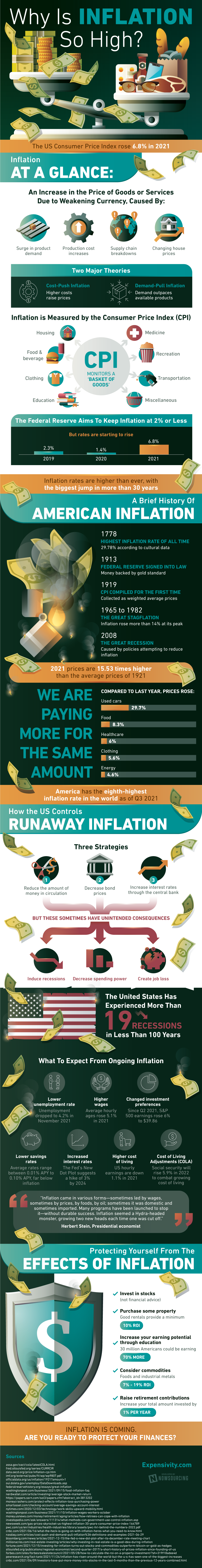

In 2021 the United States experienced an inflation rise of nearly 7%, the biggest jump we’ve seen in 30 years! Inflation is something that the country has dealt with forever, but the Federal Reserve typically aims to keep inflation at only 2% each year. This is not the first time the country has seen a jump of this magnitude, in fact this isn’t even the biggest jump we’ve seen, but it is still important to understand the effects of this rise in inflation and understand how to protect your personal finances.

Demand Outpacing Supply

First, to explain just what we’re dealing with, inflation is an increase in the price of goods or services due to weakening currency caused by different economic triggers. These triggers can be things like surges in product demand, production cost increases, supply chain breakdowns, and changes in the housing market. Two theories have been introduced to explain why inflation occurs. The first is the cost-push theory which explains that inflation occurs when higher costs for producing goods raises overall prices. The second is the demand-pull theory which explains that when demand of goods outpaces the availability of products, inflation occurs.

So what are the effects of inflation? First, on a positive note, it has been observed that inflation and unemployment are often inversely correlated, meaning that as inflation goes up, unemployment typically goes down. Even with the rise in inflation in 2021, there was a drop in the unemployment rate to 4.2%. We can also expect wages to increase with the average hourly wages rising 5% in 2021 alone.

Effect on Your Retirement

On the other side of inflation, there are negative consequences to inflation going up. Savings rates are going down, and are ranging between .01% APY to .10% APY which is far below the inflation rate. With lower savings rates, interest rates are rising. The New Dot Plot suggests that there will be a hike of 3% in interest rates by 2024. There is also the problem of the rising cost of living which is being combated by social security increasing by 6%.

Inflation is inevitable, but if you take action to protect your finances the effects will be far less intense. Consider continuing your education in order to increase your overall earning potential. 30 million Americans could be earning 70% more if they continued their education to college or post-grad degrees. Investing more money into retirement funds could also help to prepare for increased cost of living after your retirement years. Increasing the total amount invested into retirement funds by only 1% per year has the potential to be significantly beneficial. Learn more strategies for protecting your finances in the infographic below:

Source: Expensivity

1642 Views