How to Manage and Pay Tipped Employees in Restaurants

By: Wagepoint

In the restaurant industry, tips are more than something you’d associate with a homespun tip jar by the cash register—they’re a primary source of income for tipped employees. The catch is tips are also taxable income with specific responsibilities for employees and employers.

Tips Are Not Small Change

In its research, the National Restaurant Association (NRA) states that restaurants are the second-largest private sector employer in the United States:

- The restaurant industry adds jobs at a stronger rate than all other industries combined.

- By 2025, it will add a projected 1.7 million jobs.

- More than 90% of restaurants aresmall businesses with fewer than 50 employees.

- Half of all American adults have worked in the restaurant industry at some point in their lives.

- 1 in 3 Americans had their first job in a restaurant.

How Tips Affect Incomes

According to PayScale’s 2012-2013 Tipping Study, tips can account for as much as 60% of a service worker’s income.

The Top 10 Jobs Where Workers Earn Their Income From Tips

PayScale’s Tipping Study also provides a table of tipped employees, ranked by the amount of income they receive from tips. Depending on the nature of the restaurant establishment, roles within the restaurant industry account for half of this list.

| Title | % of Income From Tips |

| Gaming Dealer (casino tables) | 59% |

| Waiter/Waitress | 58% |

| Bartender | 52% |

| Banquet Captain | 45% |

| Exotic Dancer | 44% |

| Bar Manager | 40% |

| Valet | 39% |

| Busser | 37% |

| Sommelier | 34% |

| Porter/Bellhop | 32% |

The Challenge for Employers and Tipped Employees

Tips aren’t just income—they’re taxable income. This means that tipped employees are responsible for reporting tips to their employers. In turn, employers are required to accurately factor tips and withholding amounts into payroll.

The Definition of Tipped Employees and Tips

While it seems straightforward, the tangle of laws and responsibilities makes managing this process rather complex. In providing a detailed overview, we thought it would make sense to start with some basic definitions as outlined by Fact Sheet #15: Tipped Employees Under the Fair Labor Standards Act (FLSA):

Tipped employees — A tipped employee is someone who routinely earns more than $30 in tips each month.

- Tips are the property of the employee, regardless of whether or not the employer utilizes a tip credit.

- TheInternal Revenue Service (IRS) requires that employees record and report any tipped income of $20 or more per month.

- Employers may not use an employee’s tips for any reason other than as atip credit toward the minimum wage obligation.

- An employer may only count the tips that an employee actually receives toward a tip credit.

A tip (gratuity) — A tip is a sum given to an individual in addition to the service provided. They are normally provided in the form of cash (direct tip) or via credit card during bill payment (indirect tips).

- Tips are the property of the employee.

- Service charges, like a fee added for a large party, are not considered tips.

The Rules for Tip Credits

Although tips are considered the property of the employee, under FLSA guidelines, employers may count a percentage of the tips that a tipped employee earns toward meeting the federal minimum wage requirement of $7.25 per hour. (Note: State, territorial and district regulations also apply.)

Employer’s responsibilities (FLSA):

- Employers must inform tipped employees (verbally or in writing) of the cash amount of their direct wage—a minimum of $2.13 per hour.

- The maximum tip credit cannot be above $5.12 per hour.

- The tip credit claimed may not be higher than the amount of tips the employee earns.

- Employers must be able to substantiate that the total wages are meeting all minimum wage requirements.

- If the tip credit is not enough to meet minimum wage requirements, the employer mustmake up the difference.

- Deductions for walkouts, breakage or cash register shortages are illegal.

- Overtimeis calculated on the full minimum wage—not the cash wage payment minus the tip credit.

The Rules for Tip Pools

A tip pool or tip pooling (tip sharing) is when there’s an arrangement between tipped employees to share tips. For instance, servers, bar staff, greeters and bussers in a restaurant may pool their tips.

Employer’s responsibilities (FLSA):

- The FLSA does not state a minimum or maximum contribution or percentage for tip pools.

- Employers must determine and notify employees (verbally or in writing) of the required contribution amount.

- Employers may only take a tip credit from the amount of tips the employee actually receives from the tip pool.

- Only those tips that are greater than the amount of tips used for the tip credit may be taken for a tip pool.

