Paying Employees in Canada and the US: What You Need to Know

By: Wagepoint

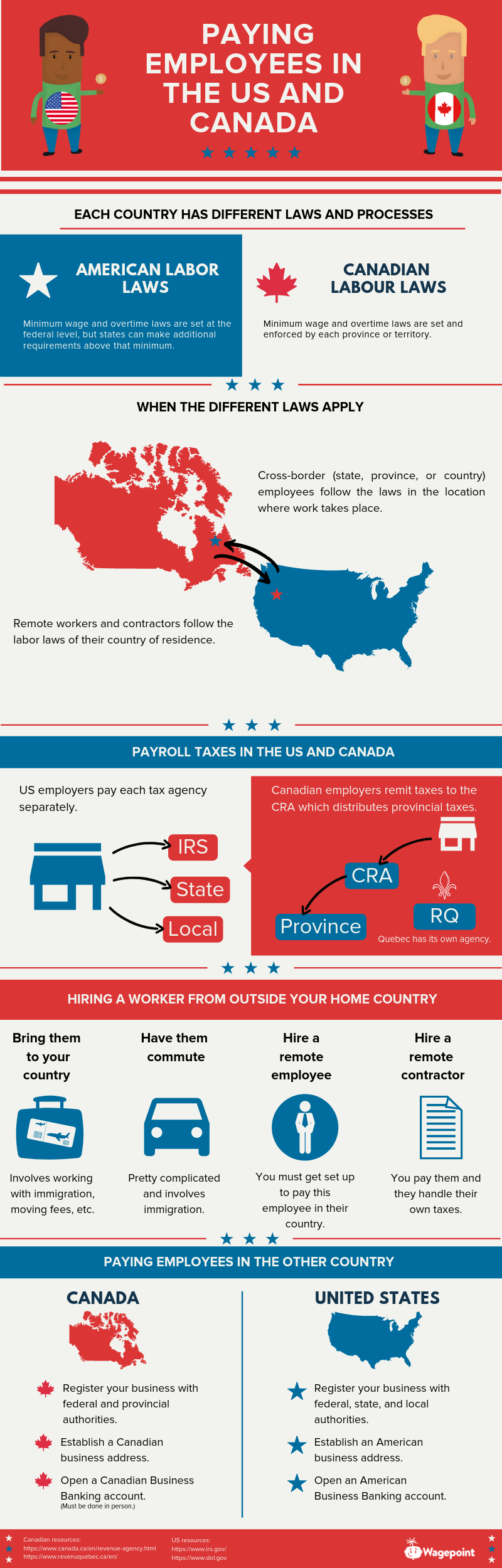

Though Canada and the US share one of the largest geographic borders in the world, there are some stark differences between the two countries—especially when it comes to the regulations related to paying employees.

Curious about what makes them the same or different? Do you have or plan on having American employees working for your Canadian business or vice versa? Here are some key things to keep in mind:

Key differences between Canadian and American labor expectations

When it comes to paying employees in Canada and the United States, there’s a lot more to it than each country having a different currency—or that the US has 50 states while Canada has 10 provinces and 3 territories. Each country also has its own way of doing things, especially when it comes to wages and taxes.

Side note: In Canada, you receive a pay cheque (two words, and not sure who came up with that spelling) for your labour (note the “ou”) while in the US you get a paycheck (one word) for your labor. And no, you can’t pay Canadians in maple syrup, nor can you pay Americans in apple pie.

Minimum wage requirements for Canada and the US

In both countries, the minimum wage varies based on the state or province where the employee is working and employers (whether American or Canadian) must be aware of and comply with these requirements.

Minimum wage in Canada

In Canada, each of the provinces and territories set and enforce their own minimum wage requirements. Some industries and types of workers have exceptions that put their minimum wage higher or lower than the normal provincial rate. For example, “student servers” in Ontario have a lower minimum than the normal wage.

Regardless, it’s on the employer to know and pay their employees correctly based on their province. See a list of minimum wage rates by province here.

