U.S. Payroll Taxes — The Taxes No One Expects…

While everyone is well aware of the impact of business income taxes, the sleeping giant of payroll taxes (also known as employment taxes or trust fund taxes) often catches business owners and employees by surprise.

This guide will give you an overview of what payroll taxes are, why they matter and how they affect your business. Hint — They’re kind of like the brick-stacking game where one mistake can send the whole thing toppling down.

“Payroll taxes are incredibly complex and leave zero room for error. We’ve seen numerous instances over the years of entrepreneurs facing extreme consequences because they failed to plan ahead and deal with their payroll taxes during the year. While procrastination can be tempting – you risk major issues unless you work with professionals to take this administrative burden off your plate and ensure it is handled correctly.”

— Brendon Pack, Senior VP, Sales, 1-800Accountant

Businesses Pay More in Payroll Taxes Than Income Taxes

In 2016, the Internal Revenue Service (IRS) collected more in payroll taxes than it did in business income taxes.

What’s in that extra half trillion dollars? A lot of pain, frustration and anguish:

- Every year, businesses incur enough annual penaltiesto pay for a new navy destroyer.

- Nearly 1 out of every 3 business owners are penalized for payroll errors.

- Small businessesare the largest segment of noncompliant taxpayers.

All of these payroll tax statistics are summarized in the infographic below.

Please include attribution to www.wagepoint.com with this graphic.

What Are Payroll Taxes?