- Tip pools may not include employees who are not customarily tipped.

Tips Paid on Credit Cards (Indirect Tips)

As more and more people use credit cards over cash, it has become common for people to add a tip as part of the same transaction. However, with each of these transactions, the employer is charged a transaction fee by the credit card company.

Employer’s responsibilities (FLSA):

- Employers must pay employees the tip minus the cost of the transaction fee.

- The transaction charge must not reduce the employees tip and resulting wage below the required minimum wage.

- Tips due to employees must be paid no later than the regular payday.

- An employer may not withhold tips until being reimbursed by the credit card company.

Employees Paid By Tips Only

In the instance that an employee’s compensation is based only on tips, with no cash wage, no tip credit can be taken by the employer and a withholding amount based on the full minimum wage is owed.

Tipped Wages and Overtime Pay

Overtime is calculated based on the full federal and or state minimum wage. The FLSA specifies a tip credit of $3.02 for overtime. This credit must be taken from the overtime rate of pay, not the regular rate of pay.

State Minimum Wage Laws and Tipping

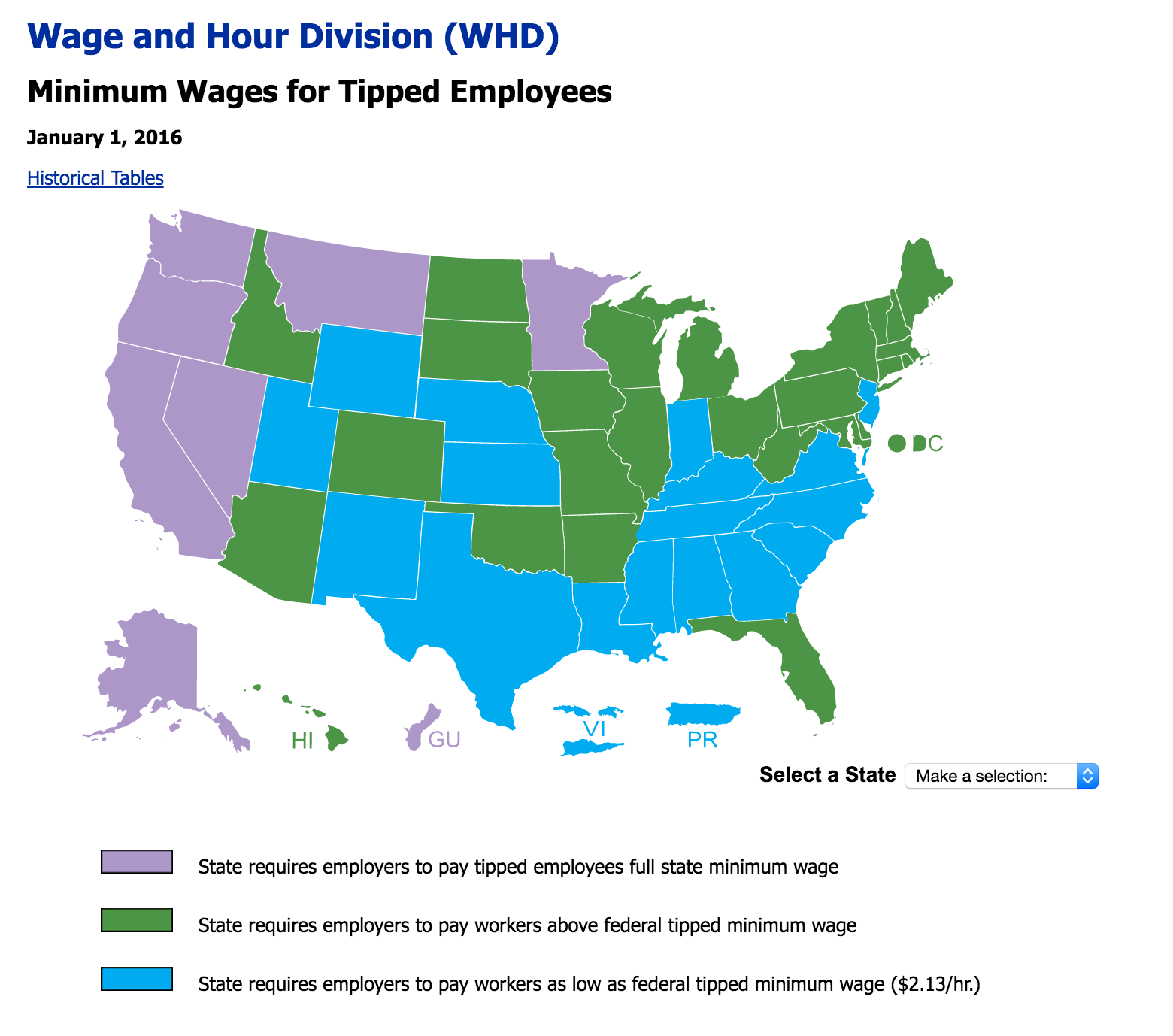

In addition to federal minimum wage laws, employers are required to meet minimum wage requirements set by the states, territories and districts in which they do business. Of course, it wouldn’t be U.S. tax law if there weren’t more than 31 flavors of interpretation.

A summary of state, territorial and district minimum wage and tipping laws:

- Alaska, California, Guam, Minnesota, Montana, Nevada, Oregon and Washington require employers to pay tipped employees full state minimum wage before tips.

- Arizona, Arkansas, Colorado, Connecticut, Delaware, the District of Columbia, Florida, Hawaii, Idaho, Illinois, Iowa, Maine, Maryland, Massachusetts, Michigan, Missouri, New Hampshire, New York, North Dakota, Ohio, Oklahoma, Pennsylvania, Rhode Island, South Dakota, Vermont, Wisconsin and West Virginia require employers to pay tipped employees above federal minimum wage.

- In Indiana, Kansas, Kentucky, Nebraska, New Jersey, New Mexico, Puerto Rico, Texas, Utah, Virginia, the Virgin Islands and Wyoming the cash payment is the same as that required under the FLSA.

- Alabama, Georgia, Louisiana, Mississippi, South Carolina and Tennessee do not have state minimum wage laws.

Four Common Employer Mistakes

Given the level of detail required to get to this point in this post, it’s no surprise that there are articles like Upstart Business Journal’s Four Common Errors When Companies Pay Their Tipped Employees outlining the following mistakes:

- Counting service charges as tips— A fixed amount, like a charge for a large party, added to a customer’s bill as a routine business practice, should not be counted as tips. Service charges are treated like commissions for wage and tax purposes and can also impact overtime rates.

- Improperly applying tip credits— In addition to understanding the FLSA responsibilities, employers must also be aware of the regulations in the states in which they operate. Employers must also ensure that tip credit is only applied to hours counted as tipped work.

- Improperly assigning tip pool credits— Employers may not assign non-tipped employees, those who do not typically receive tips, to a tip pool.

- Improperly processing withholding amounts— If employees underreport their tips and the employer makes up the difference to meet the minimum wage requirement, the employer ultimately pays a greater amount of taxes (overpays) and the employee underpays.

Employee Tip-Reporting Responsibilities

The IRS requires that tipped employees record and report any tipped income of $20 more, as well as the cash value of non-cash tips, such as sports or movie tickets, each month.

- These reports are due on the 10th day of the month following the month in which the tips were received.

- Instructions and forms for doing so are included in Publication 1244 (PDF), which includes Forms 470 and 470A.

- Employees and employers may order free copies of this publication by calling 1-800-TAX-FORM (1-800-829-3676).

- Employees can their own form of reporting, either a custom form or pen and paper, as long as it includes:

- The employee’s name, address, and social security number (SSN).

- The employer’s name and address.

- The month or period the report covers.

- The total tips received.

Why Tipped Employees Should Report Tipped Income

Given that the process is so user-friendly, it’s no wonder that there’s an ongoing struggle for compliance. Or that employees often choose the lure of instant gratification over the long-term rewards of doing the right thing. In an effort to make the reporting process more palatable, the IRS produced The Jill & Jason Show, a video on the importance of reporting tipped income.

The Consequences of Under-Reporting Tip Income for Employees

If you don’t have a spare 18 ½ minutes to watch the IRS’ Jill & Jason Show (in all of its reminds-you-of-ninth-grade-health-class glory), here are a few “highlights” on why tipped income should be reported:

- Because tips represent part of an employee’s income, under-reported income can affect:

- Eligibility and benefit amounts for programs like social security, unemployment insurance and workers’ compensation.