The best primary sources for minimum wage information in Canada are the Canada Revenue Agency (CRA)/Revenu Quebec and each provincial or territorial labour department. (Our list of minimum wage rates also links to each of the appropriate websites.)

Minimum wage in the US

On a different note, the US has a federal minimum wage that sets the standard by which states base their own enforcements.

Many states don’t even go through the trouble of creating and managing their own minimum wage—in fact, 21 out of the 50 states are currently sitting at the federal rate. In states with their own minimum wage laws, employees are entitled to the rate that is highest. This is normally the state’s minimum wage. Learn about your state’s minimum wage rate here.

Just to keep things interesting, certain cities, like Chicago and Los Angeles, have their own minimum wage laws as well. For a list of cities with their own minimum wage requirements, see this article.

The Department of Labor and each state’s labor department are the best sources for minimum wage information in the US. Their websites are also linked in our list of minimum wage rates above.

Cross-border minimum wage requirements and when they apply

If you are hiring employees from the opposite country across the border, you’ll have to meet the minimum wage requirements of the location where the work takes place. If a Canadian employee works in Saskatchewan, then you have to follow that province’s labour laws. If a US employee works in Nebraska, you again have to follow the rules that apply for that state.

The above is true whether or not your employee is remote or working at your place of business. The deciding factor is where the work takes place.

In addition to meeting the minimum wage requirements, the employer must also withhold income tax and payroll taxes every time the employee is paid. (We go into greater detail on payroll taxes later in this piece.)

Canadian and American overtime rules

Just like minimum wage requirements, the overtime rule your employee must follow falls under the jurisdiction of the state or province where the work takes place. Some rules are stricter than others, so check the overtime laws that apply.

Overtime in Canada

Like minimum wage regulations in Canada, overtime rules are set and enforced by each province and territory. Whatever work happens inside the borders of your province is subject to the rules set by your province, even if your employees commute from across a provincial border.

Most provinces classify overtime pay as anything over 8 hours in a day and 40 hours in a week at a rate of 1.5x normal pay. Employees in British Columbia can also be eligible for double overtime, getting 2x their normal pay rate for every hour worked over 12 in a day.

Learn what overtime rules apply for your province or territory here.

Overtime in the US

Each state in the US must at the minimum comply with the federal overtime rule, which requires employers to pay 1.5x the normal pay rate for any hours worked over 40 in a week.

Many states add on their own requirements on top of the 40-hour week rule, usually adding an overtime requirement for hours worked over 8 in a day. California even has a double overtime rule to be aware of, demanding 2x the normal pay rate after working 12 hours in a day or for hours worked over 8 on any 7th day of a workweek.

See your state’s overtime laws here.

Cross-border overtime requirements and when they apply

Just as employers must follow the minimum wage requirements for an employee’s place of work, they must follow the prevailing overtime rules of where the work takes place. For any employee working in-office or on location, they follow the overtime rules where the office or site is located. For remote workers this is determined again by where the work is done, such as the employee’s home.

Country-specific banking requirements for paying Canadian and US employees

Once you understand the labor laws that apply to your business and employees, the next step is knowing how to actually pay them.

In most cases, it’s simple: Your employees are living in the same country as your business, so you pay them in your country’s currency. But when you’re dealing with employees hired from outside your country, you’ll have to do things differently to adhere to international regulations.

The banking process for Canadian employers with American employees

When a Canadian business hires an American employee—who will be paid within the United States—there are several requirements to fulfill before they are eligible to work:

- Establish an American business address— This address cannot be a P.O. box, it must be a physical address.

- Open an American business banking account— This must have a US routing (transit) number that identifies the financial institution where you’ve opened the account.

- Register your business with the Internal Revenue Service (IRS)— this is the US equivalent to the CRA. The IRS handles all federal-level taxes. When registering, you will receive a Federal Employer Identification Number (FEIN) which will be used to file, pay, and report your federal taxes for your American employees.

- Shortly after registration, you’ll receive a Tax Verification Letter that contains your FEIN and details your federal payroll tax obligations.

