might apply to your specific tax situation, please give this office a call.

Author: Barry Fowler is licensed to represent taxpayers before the Internal Revenue Service (IRS) and is a longstanding member of several tax industry professional organizations including the National Association of Enrolled Agents (NAEA), National Association of Tax Preparers (NATP), Texas Society of Enrolled Agents (TSEA), and the American Society of Tax Problem Solvers (ASTPS). With experience in the tax and finance industry spanning over twenty years, Fowler’s expertise includes tax resolution, personal financial planning, tax return preparation, financial statements, and general ledger bookkeeping. He has been instrumental in helping hundreds of people resolve complex tax issues with the IRS.