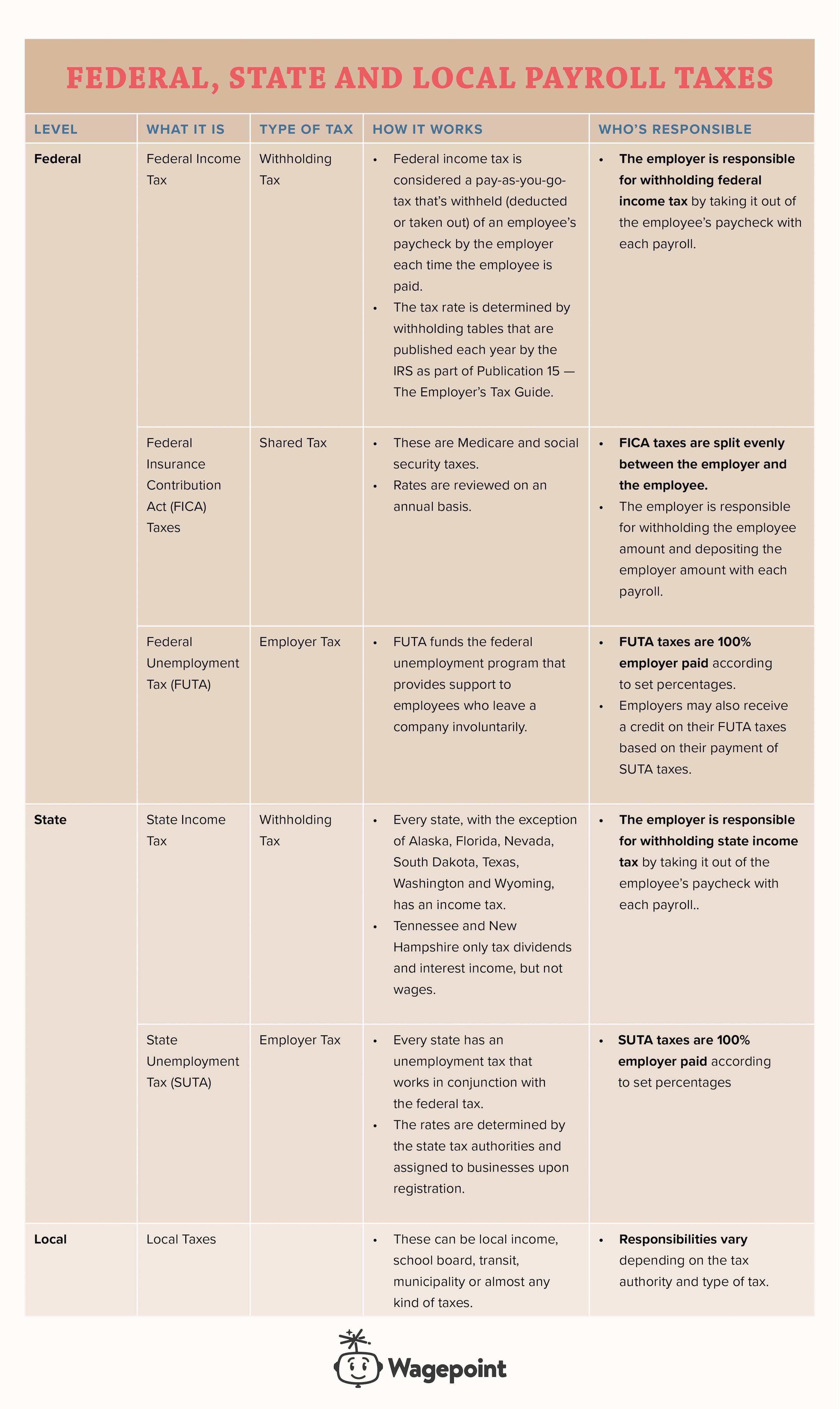

Payroll withholdings are taken out of an employee’s paycheck, every time payroll is run.

- There are federal, state and sometimes even local taxes.

- Withholding taxes are payroll taxes where the employer withholds a percentage of the employee’s income for federal, state and local income taxes.

- Employer taxes are payroll taxes that are paid by the employer only.

- Some payroll taxes, like Medicare and social security, are shared taxes that are split between the employer and employee.

When you read the definition above, you’ll notice the word employee being used time and again. In this instance, it’s not just another name for a worker, it’s actually a legal definition. Why does this matter? Employers are responsible for payroll taxes for their employees. However, employers are not responsible for managing payroll taxes for contractors.

Collecting and Reporting Payroll Taxes

Once an employer either withholds or pays a payroll tax amount, these funds must then be paid to the appropriate tax authority.

- On a federal level payroll taxes are remitted to the Internal Revenue Service (IRS).

- For states, this is the relevant tax authority, such as the department of revenue for income taxes and department of labor for unemployment taxes.

- Local taxes are paid to the appropriate local authorities, which can vary depending on the type of tax.

Payments to tax authorities follow a specific schedule that is often set by the size of your company and the amount of tax you pay. When you register your business with the IRS and any other authorities, you will be given your payment schedule. If your schedule changes, you should receive a notification.

Employers are also responsible for filing regular reports of the payroll tax amounts collected from payroll and paid to the IRS, state and local tax authorities.

- On a federal level, income tax, Medicare, social security and tipped wagesare reported on a quarterly basis using Form 941 — Employer’s Quarterly Federal Tax Return.

- FUTA is reported annually using Form 940.

- On a state level, payroll taxes are reported quarterly using wage detail reports. (There is no universal form. Requirements are set on a state-by-state basis.)

- Local reporting is set by the local tax agencies.

- At year-end, employers must provide W-2sto their employees and the relevant tax agencies by January 31.

Determining Payroll Tax Rates

There are a number of variables involved in setting and calculating the rates for payroll taxes. The following is a general overview of where the current payroll tax rates can be found and how each of the main payroll taxes works:

- Each year the IRS updates Publication 15 (Circular E) — The Employer’s Tax Guide— containing the latest withholding tables and tax rates for federal income tax, FICA taxes (Medicare and social security) and FUTA.

- The actual setting of the rates is done by lawmakers in Congress in collaboration with the related administrative agencies, such as the IRS, Social Security Administration (SSA) and Department of Labor (DOL).

- On a company level, the amounts withheld for federal income tax are also determined by each employee’s gross wages, bonus wagesand W-4 .

