Hey there, fellow traders! Today, we’re diving into the world of options trading with a focus on the powerful iron condor strategy. If you’re looking for a strategy that offers a blend of income generation and risk management, the iron condor might just be your ticket to success.

In this comprehensive guide, we’ll walk you through the ins and outs of this strategy, covering everything from the basics to implementation and adjustments. So, let’s jump right in and unlock the potential of the iron condor!

Understanding Options Trading Basics

Before we soar into the realm of iron condors, let’s start with the fundamentals. Options contracts are like little financial gems derived from underlying assets. You’ve got call options, which give you the right to buy an asset, and put options, which grant you the power to sell an asset. These options open up a world of possibilities for strategic trading.

The Mechanics of the Iron Condor Strategy

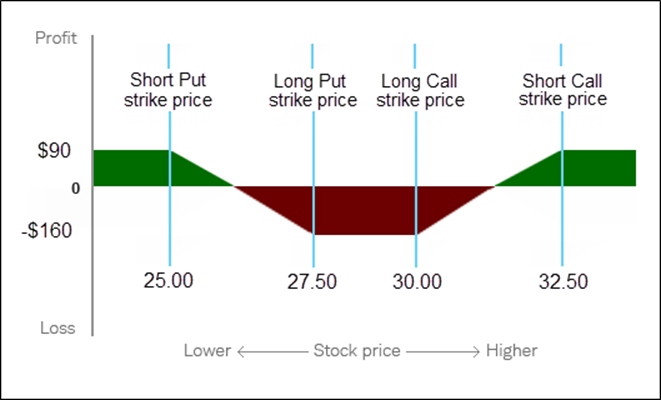

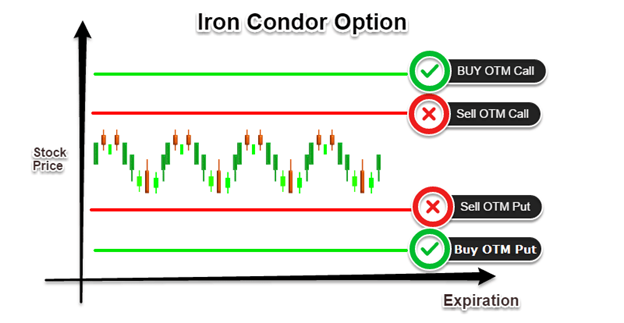

Now, let’s unravel the mystery of the iron condor strategy. The iron condor is a beautiful bird with a defined risk-reward profile. It involves constructing a spread by simultaneously selling an out-of-the-money call and an out-of-the-money put while also buying a further out-of-the-money call and put. By carefully selecting strike prices and determining the width of the spread, you can aim to maximize your profit potential while limiting your risk.

Benefits and Considerations of the Iron Condor Strategy

Why should you consider the iron condor strategy? Well, first off, it’s an income generator. You can collect premiums by selling options. Plus, the iron condor offers a high probability of profitability. With careful selection of strike prices and expiration dates, you can put the odds in your favor. And hey, let’s not forget about flexibility. You can adjust your positions and manage risk as market conditions change.

Implementing the Iron Condor Strategy Step-by-Step

Now, let’s get our hands dirty and walk through the steps of implementing the iron condor strategy. Step 1: Identify a suitable underlying asset.

- Step 2: Analyze market conditions and volatility.

- Step 3: Select strike prices and expiration dates that align with your outlook.

- Step 4: Place the iron condor trade and manage the position with vigilance.

- Step 5: Keep a close eye on your iron condor position and make adjustments as needed.

Factors to Consider when Trading Iron Condor Options

Successful iron condor trading involves considering several key factors. Volatility analysis and implied volatility play a crucial role in determining premium levels. Market conditions and trends should guide your decision-making. Probability of profit and risk-reward ratio are important metrics to evaluate. And of course, position sizing and risk management should always be on your radar.

Adjustments and Risk Management Techniques for Iron Condor Trades

In the dynamic world of options trading, adjustments and risk management are essential. Learn how to roll your iron condor position to adapt to changing market conditions. Adjust strike prices and the width of the spread to fine-tune your risk exposure. And be prepared to handle early assignments or exercising options. Stay nimble and manage your risk like a pro.

Case Studies: Real-Life Examples of Iron Condor Trades

Let’s spice things up with real-life case studies! We’ve got three examples that showcase the power of the iron condor strategy. From successful trades in sideways markets to adjusting positions in volatile conditions, these case studies provide valuable insights into implementing this strategy effectively. Get ready to learn from real-world scenarios.

Tips and Best Practices for Successful Iron Condor Trading

Want to maximize your chances of success? Here are some tips and best practices to keep in mind. Consistent market analysis and research is a key. Stay updated on market trends and news that may impact your iron condor positions. Patience is a virtue in options trading, so stick to your trading plan and avoid impulsive decisions. When executing trades, consider using limit orders to ensure you get the desired execution price. And always remember to manage your emotions and stay disciplined throughout the trading process.

Frequently Asked Questions (FAQs)

Q: What is the maximum profit and loss potential in an Iron Condor trade?

A: The maximum profit is the net credit received when establishing the trade, while the maximum loss is the difference between the width of the spread and the net credit received.

Q: Can the Iron Condor strategy be applied to any underlying asset?

A: Yes, the iron condor strategy can be used on various underlying assets such as stocks, indices, ETFs, and more.

Q: What are some alternative strategies to the Iron Condor?

A: Alternatives to the iron condor include the iron butterfly, the short strangle, and the credit spread strategies. Each strategy has its own characteristics and risk-reward profiles.

Q: How often should I monitor my Iron Condor positions?

A: Regular monitoring is important to stay informed about changes in market conditions and to evaluate the performance of your iron condor positions. Consider reviewing your positions at least once a day or as market events unfold.

Conclusion

Congratulations! You’ve taken a deep dive into the captivating world of the iron condor strategy. Armed with the knowledge of its mechanics, benefits, and implementation steps, you’re now equipped to navigate the options market with confidence. Remember to consider the factors that impact your trades, manage risk effectively, and continuously refine your approach.

With practice and perseverance, you can master the art of the iron condor and unlock its potential for consistent profits. So, spread your wings and soar to new heights in your options trading journey.

Any financial information or opinions contained in this article are the author’s own and do not represent endorsement or support of any products, services, or strategies by SmallBizClub.com.

1856 Views