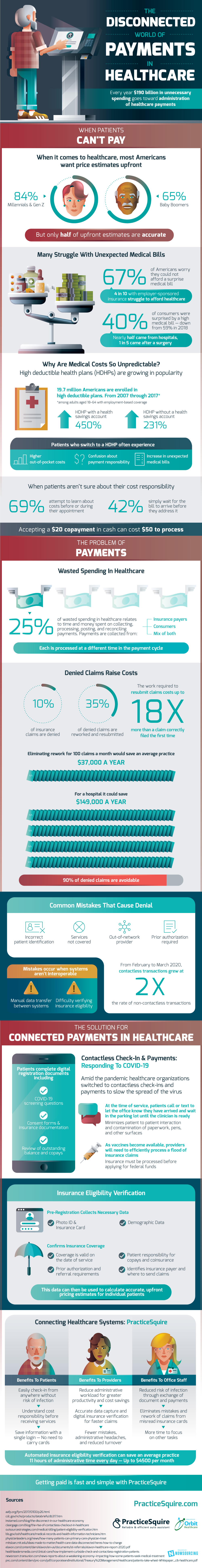

During COVID-19 the disconnected world of payments in healthcare has become increasingly complex on the payer side. When it comes to healthcare, most Americans want price estimates upfront; 84% of Millennials and Gen Z and 65% of Baby Boomers want these price estimates, yet only half are accurate.

Why are medical costs so unpredictable? With the recent rise of high deductible health plans, patients often experience higher out-of-pocket costs, confusion about payment responsibility, and an increase in unexpected medical bills. High deductible health plans with a health savings account have grown 450%, and without a health savings account, they have risen 231%. 69% of patients attempt to learn about medical costs before or during their appointment, yet most still struggle to get a clear estimate.

Every year, $190 billion in unnecessary spending goes towards the administration of payments. These payments are collected from insurance payers, consumers, and a mix of both, which are all processed at a different time in the payment cycle. Disconnected payments are a major contributor to the problem of wasted spending in healthcare. 25% of wasted spending relates to the time and money spent on collecting, processing, posting, and recording payments. A $20 copayment in cash can cost up to $50 to process.

Another way to lose money is through denied claims. 10% of insurance claims are denied, and the effort spent on reworking and resubmitting denied claims can cost up to 18 times more than a claim that was correctly filed the first time. The vast majority of denied claims are avoidable. Common mistakes that contribute to denied claims include incorrect patient identification, services not covered, and out-of-network providers. Eliminating rework for just 100 claims a month would save the average practice $37,000 a year and could save a hospital $149,000 annually.

Solutions for payment issues in healthcare are insurance eligibility verification, contactless check-in, and connected healthcare systems. Insurance eligibility collects necessary data and confirms insurance coverage, which can then be used to calculate accurate pricing estimates. Companies like PracticeSquire efficiently connect healthcare systems, making getting paid fast and simple.

Contactless check-in allows patients to easily check-in and understand cost responsibility before receiving services. Office staff get reduced risk of infection, eliminate mistakes from misread insurance cards, and gain time to focus on other tasks. Insurance providers will reduce administrative workload, get accurate data capture and digital insurance verification for faster claims and encounter fewer mistakes.

Source: PracticeSquire

1700 Views