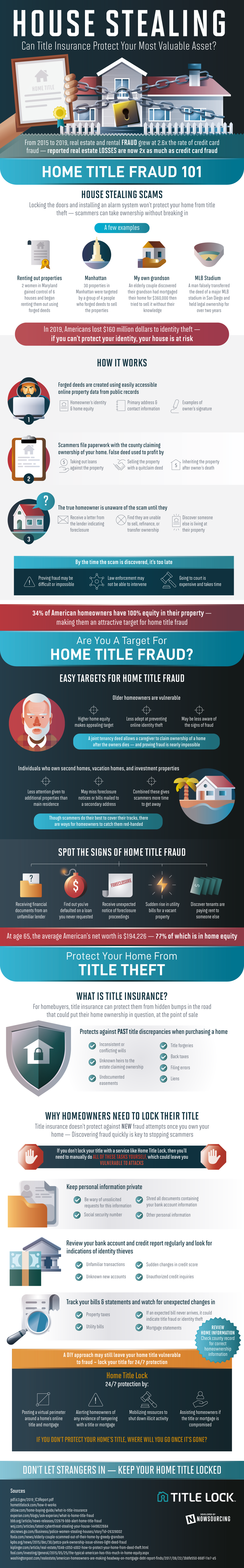

Over a third of American homeowners have 100% of their equity in their property. On average, 77% of a 65-year-old’s wealth is in their home. A home is most people’s most valuable asset, but few people are doing enough to protect it. Locking doors and installing alarms won’t protect a home from title theft; scammers can take ownership without breaking in. It’s a scheme that’s growing in popularity: from 2015 to 2019, real estate/rental fraud grew at 2.6x the rate of credit card fraud and reported twice the losses.

Watch the Signs

How does home title fraud happen? To start, the scammer creates forged deeds using easily accessible online property data found in public records. Scammers then file paperwork with the county in which the residence is located claiming ownership of that home. False deeds are used to profit by taking out loans against the property, selling the property with a quitclaim deed, or even inheriting the property after the owner’s death.

This sort of fraud often flies under the radar, so the true homeowner may be oblivious to the scam until they receive a letter from a lender indicating foreclosure, find they are unable to sell, refinance, or transfer ownership of their home, or (in extreme cases) discover a stranger living at their property. By the time a scam is uncovered, proving fraud may be difficult and law enforcement may not be able to intervene.

Most vulnerable to home title fraud are the elderly and those with additional properties beyond their primary residents. The latter category may include investment properties, vacation homes, or secondary estates.

To prevent home title fraud from happening, watch out for the signs. Possible evidence includes receiving financial documents from an unfamiliar lender, unexpected notice of foreclosure proceedings, and sudden rise in utility bills for a vacant property. All of these are things that a homeowner should respond to as soon as possible.

When buying a home, title insurance is a protection against past title discrepancies. It only works at the point of sale and does not project against new fraud attempts after a home is bought. Meanwhile, Home Title Lock is a 24/7 service that guards a home’s title the way other companies guard the physical property. They post a virtual perimeter around a home’s mortgage and title and work to shut down illicit activity when it occurs. They keep your home title locked.

Source: HomeTitleLock.com

1874 Views