The advancement in electronic payments has created significant opportunities for businesses to expand and evolve at a more excellent pace.

If you are starting an ecommerce business, you will need this article to accept payments online.

Online payments have made the payment experience seamless, hassle-free, and quick.

In this article, I will share how you can accept payments online.

Let’s begin!

How Does Online Payment Work?

When a customer tries to make an online purchase, the payment gateway gathers the information for the transaction.

The data is then transferred to the financial institution networks, which transfer the encrypted information to the customer’s bank for approval.

After the confirmation from the bank, the information is backtracked, and the merchant informs the customer of the completion of the process.

The entire process takes a few seconds to transact the amount successfully.

Here are the top benefits of online payment:

- Customers are more likely to trust recognized platforms that they already use

- Easy to manage and record online and recurring payments on your mobile

- The payment process gets simple and smooth for customers

- It is just a matter of a few seconds to transfer payments

- Adds an extra layer of security to online transactions

Top 7 Ways To Accept Payment Online

Here are the top seven ways in which you can accept online payments.

1- Receiving Payments Through Cards

Accepting payments through credit and debit cards is the most common and convenient way to take payments online.

While accepting online payments, the first and easiest way is using a credit or debit card.

Here is the process of receiving payments online through cards:

- To accept payments from credit and debit cards, you need a dedicated merchant account to store your payments.

- The merchant account checks if the funds are available in the account.

- The transaction is verified by the company (MasterCard or Visa).

- You receive money in your business account.

Usually, the amount is held within the merchant account for a few business days for security reasons.

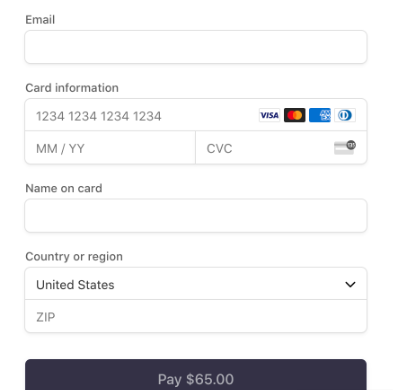

The above image appears to add the details when a person tries to pay through cards.

2- Adding a Payment Gateway

You can add a payment gateway to your website for customers to pay quickly by filling out a form online. You must create a payment gateway or use third-party software to set up the process.

You can securely process payments via a payment gateway such as PayPal, Stripe, or Authorize.net.

These platforms accept almost all the popular cards worldwide, like Visa, American Express, and Mastercard.

Here are the steps to accept payments through the payment gateway:

- Choose a payment gateway: Many payment gateways are available, each with its pricing structure and features. Research each option and choose the one that best fits your business needs. Here is an example of a payment gateway used by conveyancing solicitors, AVRillo.

- Create an account: Once you have chosen a payment gateway, you must create one. It involves providing basic information about your business and linking your bank account.

- Integrate with your website: Your payment gateway will provide you with code or plugins that you can use to integrate the payment system with your website or online store.

- Test the system: Before accepting payments, you should test the system to ensure everything is working correctly. Make a few test transactions using different credit cards to ensure the system works as expected.

- Start accepting payments: Once you have tested the system and everything is working correctly, you can start accepting payments from credit and debit cards.

Ensure to provide clear instructions to customers on completing the payment process and be available to answer any questions they might have.

3- Using eChecks And ACH

Another way to accept online payments is through an eCheck (electric check) using ACH payment options.

It allows your customer to add details like account number, name, and amount from their paper check into a software or online payment form.

The process happens electronically, generally charges lower transaction fees than credit cards, and is more predictable and secure.

It’s a way to pay by check online, which is a quicker and more reliable way than sending a paper check through the post.

To accept payments via ACH transfer, you need to give the customer your direct deposit information, which includes:

- Your bank’s routing number

- Your bank account number

You can authorize it from your bank and start receiving payments. Your customers should have access to the necessary tools and account with a service provider like Stax, Bill.com, or Gusto.

You may also receive payments through Stripe with your account; however, you will have to pay a transaction fee, and the customer needs to connect their bank account to the Plaid network.

4- Acquiring Financial Software Development Services

To automate every step of your transaction process, having software dealing with monetary transactions and accounting is essential. It aims at enhancing productivity for financial purposes.

Financial software development services are offered to develop and update custom-made applications in the finance industry. This software offers multi-factor verification, money analytics, push notifications about money transfers, integrations with social networks, and other security features.

These software are beneficial in the following ways:

- Handles manual accounting tasks, saving time

- Generates financial reports quickly

- Helps you to get detailed insights

- Simplifies your payroll process

- Stores all your financial data

- Reduces the human errors

5- Making Recurring Payments

If your business offers subscriptions or ongoing monthly services, using recurring billing software is effective.

Most of the significant payment software includes recurring billing features. You can choose to invest in such software for sending invoices automatically.

Sites like Pay Simple or Stripe could be used to set up automated recurring billing in just a few clicks.

6- Taking Help of Email Invoicing

Email invoicing is an easier way to request money online from your customers. It gives the ability to your customers to complete payments quickly.

It helps you share online payments through emails, streamline the reporting process, and securely manage your data.

Your customers can experience the convenience and ease of making payments and find payments marked as paid on their system.

Although it is not the most reliable form of receiving payments and its expected failure rates, it is essential to note that it is a part of payment processing for many businesses.

Some of the platforms that can be used for automated invoicing are Zoho Invoice, SAP Ariba, TimeSolv, and Emburse Certify.

7- Installing Mobile Payment App

There are many convenient mobile applications to use for making online contactless transactions.

With over 4.5 billion active users of smartphones, it becomes easy to enable mobile wallets to make quick payments. Some popular applications are Apple Pay, Google Pay, and Samsung Pay.

These apps store your bank details and send you confirmation receipts over emails to access cash flow reporting and manage your accounts.

Conclusion

With growing contactless online transactions, there are many options for you to choose from. The most important part is to make the process easy and smooth for your customers to pay quickly.

The better ways there are, the more they would be willing to go through and make a purchase.

2112 Views