- For Medicare, the employer and employee each contribute 1.45% for a total of 2.9%.

- Employees earning over $200,000 pay an additional .9%.

- Employers are not responsible for contributing any additional amounts for these employees and there is no maximum taxable earnings limit.

- For social security, the employer and employee each contribute 6.2% for a total of 12.4% up to a maximum taxable earnings amount of $127,200.

- FUTA is set at 6.0% with a maximum taxable earnings amount of $7,000.

- However, if an employer pays their SUTA tax on time, they can receive up to a 5.4% deduction, taking the rate down to 0.6%.

- State income taxand SUTA rates are set by each individual state, which is why we created a state-by-state map of U.S. payroll taxes.

- Local taxes are their own ball of yarn, as each tax is unique to each locality.

- Some states allow taxes for school boards, while others have transportation taxes.

- The general rule is to be aware that these taxes exist and learn how they affect your business and your payroll.

- Spelling this all out in a blog post might give War and Peace(one of the longest books ever) a run for its money. Cue the interactive, state-by-state tax map.

- When you register your business with the IRS and other tax authorities, they will issue statements telling you which rates apply to your business and which payment and reporting schedules you should follow. If you’re unsure, you can call the appropriate tax authority and/or work with a professional bookkeeper, accountant or payroll professional to determine the correct payment amounts and reporting frequencies.

Common Payroll Tax Questions

Now that you know what they are, you probably want to know the ways in which payroll taxes impact your payroll as a whole. Here are the answers to a few common questions:

How Do Payroll Taxes Affect Take-Home Pay?

In payroll speak, the amount on an employee’s paycheck before taxes are taken out is gross pay. The amount after payroll taxes and other deductions, like payroll taxes, is net pay, also known as take-home pay.

How Do Payroll Taxes Affect Bonus Wages?

Taxable income, such as bonuses, commissions, overtime pay, back pay, accumulated sick pay — also known as bonus wages — are subject to income tax at a federal, state and sometimes local level. In other words, employers have to withhold the proper amounts for these types of incomes on top of the withholding amounts for standard wages.

How Does Payroll Frequency Affect Payroll Taxes?

How often you pay your employees has a direct impact on your payroll taxes. The more frequently you run your payroll, the more often you’ll have to calculate your payroll taxes. For example, if you follow a weekly schedule, you’ll be making payroll tax calculations on a weekly basis.

How Can Payroll Software Help Me With My Payroll Taxes?

Payroll software is a tool that will help you automatically calculate, deduct, pay and report your payroll taxes — saving you time, preventing errors and letting you focus on growing your business. It can also integrate with your time tracking and accounting software for 360° reporting on your business.

How Can I Learn More About Payroll Taxes?

A bookkeeper, accountant or payroll specialist can give you valuable insights. The IRS has an overview of employer taxes and Publication 15 is considered the definitive source of federal payroll tax information. For state and local payroll taxes, you can go to the specific tax authorities — or, we’ve made it easier by putting all this information in one place in our interactive payroll tax map.

Preventing and Correcting Payroll Tax Mistakes

According to SMB CEO, payroll taxes can be a potential minefield for small businesses. As the largest source of uncollected payroll taxes, small businesses are also under greater scrutiny from the Internal Revenue Service (IRS).

While most agencies, including the IRS, will likely work with a business that’s made an honest mistake, if there’s a “willful” pattern of errors or overdue amounts, the response tends to be less generous.

Minor Payroll Tax Mistakes

These kinds of mistakes are minor, administrative in nature and don’t indicate a willful intent to deceive. In these instances, there may still be red tape to untangle, but the corrections are much “easier” to make. These mistakes also underscore the care that you should take when setting up your payroll. A few seconds of checking details could prevent hours of backtracking. Minor mistakes include:

- Incorrect or temporary employer identification numbers:This could be simple typo or transposed number. It could also be that you used a temporary ID number, issued during the application process, in a state that requires a permanent (final) ID number, issued once the application process is complete.

