I was glad to be asked about common mistakes with financial projections. I read about 100 business plans a year for angel investment and business plan competitions. Most show unrealistic profitability. More people doing business plans should realize that most startups are unprofitable at the beginning; and that high growth correlates with losses, not profits. High projected profits indicate lack of understanding, not reasonable expectations of profitability.

Profitability mistakes

- The most common mistake is with profitability. Most of the business plans I see project profits too high, or profits too early. In the real world, startups choose growth or profits, not both. The plans I see are aiming at angel investment. And for that, the investors win on growth, not profitability. Think about it: If a startup is profitable early on, it doesn’t need investors.

- The second most common mistake is underestimated marketing expenses. Many successful tech businesses, especially software and web businesses, spend 30% or more of sales on marketing.

- Don’t underestimate development expenses, testing, certifications, and expenses of regulations.

- If you are selling physical products, don’t underestimate the impact of selling through channels, as distributors and retailers take their margins and often demand admin and co-promotion expenses. And distributors often pay very slowly, like six months or so after receiving the goods.

- Never project sales by applying a small percentage to a large market. That doesn’t work. Nobody gets half a percent of a $10 billion market. Instead, sales forecasts should be built on drivers as assumptions. Drivers might be web visits and conversions, emails sent, paid search terms, or, for physical products, channel assumptions such as distributors, chains, stores, and sales per store.

- Don’t project big growth in sales with only small increases in headcount. If you are going to sell $100 million in the fifth year, get a clue: you won’t do that with only $2 million in employee expenses. Divide your projected sales by your headcount, and compare that to industry benchmarks. For most industries, $250,000 per employee is really good. If you are getting $2 million per employee, that doesn’t mean you’re going to be that efficient. It means you don’t understand the business.

Cash flow mistakes

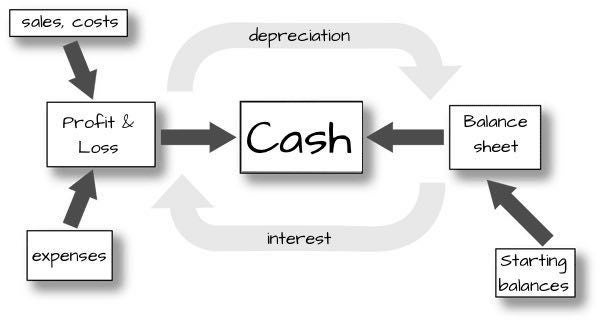

- Having a profit doesn’t mean you’ll have cash in the bank. Good startup financial projections need to include cash flow. Always. For more on that, see points 4, 6,

- Another very common mistake affects cash flow. Businesses selling to businesses (B2B) normally sell on account. A sale generates not money directly, but money owed, to be paid later, which goes on the balance sheet as Accounts Receivable, or AR. Every dollar in AR is a dollar that shows up as sales in the P&L but not in cash.

- Many plans underestimate the length of the sales cycle and expenses related to selling directly to enterprises.

- Many plans underestimate the cash flow affect of inventory. Every dollar in inventory is a dollar that hasn’t yet shown up in the P&L but may have already affected cash balances.