- Register with state tax agencies— In the United States, you also have to register with the state agencies where your employee will perform his or her work. This includes state income tax withholding and state unemployment insurance, both of which are separate agencies. You’ll use your FEIN to register, so you’ll need that first.

Once the checklist above has been completed, you’re good to go with paying your American employees. They’re required to receive US dollars, which is paid out by the American bank account you set up.

The banking process for American employers with Canadian employees

When an American business hires a Canadian employee—who will be paid within Canada—the employer must take the following steps in order to pay the employee:

- Establish a Canadian business address— This address cannot be a P.O. box, it must be a physical address.

- Open a Canadian business banking account— This must have a Canadian transit (routing) number that identifies the financial institution where you’ve opened the account. This must be done in person, it cannot be done online or by phone.

- Register your business with the Canada Revenue Agency (CRA)— The CRA is the Canadian equivalent to the IRS. As part of the registration process, the CRA will assign you a Business Number (BN) that you’ll use to identify yourself for tax purposes.

- If you’re paying an employee in Québec, you’ll also have to register with Revenu Québec.

- Register for a payroll program account— Once you have a BN, you also need to apply for a payroll program account that you will use specifically for source deductions (employer taxes).

- Register with the applicable provincial and territorial agencies— As of the writing of this article, these include Workers’ Compensation (WISB/CSST) in Ontario and Québec and the Employer Health Tax (EHT/HAPSET) in Ontario, Québec, Newfound Land, Manitoba. In 2020, British Columbia will also be starting its EHT program.

Income and payroll taxes in the US and Canada

In both countries, employees have specific payroll tax obligations. Employers must withhold certain taxes and contribute to others. On top of this, the amounts withheld and contributed must be reported and paid to the proper authorities in a timely manner.

Canadian employee and employer taxes

Of the two countries, paying taxes as an employer in Canada is by far the simplest. Instead of keeping up with a number of tax agencies like the US, employers in most provinces pay most of their federal and provincial/territorial payroll taxes to the Canadian Revenue Agency (CRA). The CRA then divvies up what taxes are for them, and automatically sends the correct payments to the provincial/territorial tax agencies.

Canadian payroll taxes include federal and provincial/territorial income tax withholding, Employment Insurance (EI) and Canada Pension Plan (CPP) contributions from employees and employers, Workers’ Compensation contributions, Health Services Fund (HSF) contributions and any additional provincial requirements. (Workers’ Comp and HSF contributions go directly to the respective tax entities.)

Withholding taxes from pay cheques and making the correct payments on time to the CRA rests solely with the employer. Using payroll software, like Wagepoint, can help you cut down on mistakes while automatically taking care of your withholding, remitting, and reporting.

US employee and employer taxes

In the US, payroll taxes are paid and reported to the relevant federal, state, and local tax agencies. Unlike Canada, each agency is a separate entity and employers are expected to register with each and every one of them that apply.

For example, a business operating in New York City would need to register with the Internal Revenue Service (IRS) (federal) and the New York state agency (state), plus the NYC agency (local).

Payroll tax obligations in the US include federal and state income tax withholding, Social Security and Medicare (FICA), federal and state unemployment (FUTA and SUTA/SUI), and any applicable local taxes based on your location. Each kind of tax must be paid directly to the correct agency—and in most cases, your unemployment insurance payments go to an entirely different entity than your income tax withholding payments.

It seems confusing, and for some states it really is. Since you will be primarily following the laws set by your state, your best bet is to contact your state agency or talk to a tax professional.

Again, calculating and withholding your payroll taxes by hand is a big task. Investing in payroll software, like Wagepoint, is the way to go if you want to save time and reduce the chances of costly mistakes.

Things to keep in mind when hiring employees in Canada and the US

We’ve hit the basics of paying your employees on each side of the border. But what about having both Canadian and American employees working in your business?

There are a number of situations that can result in hiring workers from both countries—and each situation warrants a different process for staying compliant as a business.

