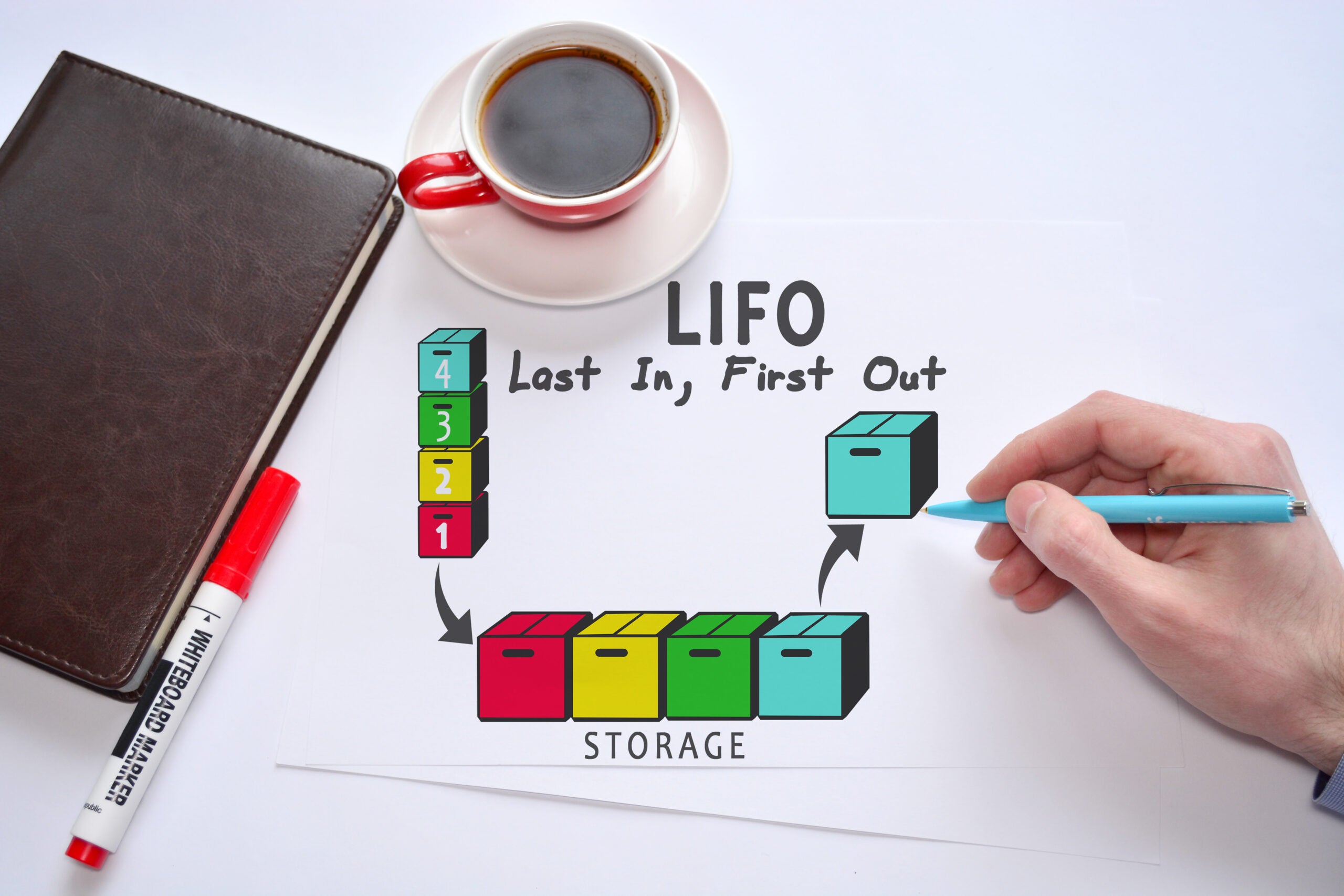

While inflation is not at the high levels seen in the last couple of years, if you haven’t elected LIFO previously, now is the time to look at Last-In-First-Out (LIFO) accounting. If you have inventories of machinery and equipment, glass products or any concrete or cement inventory, there could be tax savings for 2023.

Whether you are already on LIFO or not, analyzing the IPIC LIFO method could be a great opportunity. IPIC LIFO uses indexes published by the Bureau of Labor Statistics to measure inflation on your inventory. In 2023 these indexes show inflation is still on the rise in many industries, which means businesses of all sizes could experience tax savings using LIFO.

Whether you are a manufacturer, distributor, or retailer, you have the opportunity to mitigate the negative impact of price increases and annually save money by using the LIFO inventory method. Adopting LIFO removes the phantom profits caused by inflation, lowering your tax liability and creating cash for reinvestment in your business. Any business with over $2M in inventory that is experiencing inflation is a qualified candidate for electing LIFO. Depending on the inflation rate and the inventory level, the cash savings can be quite substantial.