- The size of loans of financing agreements that a lender is willing to issue.

- The size of contributions allowed for 401(k)s

- The penalty for under-reported tax income can be up to 50% of social security and Medicare taxes owed + 20% of the income taxes owed. Intentionally under-reporting tipped income or any income is also a criminal offense.

How Technology Can Help Transform Tip Reporting

With the prevalence of smartphones, pen and paper are being replaced by the tap of a finger, thanks to apps like Just The Tips, ServerLife, Tip Counter , Tip Bucket, Tip Jar, TipMe, Tip$ee and Tip Sheet.

Employer Tipped-Income Reporting Responsibilities

The IRS states that an employer must ensure that the minimum total tip income reported by employees during any pay period is equal to 8% of your restaurant’s total receipts for that period. The reporting process is done quarterly, through payroll, using Form 941.

It’s expected that if the total reported amount is less than 8%, the employer must make up the difference through a gross receipt method, hours worked method or good faith agreement.

In its article, What Employers Need to Know About Tip Reporting, the Restaurant Resources Group explains the three allocation methods:

- Hours worked— Allocates a tip shortfall by spreading it across tipped employees based on their percentage of hours worked. This method may only be used by restaurants with fewer than 25 full-time employees and is generally considered less accurate than the gross receipts method.

- Gross receipts— Determines the amount that each tipped employee should have reported by comparing gross receipts as a percentage of total restaurant receipts.

- Good faith agreement— Is rarely used or recommended.

A detailed explanation of each method can be found in Form 8027.

Workplace Fairness states that employers who intentionally misfile tipped incomes may be fined up to $10,000. Repeat violations can result in fines of up to $1,000 each. In extreme cases, criminal convictions may result.

Requesting a Lower Reporting Rate for Tipped Income

Employers may request a lower rate of up to 2% by submitting a petition to the IRS at:

Internal Revenue Service

National Tip Reporting Compliance

3251 North Evergreen Dr. NE

Grand Rapids, MI 49525

The petition must include:

- Your restaurant’s name, address and Employer Identification Number (EIN).

- A detailed description of your business, including restaurant type, type of clientele, a copy of your menu, days and hours of operation, service types including any self-service or server to whom the customer pays the check, whether the check is paid before or after the meal and whether alcohol is available.

- Your past 3 year’s information shown on lines 1 through 6 of Form 8027, as well as total carryout sales, total charge sales, sales percentage for breakfast, lunch and dinner; average guest check dollar amount, service charge(s) (if any) and the percentage of sales with a service charge.

Full instructions can be found in Form 8027.

Federal Compliance Agreements for Restaurants

In 1993, the IRS developed several compliance programs to help restaurants and tipped employees comply with reporting requirements through education rather than enforcement, including:

- Tip Reporting Alternative Commitment (TRAC)(PDF)

- Tip Rate Determination Agreement (TRDA)(PDF)

- Employer-designed Tip Reporting Alternative Commitment (EMTRAC)(PDF)

These voluntary programs still require employer and employee reporting. However, there are fewer lengthy IRS examinations.

How Employers Can Help Further Compliance

In spite of the fact that tips are the sole possession of the employee, employers, such as restaurants still bear the primary burden of accurately reporting tipped income each quarter. If a discrepancy or inaccuracy is found, the first place an investigating agency will look is payroll.

As employers, restaurants can improve compliance by communicating and training employees, involving the services third-party experts in related employment and tax legislation and streamlining processes through the use of accounting and payroll technologies.

Author: Content guru and marketing co-conspirator at Wagepoint, Michelle Mire is a professional writer with agency and corporate experience who is now diving into payroll with full scuba gear in tow. When away from the keyboard she spends time hiding chocolate from her children and attempting to escape for a morning run (to work off the chocolate).

Author: Content guru and marketing co-conspirator at Wagepoint, Michelle Mire is a professional writer with agency and corporate experience who is now diving into payroll with full scuba gear in tow. When away from the keyboard she spends time hiding chocolate from her children and attempting to escape for a morning run (to work off the chocolate).