Like a real-estate expert peeking in every closet to determine a home’s worth, private equity firms consider multiple factors to evaluate companies they are buying or selling. When lower-to-middle-market private equity firms analyze the value of small and medium-size businesses (SMBs), it’s crucial for them to understand all the elements of a company’s value, areas of risk, and investments that will yield the greatest return.

A business’s ability to leverage technology is critical for outperforming competition. So private equity firms place an ever-increasing emphasis on technology when calculating SMB valuation and determining value creation strategy. A key factor, is the SMB’s “Tech Equity,” a term I coined that describes the capabilities of a company’s technology portfolio that drive differentiation and value creation.

Tech Equity components are divided into two categories: Alpha and Beta.

Alphas – The renovated kitchens of Tech Equity

For a potential homebuyer thinking about lasting value, the quality and condition of kitchens and bathrooms are paramount. Alpha components are the Tech Equity equivalent of kitchens and bathrooms because they indicate the types of technology investment that create value and result in the greatest return on investment. For this reason, strong Alphas, including establishing a digital culture that attracts talented technical people, as well as digitally enabled internal processes throughout the organization, will contribute positively to an SMBs valuation.

SMBs that are weak in the Alpha components, like digital services for personalized customer experiences, or maintaining and analyzing data on customer interactions, may see a negative effect on valuation. However, less than optimal Alpha components reveal to private equity the type of investments likely to yield future profit. Just as a realtor recommends renovating the kitchen to increase home value, private equity firms and SMBs that invest in improving the Alpha Tech Equity components increase their return on investment.

Betas – The roofs and foundations of Tech Equity

We know that a homebuyer isn’t just going to look for updated kitchens and baths. A leaky roof or a cracking foundation are sources of risk that can be costly to address. Similarly, private equity must identify potential risks in an SMB’s technology portfolio. Beta components are the Tech Equity equivalent of roofs and foundations because they’re essential for mitigating risk. A company with an aging technology infrastructure is at risk for costly upgrades and is more prone to the volatility of outages than competitors that have maintained and modernized their Beta Tech Equity components.

Though the Alpha components provide the greatest investment return, it’s important to factor the Beta Tech Equity components into SMB valuation and include them in technology investment considerations.

Is this house in order?

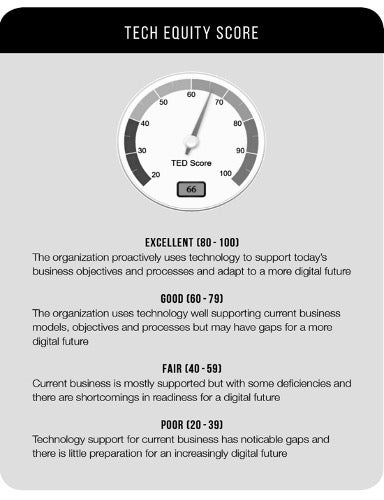

A savvy purchaser is sure to perform a thorough home inspection. But how can we factor Tech Equity into valuations and investment strategy if we don’t have a way to measure it? Fortunately, the IT Ally Institute created a powerful tool, the Tech Equity Diagnostic, evaluates and measures a company’s Tech Equity.

The diagnostic is a set of 53 questions divided amongst Alpha and Beta Tech Equity components. The overall weight for each of the categories and questions is based on research by the IT Ally Institute. When an organization takes the diagnostic, these weights all factor into determining an overall Tech Equity score that provides a metric by which to evaluate their Tech Equity. With this metric, they will better understand where to make needed investments to balance their technology portfolio.

Whether in the market for a fixer-upper or the SMB equivalent of a dream home, private equity firms increasingly include technology in their SMB evaluations. With an assessment tool like the Tech Equity Diagnostic, private equity firms can make informed decisions in their quest to create value and maximize their return on investment.

Author: Michael C. Fillios is the founder and CEO of IT Ally, a business and technology advisory firm for family owned and private equity backed small- and medium-sized businesses (SMBs). He is a former Fortune 500 global CIO, small business CFO, technology entrepreneur and management consultant with more than 25 years of experience. His first book, Tech Debt 2.0®: How to Future Proof Your Small Business and Improve Your Tech Bottom Line, was published by the IT Ally Institute in April 2020. His new book is, Tech Equity, How to Future Ready Your Small Business and Outperform Your Competition (IT Ally Institute, May 4, 2023). Learn more at itallyllc.com.

Author: Michael C. Fillios is the founder and CEO of IT Ally, a business and technology advisory firm for family owned and private equity backed small- and medium-sized businesses (SMBs). He is a former Fortune 500 global CIO, small business CFO, technology entrepreneur and management consultant with more than 25 years of experience. His first book, Tech Debt 2.0®: How to Future Proof Your Small Business and Improve Your Tech Bottom Line, was published by the IT Ally Institute in April 2020. His new book is, Tech Equity, How to Future Ready Your Small Business and Outperform Your Competition (IT Ally Institute, May 4, 2023). Learn more at itallyllc.com.

1604 Views