For anyone who was around during the hyper-inflation days of Presidents Ford and Carter, the current economic climate as something of an Alice-in-Wonderland feel.

I say this because in those days the Fed was continually hiking its interest rate to bring down inflation. Today, the Fed is more worried that there isn’t quite enough inflation in the economy and, interestingly enough, its solution is the same: raise the interest rate. (But to be fair, the modest rate hikes envisioned by the Fed are nothing compared to the way it boosted rates back in the 1970s in its attempt to strangle inflation out of the economy.)

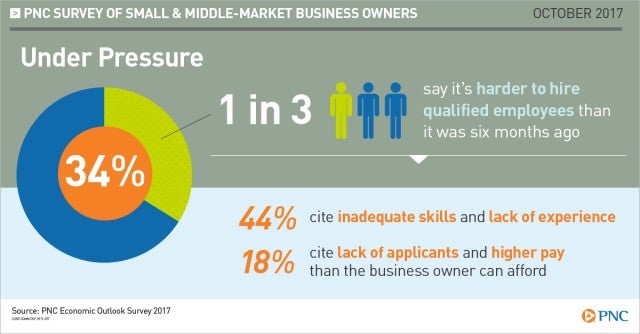

I think our unfamiliarity with this persistently low inflation may also relates to some recent business survey results and employment news:

- Unemployment ticked down to 4.2 percent in September while the economy lost 33K jobs,

- Business owners say that it’s more difficult to hire people than it was six months to a year ago (and it wasn’t easy then, either),

- The labor participation rate is finally going up, and

- Many businesses (58 percent) don’t plan to raise wages because it doesn’t seem to affect hiring or retention, yet the recent employment statistics showed the biggest jump in hourly wages (2.9 percent year over year) in a long, long time.

Most of the lost jobs are due to the hurricanes, so we can expect them to bounce back quickly as businesses get back on their feet. What is interesting to me is the persistent difficulty businesses have hiring people yet they seem somewhat reluctant to sweeten the salary pot.

The recently released PNC Bank Survey concludes that small and mid-size business leaders, while curbing their enthusiasm, remain optimistic on the economy. The same survey says that although hiring is a huge problem, offering higher wages hasn’t helped.

I find it difficult to square this finding with the fact that hourly wages are up nearly 3 percent over last year. Someone is boosting wages out there. Since fall 2016 the percentage of employers planning wage hikes has gone from a low of 28 percent, to a peak of 41 percent, to 37 percent in the most recent survey. I suppose that minority large is enough to make a decent impact on wage growth.

The inability of higher pay to attract or retain employees may reflect the reality of a long-term low-inflation environment. People aren’t frightened by escalating prices eating away at their spending power today. I suspect this is especially true for professionals who depend on their cars for their work. With fuel prices at reasonable levels, many have been able to pocket the savings.

According to Gus Faucher, chief economist of The PNC Financial Services Group, Inc., “Hiring has become more difficult across all skill levels. Organizations even report that they have turned down business because of a lack of workers. That said, the one ongoing problem with the economic expansion remains persistently soft wage growth. Given the low unemployment rate and consistent complaints from firms about the difficulty in finding workers, wage growth should be stronger. Wage growth is likely to pick up as the job market continues to tighten.”

(Faucher said that before seeing the latest numbers, yet he could be right. We know that these statistics are constantly revised, so that 2.9 percent wage growth statistic might get pared down in coming months.)

While the hiring problem has many facets, identifying the other huge problem facing business owners is pretty straightforward: the high cost of health care related expenses.

Sageworks recently surveyed accountants and healthcare came in a close second (41.3 percent) to hiring (44.4 percent) in the areas of concern among their clients. Other areas of concern were:

- The burden of government regulations, 29.8 percent,

- Tax compliance complexity, 27.1 percent, and

- The current administration/Congress, 22.2 percent.

Just over 26 percent of the accountants surveyed by Sageworks said that their clients haven’t expressed these concerns at all.

While I don’t think the government can do anything to ease the hiring problem for businesses – at least in the short term – it can address the other big issues identified in the Sageworks survey, especially easing the regulatory burden and taking the complexity out of tax compliance.

Finally, we hear a lot of our elected officials talking about those issues, perhaps we should be encouraged that they at least recognize the problems. Whether they do anything about them, of course, is a different question.