Your first month of business can be the most stressful and harried time as a business owner — you likely have a to-do list a mile long, and are losing sleep at night with all the items running through your head that you need to check off. One of the most important areas to concentrate on, however, is the financial success of your business. Otherwise, you might fall victim to the 20 percent of small businesses that fail in their first year.

In our first part of this series, we shared three things you should do within your first month to set a strong financial foundation for your business. These were:

- Research the competition’s prices

- Open a business checking account (and keep your personal expenses separate)

- Choose a top-notch accounting software such as FreshBooks, Xero or QuickBooks

Now, we’ll share with you three more things you should focus on in your first month. These are specifically around forming your business into a legal business entity—an important first step to protect yourself from liability, maximize tax savings and more.

4) Form an LLC

Determining your business structure is the next step to ensuring your personal finances. With an LLC, your assets will be protected against debts and liabilities that your business may incur. It can also help your business appear more formal when you have an official business name such as “Kim Perkins Graphic Design, LLC” that you can put on your website, email and business cards. In addition, forming an LLC will support better business taxes.

One of the most advantageous aspects of the LLC is that it can choose how it is treated as a taxable entity. According to the IRS an LLC is, by default, federally taxed as a partnership (in the case of a multi-member LLC) or as a sole proprietor (in the case of a single member LLC). The LLC, however, may elect to be taxed as a C- or S-corporation at any time the members so choose. In addition, the LLC typically does not pay taxes for itself. Instead, the net income/loss is “passed through” to the personal income of the owner(s)/member(s), and is simply taxed as personal income. Federally, LLC taxation is handled very much the same as a partnership or sole proprietorship, in the case of a single member LLC.

5) Consider Filing Your LLC as an S Corp for Tax Savings

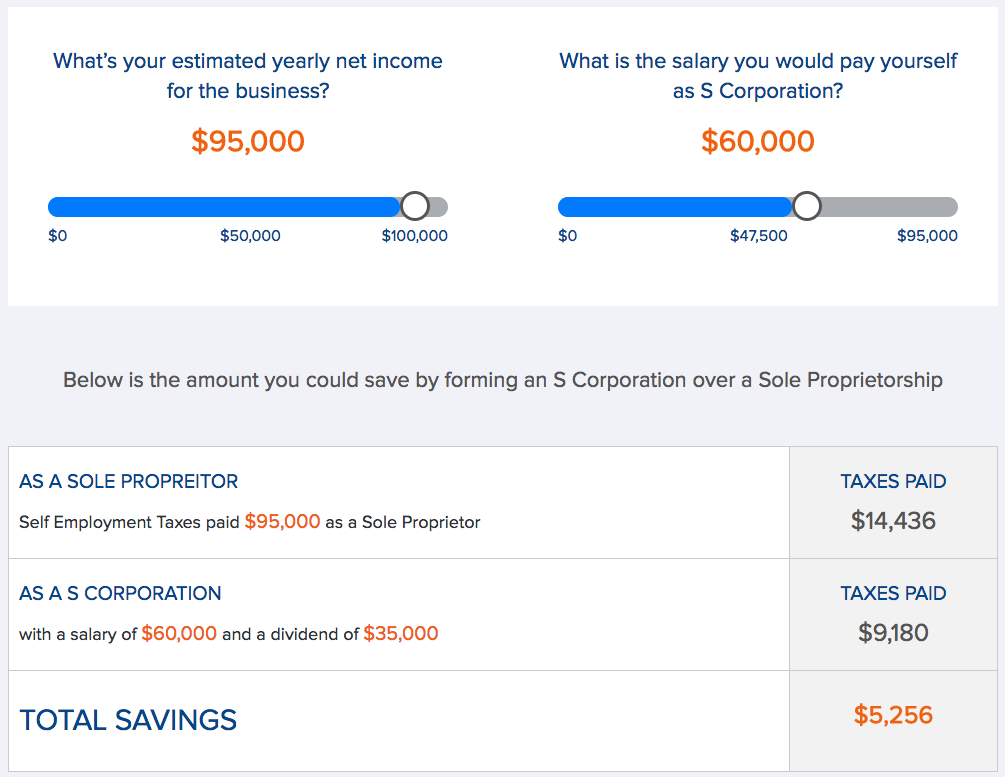

As the both the owner and employee of your business, you obviously need to be compensated for your services. As with any job, you’ll report your earnings on your personal income tax return and pay into Social Security and Medicare. However, if you choose to file your taxes as an S Corporation, your earnings are considered as an S Corp distribution and not as an employee salary therefore allowing you to forego paying Social Security or Medicare taxes. If you form an LLC, many business owners don’t know that they can elect that their LLC is filed as an S Corp, saving them money every year on self-employment and payroll taxes. To understand just how much you could be saving, check out this S Corporation Tax Calculator.

6) Make Sure Your Business Has an EIN

As a business, many states require that you apply for an Employer Identification Number (EIN) which is also known as a Federal Tax Identification Number. You can apply for your EIN online for free through the IRS’ website yourself or many online formation companies will include this as part of their business incorporation services. Not only will you use the EIN to file your tax return and fill out W-9s for clients, but you must have an EIN to apply for a business checking account or online business loan.

The journey of a thousand miles starts with just one step. Today we’ve given you the first six to begin your adventure towards fulfilling your entrepreneurial aspirations as the next small business owner doing great things in America.

3307 Views