- Incorrect payroll tax payment schedule— This can happen if you enter the wrong information during setup or if a tax authority has notified you that you’ve been assigned a new payment schedule and you haven’t updated your information in the payroll software.

- Incorrect payment posting— Every once and awhile, even the tax agencies make mistakes. If a payment is missing, but you know that you’ve deposited it, check to see if it might have been posted to the wrong business ID or payment period.

Major Payroll Tax Mistakes

Payroll taxes are also called trust fund taxes because the funds are held “in trust” by the employer until they are passed to the relevant tax authorities. While innocent mistakes can happen, if there are signs of negligence or intent, you could be facing some serious fines and potential legal troubles.

- Repeatedly paying or filing late— Missing your payment and reporting deadlines time and again will lead to fines. It also shows a lack of good faith that will not help you if you have any other issues to resolve.

- Repeatedly making mistakes— If you underreport your liabilities or use the wrong tax tables time and again, the tax authorities will get increasingly more aggressive each time an error is left uncorrected.

- Classifying employees as contractors — If you’ve been misclassifyingan employee as a contractor, you will be liable for all of the back taxes. If you think it’s not a big deal, it is, just ask Uber about their $100 million USD lawsuit.

- Not paying your payroll taxes to the tax authorities — The funds you collect for payroll taxes are considered the property of the federal, state and local tax agencies. It’s not just wrong to do this, it’s against the law. If the sums are large and the pattern repeats, businesses can be fined or worse. In extreme instances, the IRS can impose criminal sentences and even close businesses.

- Not collecting payroll taxes at all — Avoidance is never the answer.

- If you want to have employees, you have to accept the responsibility of payroll taxes. If you don’t withhold the proper amounts, your employees will pay higher taxes and miss out on higher benefit levels for Medicare, social security and unemployment.

- Consider the implications of having federal, state and local tax authorities go back through years and years of your records and assessing back taxes. If this doesn’t make you shudder, it should.

The Penalties for Payroll Tax Mistakes

If you fall behind on your payroll taxes, your troubles multiply rapidly — as in exponentially.

- If you’re late on paying (depositing) your federal payroll taxes to the IRS, the fines are:

- 1-5 days — 2% of the amount owed

- 6-15 days — 5% of the amount owed

- After 16 days — 10% of the amount owed

- More than 10 days you receive your first notice — 15% of the amount owed

- If you fall behind on your reporting, the fine is 5% of the amount owed, up to 25%.

- If you fail to pay your fines, add another .5% per month and another 1% after your notice, up to 25%.

- These fines are also subject to quarterly interest ranging from 3-6% and you will pay interest until you’ve paid the full amount.

Who’s Responsible?

Ultimately, even if you use third-party software, the employer is held responsible for the mistakes. For example, if there are fines, the costs go back to the business and the business owner. The IRS even has the right to go after the business owner’s personal assets (including any personal income tax refunds), regardless of business structure. In other words, you get to help buy the Navy its new destroyer.

How are you handling your payroll tax balancing act? Please share your thoughts and questions in the comments below. This is a very complex topic. If there’s a point of confusion, we’d love to help provide some clarity.

Disclaimer: While every care has been taken to ensure the accuracy of this content, the relevant laws undergo constant revision. It is a best practice to stay informed on these topics and to consult with experienced professionals. Any errors or inaccuracies brought to our attention will be corrected as quickly as possible.

Author: Blogmaster, content expert and marketing guru at Wagepoint, Michelle Mire is having fun (seriously I am) extolling the virtues of small business payroll and generating articles with actionable advice for small businesses and startups. Michelle probably needs to get out a little more often.

Author: Blogmaster, content expert and marketing guru at Wagepoint, Michelle Mire is having fun (seriously I am) extolling the virtues of small business payroll and generating articles with actionable advice for small businesses and startups. Michelle probably needs to get out a little more often.