Hiring employees for country-specific locations

The easiest way to handle a workforce with both Canadian and American employees is to have separate locations operating in each country. Canadian employees work in the Canadian location, and Americans work in the US location.

Having more than one location or headquarters can be an added stressor as your business grows, but it’s a lot easier to keep your workforce regulations aligned with the country they’re working in. That way, your labor laws, payroll taxes, and employer requirements all fit together. (And there’s no extra paperwork.)

This route only really makes sense if you’re already serving customers in both countries or are looking to expand into a new national market. Opening a new location in your neighboring country just so you can hire a single employee is a really time-consuming and unnecessary tactic.

Other solutions for cross-border employees

If your business operates in one country only and you find the perfect job candidate from across the way, things get a little hairier. There are three main ways it can shake out:

- Commuters

Of all the different options, this one is the most difficult to navigate as an employer. Because of this difficulty, it isn’t recommended to have employees commute across the border if they aren’t the absolute best person for a job. The process dips into some immigration laws and regulations, so the candidate needs to be worth the effort.

In both the US and Canada, employers looking to hire an employee from the opposite country must go through a set of preliminary procedures. These include getting an audit done by their federal government to ensure your hire doesn’t hurt the national economy, plus some other registration requirements for the candidate to complete. The regulations also depend on what industry they’re in, and what type of worker they are hiring.

In both countries, when work is being performed in the opposite country of the employee’s residence (aka they regularly commute across the border), then a work visa is required. This will be an absolute necessity to keep your employee around and not run into legal issues.

Once all that information is received and your new employee is permitted to work for your country, you have to then deal with taxes from the neighboring country. The US and Canada have a tax treaty that prevents employees from being taxed twice—once by each country—but this still requires a little extra effort and paperwork on the part of the employer.

Your best bet? Find a business and tax professional that specializes in cross-border employment. They can help you understand and complete the preliminary requirements before you make your final decision. Immigration and taxes are not things you want to make mistakes with.

The Canadian Labour Program and the US Department of Labor websites are your best resources to learn about what steps you need to take when hiring an employee outside your country.

- Remote employees

As more of the workforce moves online, you’re more than likely to hire a remote employee at some point. With the mobility of remote work, it’s also likely the best candidate isn’t local to your immediate area (or country, for that matter).

A big perk of remote work is not having to apply for a work visa. Because the employee isn’t physically commuting to the other country, there’s no need to go through the immigration-heavy procedures necessary for an in-person hire.

Before you hire a remote worker, be aware of the regulations involved with income and payroll taxes. Although Canada and the United States have a treaty to prevent double-taxation, each country classifies tax-qualifying income based on different parameters. Canada uses your residence to determine tax liability, while the US uses where your work takes place to qualify your tax liability.

Here’s a helpful list of cross-border telecommuting scenarios that show the differences in regulations based on a number of factors.

- Remote contractors

Instead of hiring a remote worker as an employee, there’s also the option of classifying the individual as a contractor. The benefits for the employer are that they don’t have to administer payroll taxes. For employees, the benefit is a matter of preference. Self-employed taxes can be an administrative burden. However, some contractors prefer the sense of autonomy associated with being a contractor.

Another factor to consider, beyond financial, is the type of relationship you want to build with this individual. Contract work is often perceived as less of a commitment than being a full employee. If engagement is crucial to your brand, this is something to consider.

Not sure of the difference between an employee or a contractor? This article will help you out.

Expand your workforce with Canadian and American workers

There are tons of talented employees out there. Understanding the differences between Canada and the US—and how to access and pay workers on both sides of the border—can help you expand your talent pool for your next open position. And when you need to pay these employees, we know a little software company that can pay employees in both the United States and Canada. Psst… that’s us!

The advice we share on our blog is intended to be informational. It does not replace the expertise of accredited business professionals.

Author: Erika Yohn is a savvy Millenial on Wagepoint’s marketing team. Now a retired soccer player, she spends a lot of time browsing Twitter to stay updated on the current trends – especially when it comes to memes. With a hand in all things marketing, she likes to keep things fun and useful for Wagepoint’s customers.